Schedule 3 Form 1040 Additional Credits and Payments 2023

What is the Schedule 3 Form 1040 Additional Credits And Payments

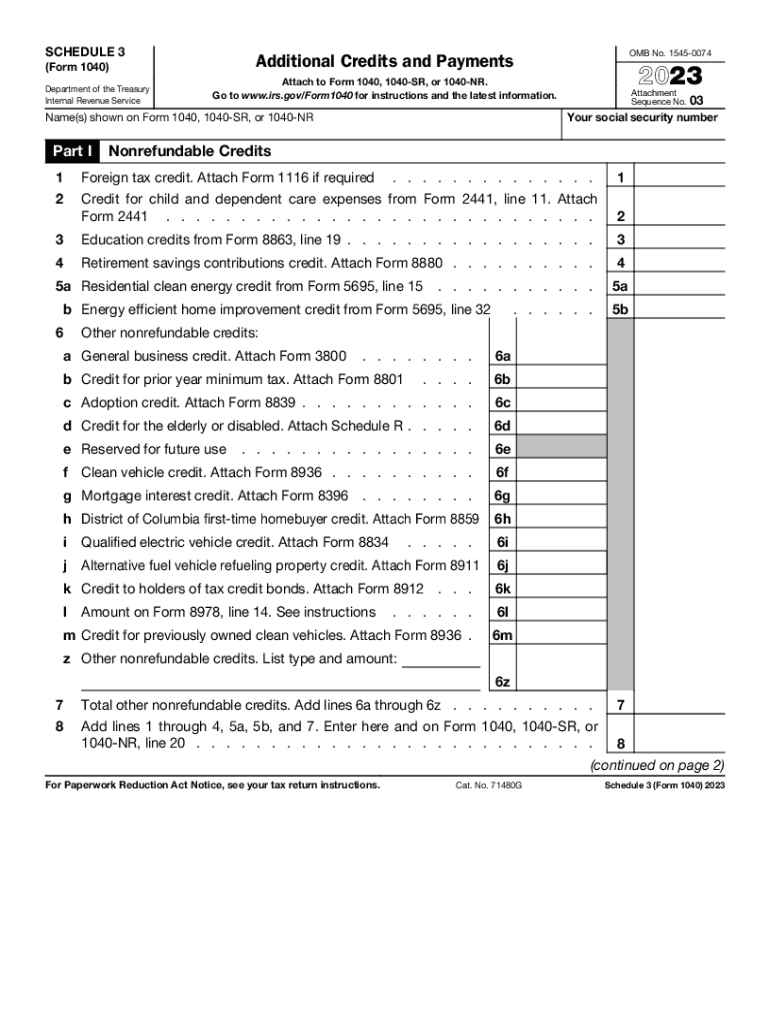

The Schedule 3 Form 1040, titled Additional Credits and Payments, is a supplementary form used by taxpayers in the United States to report various nonrefundable and refundable tax credits. This form is essential for individuals who wish to claim credits that can reduce their overall tax liability. It is part of the Form 1040 series, which is the standard individual income tax return form used by U.S. taxpayers. The Schedule 3 allows taxpayers to detail specific credits, such as the Foreign Tax Credit and the Credit for Other Dependents, among others.

How to use the Schedule 3 Form 1040 Additional Credits And Payments

Using the Schedule 3 Form 1040 involves a few straightforward steps. First, ensure that you have completed your main Form 1040. The Schedule 3 is attached to this form and provides a space to list eligible credits. You will need to gather information regarding the credits you are claiming, which may include documentation or records proving eligibility. Once you have filled out the Schedule 3, it is submitted along with your Form 1040 during tax filing.

Steps to complete the Schedule 3 Form 1040 Additional Credits And Payments

Completing the Schedule 3 Form 1040 requires careful attention to detail. Follow these steps:

- Start with your completed Form 1040, as Schedule 3 is an attachment.

- Identify the credits you are eligible to claim. Review the instructions provided by the IRS for Schedule 3.

- Fill in the appropriate lines on Schedule 3, providing accurate figures for each credit.

- Double-check your entries for accuracy to avoid potential delays or issues with your tax return.

- Attach Schedule 3 to your Form 1040 before submission.

Key elements of the Schedule 3 Form 1040 Additional Credits And Payments

The Schedule 3 Form 1040 contains several key elements that taxpayers must understand:

- Part I: This section lists nonrefundable credits, which can reduce tax liability but cannot result in a refund.

- Part II: This section includes refundable credits, which can provide a refund if they exceed the tax owed.

- Instructions: Detailed guidance is provided for each credit, helping taxpayers determine eligibility and how to report them.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule 3 Form 1040. Taxpayers should refer to the official IRS instructions for the most accurate and up-to-date information. These guidelines include definitions of each credit, eligibility requirements, and examples of how to fill out the form correctly. Following IRS guidelines ensures that taxpayers can maximize their credits and avoid errors that could lead to penalties or delays.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule 3 Form 1040 align with the general tax filing deadlines in the United States. Typically, individual tax returns are due on April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of these dates to ensure timely filing and avoid penalties. Additionally, extensions may be available, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Quick guide on how to complete schedule 3 form 1040 additional credits and payments

Effortlessly Prepare Schedule 3 Form 1040 Additional Credits And Payments on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Schedule 3 Form 1040 Additional Credits And Payments on any device using the airSlate SignNow apps for Android or iOS, and simplify any document-related tasks today.

How to Modify and Electronically Sign Schedule 3 Form 1040 Additional Credits And Payments with Ease

- Locate Schedule 3 Form 1040 Additional Credits And Payments and click on Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal authority as a conventional ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you select. Modify and electronically sign Schedule 3 Form 1040 Additional Credits And Payments to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule 3 form 1040 additional credits and payments

Create this form in 5 minutes!

How to create an eSignature for the schedule 3 form 1040 additional credits and payments

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 1040 schedule 3 form?

The 2023 1040 schedule 3 form is an essential tax document used to report nonrefundable credits and other payments. This form helps taxpayers determine their tax liabilities and any refundable credits they may qualify for. Understanding this form is crucial for accurate tax reporting in 2023.

-

How can airSlate SignNow help with the 2023 1040 schedule 3 form?

airSlate SignNow provides an efficient solution for signing and managing the 2023 1040 schedule 3 form digitally. Our platform allows users to easily send, eSign, and track their tax documents, ensuring that everything is completed accurately and on time. Enjoy a seamless user experience while handling your tax paperwork.

-

Is there a cost associated with using airSlate SignNow for the 2023 1040 schedule 3 form?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. While there is a nominal fee for using our eSignature and document management services, the efficiency and convenience gained from our platform make it a cost-effective solution for managing the 2023 1040 schedule 3 form.

-

What features does airSlate SignNow offer for handling the 2023 1040 schedule 3 form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for the 2023 1040 schedule 3 form. These tools help streamline the tax preparation process, making it easier to fill out and submit your forms. Our platform is user-friendly and designed to enhance collaboration and efficiency.

-

Can I integrate airSlate SignNow with other applications for the 2023 1040 schedule 3 form?

Absolutely! airSlate SignNow offers integrative capabilities with various software applications to simplify the process of handling the 2023 1040 schedule 3 form. Whether it's CRM systems or accounting software, our integrations promote a smoother workflow and better document management.

-

What benefits does airSlate SignNow provide for completing the 2023 1040 schedule 3 form?

Using airSlate SignNow for the 2023 1040 schedule 3 form allows for faster processing times and reduced paper waste. Our electronic signature solution enhances compliance and security, ensuring that your tax documents are handled safely. Ultimately, our platform empowers users to manage their tax forms with ease and confidence.

-

Is airSlate SignNow secure for signing the 2023 1040 schedule 3 form?

Yes, airSlate SignNow prioritizes the security of all documents, including the 2023 1040 schedule 3 form. We employ advanced encryption and secure data handling practices to protect sensitive information throughout the eSigning process. Your tax documents are safe with us.

Get more for Schedule 3 Form 1040 Additional Credits And Payments

Find out other Schedule 3 Form 1040 Additional Credits And Payments

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later