Schedule 3 Form 1040 Additional Credits and Payments 2022

What is the Schedule 3 Form 1040 Additional Credits And Payments

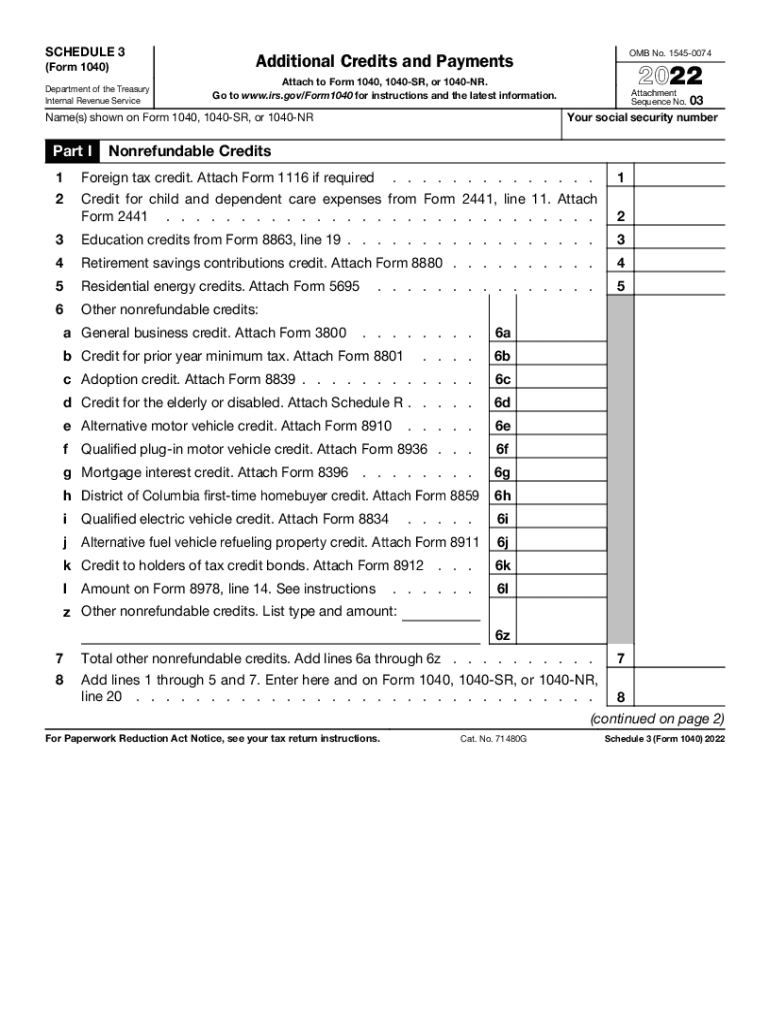

The Schedule 3 form is an essential component of the U.S. tax filing process, specifically for individuals using Form 1040. It is designed to report additional credits and payments that may reduce the overall tax liability. This form includes various tax credits, such as the foreign tax credit, the credit for child and dependent care expenses, and the credit for other dependents. Understanding this form is crucial for taxpayers to ensure they are accurately claiming all eligible credits, which can significantly impact their tax return.

How to use the Schedule 3 Form 1040 Additional Credits And Payments

Using the Schedule 3 form involves several steps to ensure accurate reporting of additional credits and payments. Taxpayers should first gather all relevant documentation related to the credits they intend to claim. This includes records of child care expenses, foreign taxes paid, and any other applicable credits. After completing Form 1040, taxpayers will fill out Schedule 3 by entering the amounts for each credit in the designated sections. Finally, the completed Schedule 3 must be attached to the Form 1040 when submitting the tax return to the IRS.

Steps to complete the Schedule 3 Form 1040 Additional Credits And Payments

Completing the Schedule 3 form requires careful attention to detail. Follow these steps:

- Gather all necessary documentation for the credits you wish to claim.

- Obtain a copy of the Schedule 3 form, which can be found on the IRS website or through tax preparation software.

- Fill in your personal information at the top of the form, ensuring it matches your Form 1040.

- Enter the amounts for each applicable credit in the corresponding lines on Schedule 3.

- Double-check your entries for accuracy and completeness.

- Attach Schedule 3 to your completed Form 1040 before submission.

Key elements of the Schedule 3 Form 1040 Additional Credits And Payments

Several key elements define the Schedule 3 form. It includes sections for various credits, such as:

- Foreign tax credit

- Credit for child and dependent care expenses

- Credit for other dependents

- Retirement savings contributions credit

Each section requires specific information and calculations, making it important for taxpayers to understand the eligibility criteria for each credit. Accurate completion of these sections can lead to significant tax savings.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule 3 form. Taxpayers should refer to the IRS instructions for Form 1040 and Schedule 3 to understand the eligibility requirements for each credit. These guidelines outline how to calculate the credits, the necessary documentation to support claims, and any limitations that may apply. Adhering to these guidelines is crucial for ensuring compliance and avoiding potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule 3 form align with the general tax return deadlines established by the IRS. Typically, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may file for additional time to submit their tax returns. Keeping track of these important dates is essential for timely and compliant filing.

Quick guide on how to complete 2022 schedule 3 form 1040 additional credits and payments

Prepare Schedule 3 Form 1040 Additional Credits And Payments effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, enabling you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without holdups. Manage Schedule 3 Form 1040 Additional Credits And Payments on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The simplest method to alter and eSign Schedule 3 Form 1040 Additional Credits And Payments with ease

- Locate Schedule 3 Form 1040 Additional Credits And Payments and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Schedule 3 Form 1040 Additional Credits And Payments and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 schedule 3 form 1040 additional credits and payments

Create this form in 5 minutes!

People also ask

-

What is the 'schedule 3' feature in airSlate SignNow?

The 'schedule 3' feature in airSlate SignNow allows users to set specific time frames for document signing and delivery. This ensures that all parties involved are informed and ready, improving the overall efficiency of the signing process. It is especially beneficial for businesses that require timely responses and actions.

-

How does the pricing structure work for the 'schedule 3' feature?

The pricing for the 'schedule 3' feature is part of our tiered subscription model. Depending on your chosen plan, users can access additional functionalities, including advanced scheduling capabilities. This makes airSlate SignNow a cost-effective solution for businesses of all sizes, ensuring valuable features without breaking the bank.

-

What are the key benefits of using 'schedule 3' with airSlate SignNow?

Using 'schedule 3' with airSlate SignNow provides enhanced organization and time management for document workflows. It allows teams to efficiently manage deadlines and ensures that documents are signed promptly. This feature ultimately leads to quicker turnaround times and improved client satisfaction.

-

Can I integrate 'schedule 3' with other applications?

Yes, the 'schedule 3' feature in airSlate SignNow easily integrates with numerous applications, enhancing its functionality. You can connect it with popular tools like CRMs and project management software, streamlining your workflow further. This seamless integration helps you manage documents and schedules more efficiently.

-

Is there a mobile app for using 'schedule 3'?

Absolutely! AirSlate SignNow offers a mobile app that supports the 'schedule 3' feature, allowing users to manage document signing on the go. Whether you are at the office or traveling, you can ensure that your documents are signed and scheduled promptly, which is crucial for busy professionals.

-

How secure is the 'schedule 3' feature in airSlate SignNow?

Security is of utmost importance at airSlate SignNow. The 'schedule 3' feature utilizes bank-level encryption to ensure that all documents and schedules remain secure. This means that your sensitive information is protected throughout the signing process.

-

Are there any limits on using the 'schedule 3' feature?

The 'schedule 3' feature may have limitations based on the subscription plan you choose with airSlate SignNow. Higher-tier plans typically offer expanded functionalities and fewer restrictions. It's essential to review our pricing plans to ensure you select one that meets your business needs.

Get more for Schedule 3 Form 1040 Additional Credits And Payments

- Letter from tenant to landlord containing notice to landlord to cease retaliatory decrease in services kansas form

- Temporary lease agreement to prospective buyer of residence prior to closing kansas form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction 497307473 form

- Letter from landlord to tenant returning security deposit less deductions kansas form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return kansas form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return kansas form

- Letter from tenant to landlord containing request for permission to sublease kansas form

- Letter tenant damages form

Find out other Schedule 3 Form 1040 Additional Credits And Payments

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document