Schedule 3 Form 1040 2020

What is the Schedule 3 Form 1040

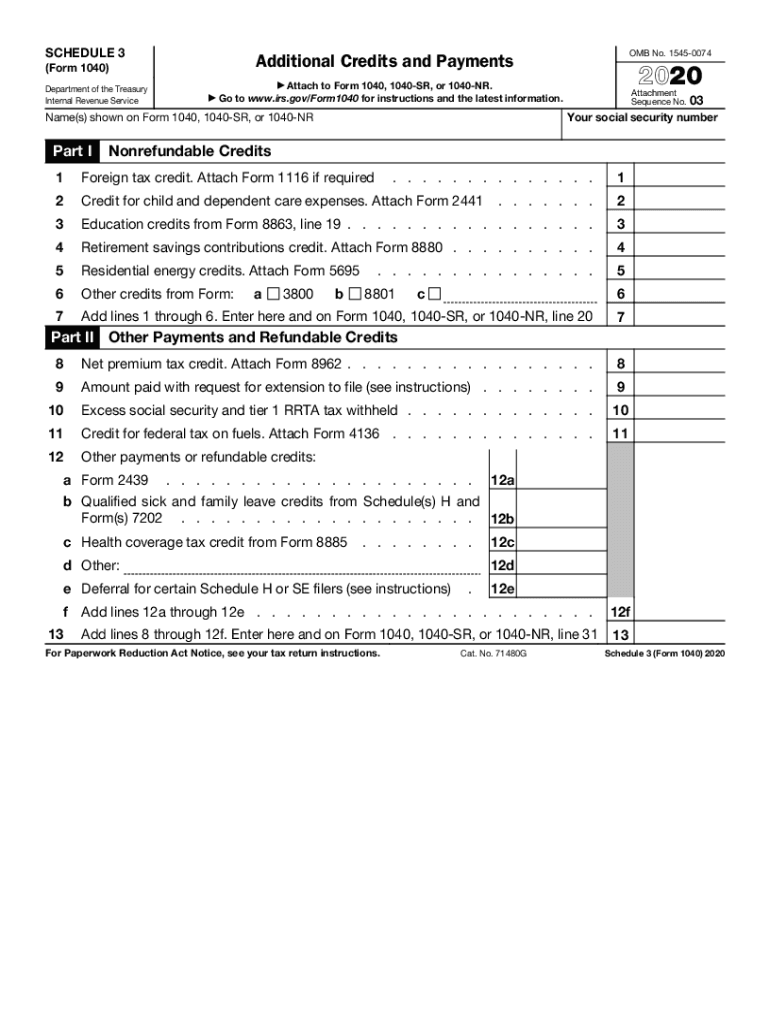

The Schedule 3 form, officially known as the 2020 Form 1040 Schedule 3, is an essential document used by taxpayers in the United States to report additional credits and payments. It is primarily utilized by individuals who need to claim nonrefundable credits, such as the foreign tax credit or the credit for child and dependent care expenses. This form supplements the main Form 1040, ensuring that all eligible credits are accounted for in the overall tax calculation.

How to use the Schedule 3 Form 1040

To effectively use the Schedule 3 form, taxpayers must first complete their primary Form 1040. After determining their total income and deductions, they can identify any credits they may qualify for. The Schedule 3 form provides sections to detail these credits, which will ultimately reduce the total tax liability. It is crucial to ensure that all information is accurate and complete to avoid delays or issues with the IRS.

Steps to complete the Schedule 3 Form 1040

Completing the Schedule 3 form involves several straightforward steps:

- Begin by gathering all necessary financial documents, including W-2s and 1099s.

- Fill out your Form 1040 to determine your total income and deductions.

- Identify the credits you are eligible for and locate the corresponding sections on Schedule 3.

- Input the relevant information into Schedule 3, ensuring accuracy in all entries.

- Review the completed form for any errors before submitting it with your Form 1040.

Legal use of the Schedule 3 Form 1040

The Schedule 3 form is legally binding when completed accurately and submitted according to IRS guidelines. It is important to adhere to all relevant tax laws and regulations to ensure compliance. Electronic signatures are accepted, provided they meet the requirements set forth by the ESIGN Act, UETA, and other applicable legislation. Utilizing a reliable eSignature solution can enhance the security and validity of your submission.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule 3 form, including instructions on which credits can be claimed and how to report them. Taxpayers should consult the IRS instructions for the Schedule 3 form for detailed information on eligibility criteria, required documentation, and any updates for the current tax year. Staying informed about IRS guidelines helps ensure that all claims are legitimate and compliant with federal tax laws.

Filing Deadlines / Important Dates

Taxpayers must be aware of critical deadlines when filing their Schedule 3 form. Generally, the deadline for submitting Form 1040, along with Schedule 3, is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It is advisable to file early to avoid potential complications and ensure timely processing of any refunds or credits.

Quick guide on how to complete schedule 3 form 1040 2020

Complete Schedule 3 Form 1040 effortlessly on any device

Online document management has become prevalent among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Schedule 3 Form 1040 on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Schedule 3 Form 1040 easily

- Find Schedule 3 Form 1040 and click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Schedule 3 Form 1040 and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule 3 form 1040 2020

Create this form in 5 minutes!

How to create an eSignature for the schedule 3 form 1040 2020

The best way to generate an electronic signature for a PDF file in the online mode

The best way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is the schedule 3 feature in airSlate SignNow?

The schedule 3 feature in airSlate SignNow allows users to set up recurring signing events for documents. This means you can automate the signing process without having to manually send reminders or documents repeatedly. It streamlines workflows, saving time and ensuring consistent follow-ups.

-

How does pricing work for the schedule 3 feature?

Pricing for the schedule 3 feature is competitive and varies based on the plan you choose with airSlate SignNow. Each plan includes access to various e-signature functionalities, including schedule 3 capabilities, with tiered pricing options to fit different business sizes. You can explore each plan's details on our pricing page.

-

What are the main benefits of using schedule 3?

Using schedule 3 in airSlate SignNow offers several benefits, such as increased efficiency, reduced administrative burden, and enhanced client satisfaction. By automating the scheduling of document signing, businesses can focus on other crucial tasks while ensuring timely completion of agreements. It’s an invaluable tool for organizations that require regular document execution.

-

Can I integrate schedule 3 with other tools?

Yes, schedule 3 in airSlate SignNow easily integrates with numerous third-party applications such as CRM systems, project management tools, and workflow platforms. This allows you to seamlessly incorporate e-signatures into your existing processes without disrupting your current systems. Check our integrations page for a full list of compatible applications.

-

Is there a mobile app for managing schedule 3?

Absolutely! airSlate SignNow offers a mobile app that allows users to manage schedule 3 features on the go. You can send, sign, and track documents directly from your smartphone or tablet, making it easy to handle e-signatures anytime and anywhere. This flexibility is perfect for professionals who are frequently on the move.

-

How secure is my data when using schedule 3?

Data security is a top priority for airSlate SignNow, especially when using the schedule 3 feature. We employ advanced encryption and stringent security protocols to ensure that all documents and user information remain confidential. Additionally, our platform complies with various industry regulations, providing peace of mind to our users.

-

What types of documents can I use with schedule 3?

With schedule 3 in airSlate SignNow, you can use a wide variety of documents, including contracts, agreements, and consent forms. The feature is versatile and supports various file formats, enabling you to automate the signing of almost any document type efficiently. This flexibility makes it suitable for businesses across different industries.

Get more for Schedule 3 Form 1040

Find out other Schedule 3 Form 1040

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free