Schedule 3 2018

What is the Schedule 3

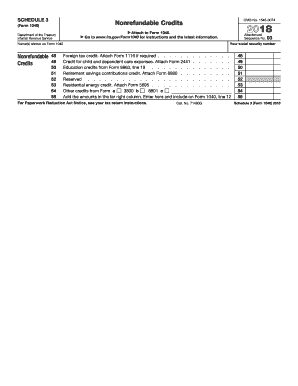

The 2018 Schedule 3 is a tax form used in conjunction with Form 1040, specifically designed to report certain nonrefundable credits. These credits can reduce the amount of tax owed, making it essential for taxpayers to understand its purpose and requirements. The form includes various sections that cater to different types of credits, such as the foreign tax credit, credit for the elderly or the disabled, and education credits, among others. Properly completing Schedule 3 can help taxpayers maximize their tax benefits and ensure compliance with IRS regulations.

How to use the Schedule 3

Using the 2018 Schedule 3 involves several steps to accurately report your nonrefundable credits. First, gather all necessary documentation related to the credits you intend to claim. This may include receipts, tax statements, and any other relevant information. Next, fill out the form by providing your personal information and detailing the specific credits you qualify for. Ensure that you follow the instructions provided by the IRS to avoid errors. After completing the form, review it for accuracy before submitting it along with your Form 1040.

Steps to complete the Schedule 3

Completing the 2018 Schedule 3 requires careful attention to detail. Here are the steps to follow:

- Begin with your personal information at the top of the form, including your name and Social Security number.

- Identify the credits you are eligible for and locate the corresponding sections on the form.

- Fill in the required amounts for each credit, ensuring that you have supporting documentation for your claims.

- Double-check all entries for accuracy and completeness.

- Attach Schedule 3 to your Form 1040 when filing your taxes.

Key elements of the Schedule 3

The 2018 Schedule 3 consists of several key elements that taxpayers should be aware of. These include:

- Personal Information: This section requires your name, Social Security number, and filing status.

- Credit Categories: The form is divided into various categories of credits, such as education, foreign tax, and retirement savings.

- Calculation Fields: Each credit section includes fields for entering the amount of the credit and any limitations that may apply.

- Signature Section: At the end of the form, you must sign and date to certify the accuracy of the information provided.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 2018 Schedule 3. It is important to refer to the official IRS instructions for the form, which detail eligibility requirements, necessary documentation, and filing procedures. These guidelines ensure that taxpayers understand how to properly claim their credits and avoid potential penalties. Following the IRS guidelines can also help streamline the tax filing process and improve the likelihood of a successful submission.

Filing Deadlines / Important Dates

Filing deadlines for the 2018 Schedule 3 align with the general tax filing deadlines set by the IRS. Typically, individual tax returns must be filed by April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may apply for, as well as the implications of late filing. Staying informed about these important dates is crucial for timely and compliant tax submissions.

Quick guide on how to complete 2018 schedule 3

Complete Schedule 3 effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, since you can find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Schedule 3 on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Schedule 3 seamlessly

- Find Schedule 3 and click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Schedule 3 and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 schedule 3

Create this form in 5 minutes!

People also ask

-

What is the 2018 schedule 3 and how does it relate to airSlate SignNow?

The 2018 schedule 3 refers to the specific form used for reporting additional income and adjustments in tax filings. airSlate SignNow simplifies the signing and submission process for such documents, ensuring a seamless experience for businesses and individuals dealing with the 2018 schedule 3.

-

Is airSlate SignNow compatible with the 2018 schedule 3?

Yes, airSlate SignNow is fully compatible with the 2018 schedule 3. Users can easily upload, send, and eSign their 2018 schedule 3 forms, facilitating a straightforward and efficient document workflow for tax purposes.

-

What pricing options does airSlate SignNow offer for users needing to handle the 2018 schedule 3?

airSlate SignNow offers various pricing plans to accommodate different user needs when managing documents like the 2018 schedule 3. These plans range from basic to premium, ensuring that users have access to features that suit their requirements without overspending.

-

What features does airSlate SignNow provide for the 2018 schedule 3?

airSlate SignNow provides essential features such as document templates and eSigning capabilities specifically designed for forms like the 2018 schedule 3. Users benefit from customizable workflows, easy document tracking, and secure cloud storage that enhances the overall user experience.

-

Can I integrate airSlate SignNow with other software for managing the 2018 schedule 3?

Absolutely! airSlate SignNow offers integrations with popular software such as cloud storage solutions and productivity applications to streamline the management of your 2018 schedule 3. This ensures that users can seamlessly connect their existing tools and maintain a cohesive workflow.

-

What are the benefits of using airSlate SignNow for my 2018 schedule 3?

Using airSlate SignNow for your 2018 schedule 3 offers numerous benefits, including enhanced efficiency and reduced paperwork. The platform not only accelerates the signing process but also provides a secure and organized way to manage sensitive tax documents.

-

How does airSlate SignNow ensure the security of my 2018 schedule 3 documents?

airSlate SignNow places a strong emphasis on security, employing encryption and compliance features to protect your 2018 schedule 3 documents. Users can be confident that their sensitive information is safe throughout the signing process.

Get more for Schedule 3

- Oh theft form

- Ohio theft form

- Ohio identity form

- Identity theft by known imposter package ohio form

- Organizing your personal assets package ohio form

- Essential documents for the organized traveler package ohio form

- Essential documents for the organized traveler package with personal organizer ohio form

- Letters of recommendation package ohio form

Find out other Schedule 3

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple