Minnesota Form 2021

What is the Minnesota W-4MN Form?

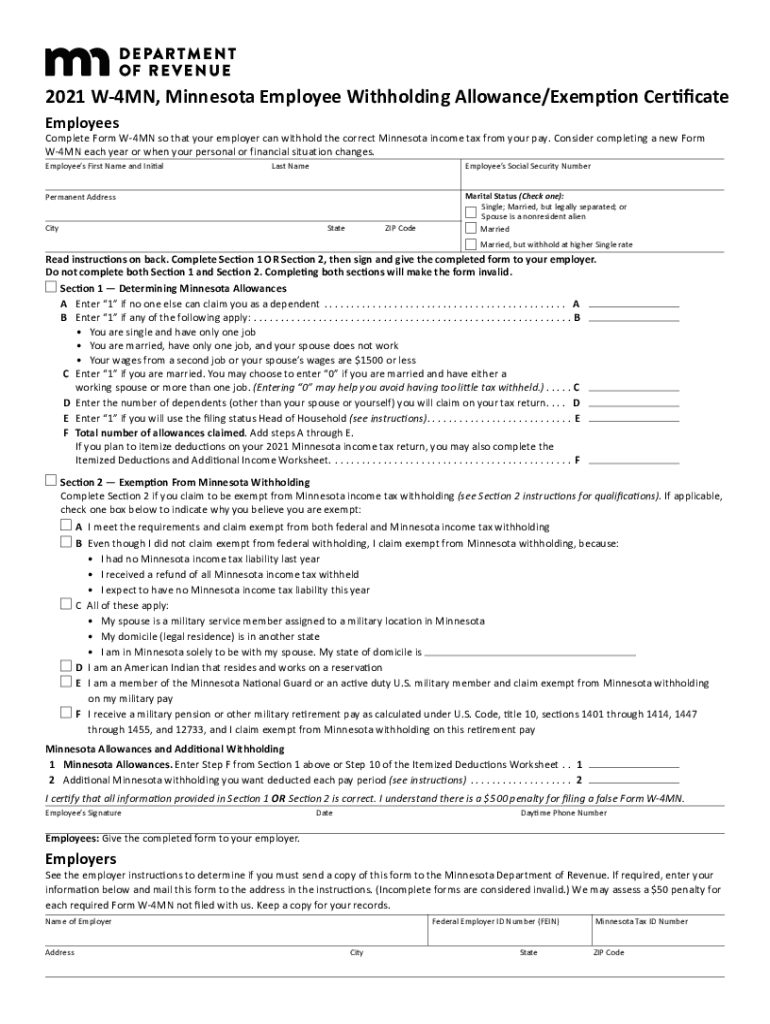

The Minnesota W-4MN form is an employee withholding allowance certificate used by employers in Minnesota to determine the amount of state income tax to withhold from an employee's paycheck. This form is essential for ensuring that the correct amount of taxes is deducted based on the employee's personal financial situation. By completing the W-4MN, employees can claim allowances that reflect their tax situation, which may include factors such as marital status, dependents, and other deductions.

How to Use the Minnesota W-4MN Form

Using the Minnesota W-4MN form involves a few straightforward steps. First, employees should obtain the form from their employer or download it from the official Minnesota Department of Revenue website. Next, they need to fill out the form accurately, providing personal information such as name, address, and Social Security number. Employees should then calculate the number of allowances they are eligible to claim based on their specific circumstances, which can help reduce their withholding amount. Finally, the completed form should be submitted to the employer for processing.

Steps to Complete the Minnesota W-4MN Form

Completing the Minnesota W-4MN form requires careful attention to detail. Here are the steps to follow:

- Obtain the Minnesota W-4MN form from your employer or the Minnesota Department of Revenue website.

- Fill in your personal information, including your name, address, and Social Security number.

- Determine your filing status (single, married, etc.) and the number of allowances you wish to claim.

- Consider any additional withholding amounts if necessary, based on your financial situation.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer.

Key Elements of the Minnesota W-4MN Form

The Minnesota W-4MN form includes several key elements that are crucial for accurate tax withholding. These elements include:

- Personal Information: This section requires your name, address, and Social Security number.

- Filing Status: Indicate whether you are single, married, or head of household.

- Allowances: Claim the number of allowances you are eligible for, which affects your withholding amount.

- Additional Withholding: Optionally specify any extra amount you want withheld from your paycheck.

Legal Use of the Minnesota W-4MN Form

The Minnesota W-4MN form is legally binding once completed and submitted to your employer. It is essential for compliance with state tax regulations, as it ensures that the correct amount of state income tax is withheld from your wages. Failure to submit a W-4MN form may result in your employer withholding the maximum amount of state tax, which could lead to a larger tax refund or a tax liability at the end of the year. Therefore, it is important to review and update the form whenever there are changes in your personal or financial situation.

Form Submission Methods

The Minnesota W-4MN form can be submitted to your employer in several ways. Typically, the form is filled out on paper and handed directly to the payroll department. Some employers may also allow electronic submission via email or through an online employee portal. It is important to check with your employer regarding their preferred submission method to ensure timely processing of your withholding allowances.

Quick guide on how to complete 2021 minnesota form

Complete Minnesota Form effortlessly on any device

Digital document management has gained popularity among organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without disruptions. Manage Minnesota Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Minnesota Form seamlessly

- Find Minnesota Form and click on Get Form to begin.

- Utilize the features we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information using the tools that airSlate SignNow has specifically designed for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form - via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any chosen device. Modify and eSign Minnesota Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 minnesota form

Create this form in 5 minutes!

How to create an eSignature for the 2021 minnesota form

The way to make an electronic signature for a PDF document in the online mode

The way to make an electronic signature for a PDF document in Chrome

The best way to generate an e-signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your mobile device

The way to generate an e-signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the Minnesota W form and how does airSlate SignNow help with it?

The Minnesota W form is a tax document used by Minnesota residents to report their withholding information. With airSlate SignNow, you can easily send, eSign, and store your Minnesota W form securely in one place. Our platform simplifies the process, ensuring your tax forms are completed accurately and efficiently.

-

Is airSlate SignNow affordable for businesses needing to manage Minnesota W forms?

Yes, airSlate SignNow offers cost-effective pricing plans tailored to businesses of all sizes. With our service, you can manage your Minnesota W forms without breaking the bank, providing great value for your document management needs.

-

What features does airSlate SignNow offer for managing the Minnesota W form?

airSlate SignNow provides a variety of features for managing the Minnesota W form, including eSignature capabilities, templates, and secure cloud storage. You can streamline the entire process, making it easy to fill out, sign, and send your forms with just a few clicks.

-

Can airSlate SignNow integrate with other platforms for handling Minnesota W forms?

Certainly! airSlate SignNow offers seamless integrations with popular business applications like Google Drive, Salesforce, and others. This integration capability allows businesses to efficiently manage their Minnesota W forms alongside other essential tools.

-

What are the benefits of using airSlate SignNow for Minnesota W forms?

Using airSlate SignNow for your Minnesota W forms brings numerous benefits, including time savings and improved accuracy. Our platform reduces the chances of errors in your forms with its user-friendly interface, ensuring smooth submission to tax authorities.

-

How secure is airSlate SignNow when handling the Minnesota W form?

Security is a top priority at airSlate SignNow. When handling sensitive tax documents like the Minnesota W form, we use advanced encryption and compliance measures to protect your data at all times, giving you peace of mind.

-

Is it easy to get started with airSlate SignNow for my Minnesota W form needs?

Absolutely! airSlate SignNow is designed to be user-friendly, allowing you to get started quickly. You can create and manage your Minnesota W forms in just a few steps, making it an ideal solution for businesses looking to streamline their document workflow.

Get more for Minnesota Form

Find out other Minnesota Form

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF