MWR, Reciprocity ExemptionAffidavit of Residency 2025-2026

Understanding Minnesota Withholding Requirements

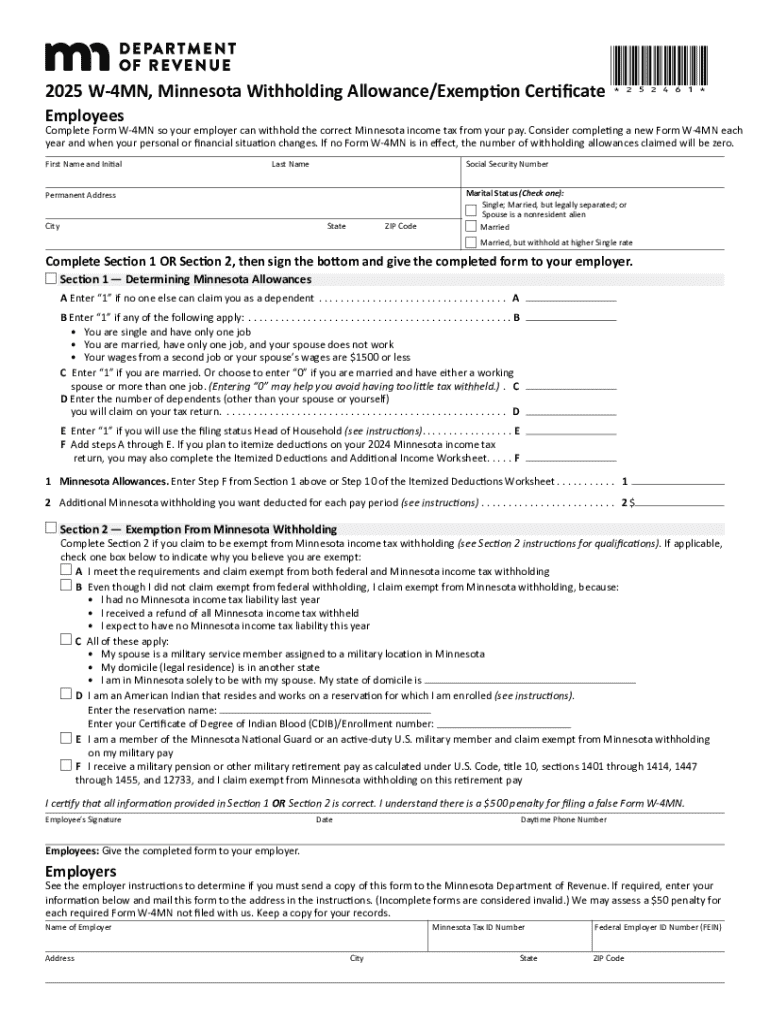

The Minnesota withholding system is designed to ensure that state income taxes are collected from employees' wages. Employers are responsible for withholding a portion of employees' earnings and remitting it to the Minnesota Department of Revenue. This process helps individuals meet their tax obligations throughout the year, rather than facing a large tax bill at the end of the tax season. Understanding the Minnesota withholding requirements is crucial for both employers and employees to ensure compliance and avoid penalties.

Steps to Complete the Minnesota Withholding Form

To complete the Minnesota withholding form, known as the W-4MN, follow these steps:

- Obtain the W-4MN form from the Minnesota Department of Revenue or your employer.

- Fill out your personal information, including your name, address, and Social Security number.

- Indicate your filing status, such as single, married, or head of household.

- Complete the section regarding additional withholding if you anticipate owing more taxes.

- Sign and date the form before submitting it to your employer.

Eligibility Criteria for Minnesota Withholding

Eligibility for Minnesota withholding primarily depends on your employment status and residency. Generally, if you work in Minnesota or are a resident, you are subject to withholding. Specific criteria include:

- Employees who earn wages from an employer in Minnesota.

- Residents who receive income from sources outside Minnesota.

- Non-residents who work in Minnesota and meet certain income thresholds.

Filing Deadlines for Minnesota Withholding

Timely filing of Minnesota withholding forms is essential to avoid penalties. Key deadlines include:

- Employees must submit their W-4MN form to their employer before the first paycheck.

- Employers are required to remit withheld taxes to the state on a regular basis, typically monthly or quarterly, depending on the amount withheld.

- Annual reconciliation of withheld amounts must be completed by January 31 of the following year.

Required Documents for Minnesota Withholding

When completing the Minnesota withholding process, certain documents are necessary to ensure accuracy and compliance. These include:

- The W-4MN form, which provides the necessary information for withholding calculations.

- Proof of residency, if applicable, for individuals claiming exemption from withholding.

- Previous year’s W-2 forms to help determine withholding needs based on past earnings.

Common Penalties for Non-Compliance

Failure to comply with Minnesota withholding regulations can result in significant penalties. Common penalties include:

- Fines for employers who fail to withhold the correct amount of taxes.

- Interest charges on unpaid withholding amounts.

- Potential legal action for repeated non-compliance.

Digital vs. Paper Version of the Minnesota Withholding Form

Employers and employees can choose between digital and paper versions of the Minnesota withholding form. The digital version offers convenience and faster processing, while the paper version may be preferred by those who are not comfortable with digital submissions. Regardless of the method chosen, it is important to ensure that the form is filled out accurately and submitted on time to avoid any issues with withholding compliance.

Create this form in 5 minutes or less

Find and fill out the correct mwr reciprocity exemptionaffidavit of residency

Create this form in 5 minutes!

How to create an eSignature for the mwr reciprocity exemptionaffidavit of residency

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Minnesota withholding and how does it affect my business?

Minnesota withholding refers to the state tax that employers are required to deduct from employees' wages. Understanding Minnesota withholding is crucial for compliance and ensuring that your business meets state tax obligations. airSlate SignNow can help streamline the documentation process related to Minnesota withholding, making it easier for businesses to manage their payroll.

-

How can airSlate SignNow assist with Minnesota withholding documentation?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning documents related to Minnesota withholding. Our solution simplifies the process of managing tax forms and employee agreements, ensuring that all necessary documentation is completed accurately and on time. This helps businesses maintain compliance with Minnesota withholding regulations.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that support efficient management of Minnesota withholding documents, ensuring you get the best value for your investment. You can choose a plan that fits your budget while benefiting from our comprehensive eSigning solutions.

-

What features does airSlate SignNow offer for managing Minnesota withholding?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning, all designed to facilitate the management of Minnesota withholding documents. These features help reduce errors and save time, allowing businesses to focus on their core operations while ensuring compliance with state regulations.

-

Can airSlate SignNow integrate with other payroll systems for Minnesota withholding?

Yes, airSlate SignNow seamlessly integrates with various payroll systems to enhance the management of Minnesota withholding. This integration allows for automatic updates and ensures that all relevant documents are easily accessible. By connecting your payroll system with airSlate SignNow, you can streamline your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for Minnesota withholding?

Using airSlate SignNow for Minnesota withholding offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform simplifies the eSigning process, allowing businesses to quickly obtain necessary signatures on tax-related documents. This not only saves time but also minimizes the risk of errors associated with manual processes.

-

Is airSlate SignNow secure for handling Minnesota withholding documents?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that all Minnesota withholding documents are protected. Our platform uses advanced encryption and secure storage solutions to safeguard sensitive information, giving businesses peace of mind when managing their tax-related documentation.

Get more for MWR, Reciprocity ExemptionAffidavit Of Residency

Find out other MWR, Reciprocity ExemptionAffidavit Of Residency

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy