Minnesota Minnesota Employee Withholding AllowanceExemption 2020

Understanding the Minnesota Employee Withholding Allowance Exemption

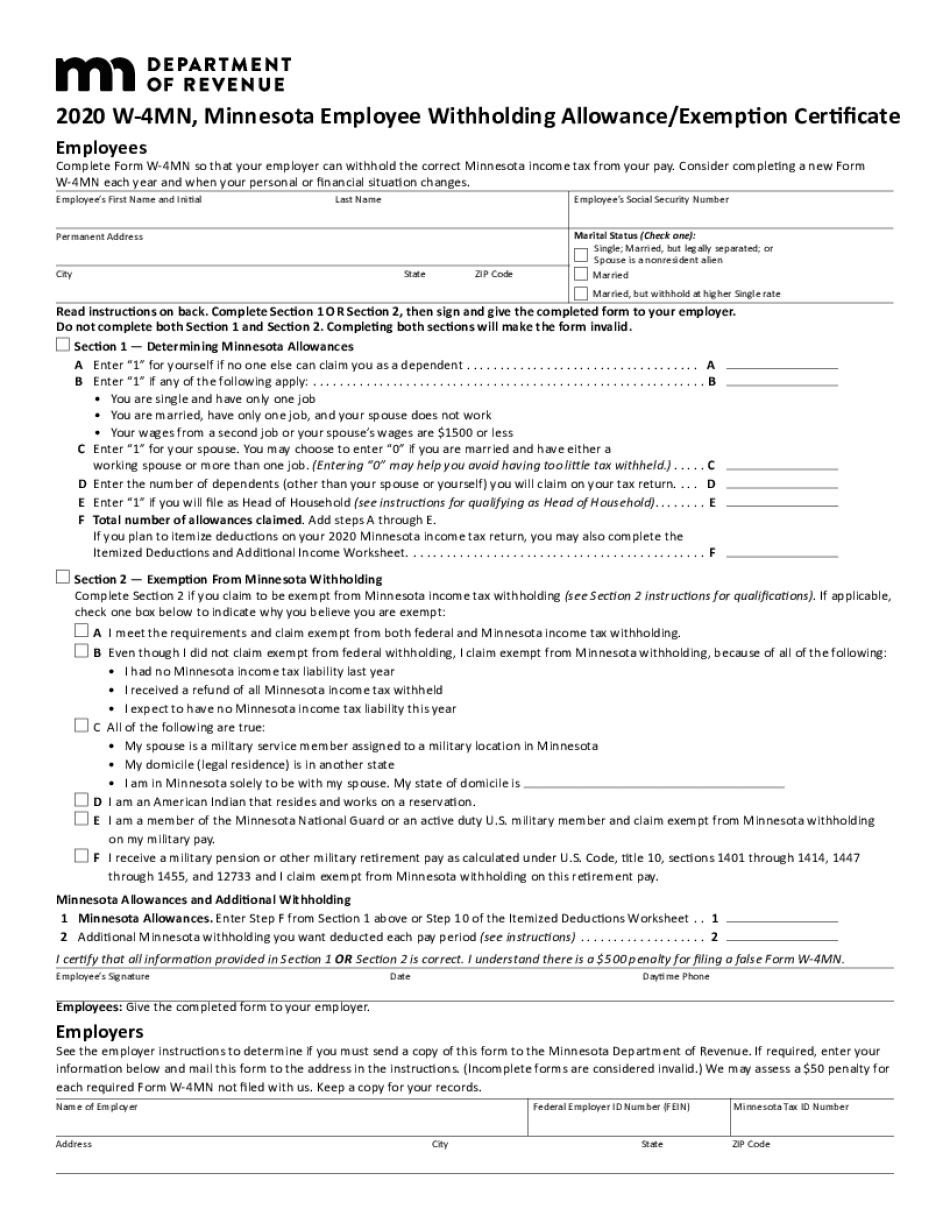

The Minnesota Employee Withholding Allowance Exemption allows employees to claim exemptions from state income tax withholding. This exemption is particularly beneficial for individuals who expect to owe no Minnesota income tax for the year or whose tax liability will be less than the amount withheld. Understanding this exemption is essential for ensuring accurate tax withholding and avoiding unexpected tax bills at the end of the year.

Steps to Complete the Minnesota Employee Withholding Allowance Exemption

Completing the Minnesota Employee Withholding Allowance Exemption involves several straightforward steps:

- Obtain the appropriate form, typically the Minnesota W-4MN.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the number of allowances you are claiming. This number affects how much tax is withheld from your paycheck.

- If applicable, claim any additional exemptions based on your specific tax situation.

- Sign and date the form to validate your claims.

Legal Use of the Minnesota Employee Withholding Allowance Exemption

The legal framework surrounding the Minnesota Employee Withholding Allowance Exemption ensures that employees can legitimately reduce their withholding based on their tax situation. To be eligible, individuals must meet specific criteria, including having no tax liability or being exempt from tax withholding. It is crucial to provide accurate information to avoid penalties or issues with the Minnesota Department of Revenue.

Eligibility Criteria for the Minnesota Employee Withholding Allowance Exemption

To qualify for the Minnesota Employee Withholding Allowance Exemption, you must meet certain criteria:

- You must be an employee receiving wages subject to Minnesota state income tax.

- Your expected tax liability for the year must be zero, or you must qualify for an exemption based on specific conditions.

- You should not have had a tax liability in the previous year or expect to have one in the current year.

Form Submission Methods for the Minnesota Employee Withholding Allowance Exemption

Once you have completed the Minnesota Employee Withholding Allowance Exemption form, you can submit it through various methods:

- Online submission through your employer's payroll system, if available.

- Mail the completed form directly to your employer's payroll department.

- In-person submission at your employer's office, if required.

Key Elements of the Minnesota Employee Withholding Allowance Exemption

Understanding the key elements of the Minnesota Employee Withholding Allowance Exemption can help ensure compliance and proper tax planning:

- The form must be completed accurately to reflect your current tax situation.

- Claiming too many exemptions can lead to under-withholding, resulting in tax liabilities.

- Employers are required to keep the form on file and may request updates if your situation changes.

Quick guide on how to complete minnesota minnesota employee withholding allowanceexemption

Complete Minnesota Minnesota Employee Withholding AllowanceExemption effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as a suitable eco-friendly alternative to conventional printed and signed paperwork, allowing you to easily locate the appropriate form and store it securely online. airSlate SignNow provides you with all the necessary tools to create, adjust, and eSign your documents promptly and without delays. Manage Minnesota Minnesota Employee Withholding AllowanceExemption across any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Minnesota Minnesota Employee Withholding AllowanceExemption without hassle

- Locate Minnesota Minnesota Employee Withholding AllowanceExemption and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, arduous form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Adjust and eSign Minnesota Minnesota Employee Withholding AllowanceExemption while ensuring outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct minnesota minnesota employee withholding allowanceexemption

Create this form in 5 minutes!

How to create an eSignature for the minnesota minnesota employee withholding allowanceexemption

How to make an electronic signature for a PDF file online

How to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the mn w form and how does it work with airSlate SignNow?

The mn w form is a document that can be easily signed and sent through airSlate SignNow. This platform allows users to streamline the process by creating, editing, and managing the mn w form electronically, reducing time and paperwork.

-

How much does it cost to use airSlate SignNow for the mn w form?

airSlate SignNow offers various pricing plans to suit different business needs, starting with a free trial. Subscription costs depend on the features you choose, but the platform remains cost-effective, especially for managing documents like the mn w form.

-

What features does airSlate SignNow provide for the mn w form?

airSlate SignNow provides a comprehensive suite of features for the mn w form, including eSigning, document templates, and audit trails. These features enhance efficiency and ensure a secure process for document management.

-

Can I integrate the mn w form with other applications using airSlate SignNow?

Yes, airSlate SignNow allows seamless integration with various applications, enabling users to link the mn w form with tools they already use. This integration enhances workflow efficiency and simplifies the document management process.

-

What are the benefits of using airSlate SignNow for the mn w form?

Using airSlate SignNow for the mn w form provides numerous benefits, including saving time on paper processes, enhancing document security, and improving collaboration among team members. It’s an effective solution for any business looking to optimize their document workflows.

-

Is it easy to create a mn w form using airSlate SignNow?

Creating a mn w form with airSlate SignNow is straightforward and user-friendly. The platform offers intuitive design tools that allow users to quickly set up their forms without needing any technical expertise.

-

Can I track the status of my mn w form with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for your mn w form. You can monitor when it is viewed, signed, and completed, giving you full visibility into the document’s progress.

Get more for Minnesota Minnesota Employee Withholding AllowanceExemption

- Advertising executive agreement self employed independent contractor form

- Trainer agreement form

- Self employed business development executive agreement form

- Car agreement purchase form

- Assembly agreement form

- Independent contractor application 497337199 form

- Hotel agreement form

- Occupational therapist agreement self employed independent contractor form

Find out other Minnesota Minnesota Employee Withholding AllowanceExemption

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF