PDF Instructions for Form 8865 Internal Revenue Service 2021

What is the PDF Instructions For Form 8865 Internal Revenue Service

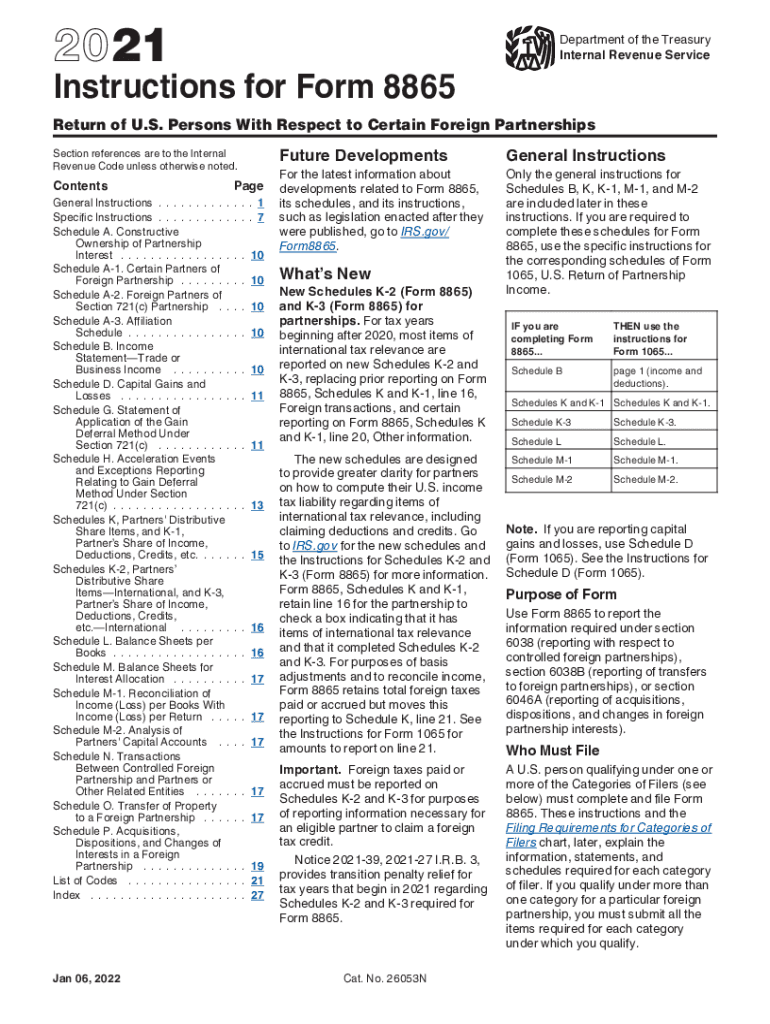

The PDF Instructions for Form 8865 are essential guidelines provided by the Internal Revenue Service (IRS) for U.S. taxpayers who have certain interests in foreign partnerships. This form is crucial for reporting information regarding the foreign partnership's income, deductions, and credits. The instructions detail the requirements for completing the form accurately, ensuring compliance with U.S. tax laws. Understanding these instructions is vital for individuals and businesses involved in international partnerships to avoid penalties and ensure proper tax reporting.

Steps to complete the PDF Instructions For Form 8865 Internal Revenue Service

Completing the PDF Instructions for Form 8865 involves several key steps to ensure accuracy and compliance:

- Gather necessary information about the foreign partnership, including its name, address, and Employer Identification Number (EIN).

- Review the specific sections of the form that pertain to your partnership interest, as there are different requirements based on the type of partnership.

- Fill out the form with accurate financial data, including income, deductions, and any other relevant information about the partnership.

- Double-check all entries for accuracy, ensuring that all required fields are completed.

- Sign and date the form, as required, to validate your submission.

Legal use of the PDF Instructions For Form 8865 Internal Revenue Service

The legal use of the PDF Instructions for Form 8865 is governed by U.S. tax law, which mandates accurate reporting of foreign partnership interests. Completing the form according to the provided instructions ensures compliance with IRS regulations. Failure to adhere to these guidelines can result in penalties, including fines or additional taxes owed. It is important to understand that these instructions serve as a legal framework for reporting and must be followed meticulously to avoid legal complications.

Filing Deadlines / Important Dates

Filing deadlines for Form 8865 are critical for compliance. Generally, the form must be filed by the due date of the U.S. tax return for the partner, including extensions. Typically, this means that the form is due on the fifteenth day of the fourth month following the end of the partnership's tax year. For partnerships with a fiscal year ending on December 31, the form would be due by April 15 of the following year. It is essential to keep track of these deadlines to avoid late filing penalties.

Required Documents

To complete Form 8865 accurately, several documents are typically required:

- Financial statements of the foreign partnership, including balance sheets and income statements.

- Documentation of any transactions between the U.S. partner and the foreign partnership.

- Records of any foreign taxes paid or accrued by the partnership.

- Any prior year tax returns related to the partnership, if applicable.

Penalties for Non-Compliance

Non-compliance with the requirements for Form 8865 can lead to significant penalties. The IRS imposes a penalty for failing to file the form, which can amount to thousands of dollars per month until the form is submitted. Additionally, if the form is filed late or contains inaccuracies, this can lead to further scrutiny from the IRS and potential audits. Understanding these penalties emphasizes the importance of accurate and timely filing.

Quick guide on how to complete pdf 2021 instructions for form 8865 internal revenue service

Effortlessly Prepare PDF Instructions For Form 8865 Internal Revenue Service on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documentation, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents quickly and without delay. Handle PDF Instructions For Form 8865 Internal Revenue Service on any device using the airSlate SignNow applications available for Android or iOS, and enhance your document-centric processes today.

Edit and eSign PDF Instructions For Form 8865 Internal Revenue Service with Ease

- Find PDF Instructions For Form 8865 Internal Revenue Service and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign feature, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searching for forms, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs within a few clicks from any device you select. Edit and eSign PDF Instructions For Form 8865 Internal Revenue Service to ensure clear communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf 2021 instructions for form 8865 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the pdf 2021 instructions for form 8865 internal revenue service

The best way to generate an electronic signature for a PDF file in the online mode

The best way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your smartphone

The way to make an e-signature for a PDF file on iOS devices

How to make an electronic signature for a PDF on Android

People also ask

-

What are the IRS 8865 instructions?

The IRS 8865 instructions provide detailed guidelines for U.S. persons involved in certain foreign partnerships. These instructions help taxpayers accurately report their interests and transactions, ensuring compliance with IRS regulations. Understanding these guidelines is crucial for avoiding potential penalties.

-

How can airSlate SignNow assist with the IRS 8865 instructions?

airSlate SignNow offers a streamlined solution for managing the documentation required for IRS 8865 instructions. Our platform allows you to easily eSign and send necessary forms, reducing the complexity of compliance. With electronic signatures, your documents are processed quickly and securely.

-

Is airSlate SignNow easy to use for IRS 8865 documents?

Yes, airSlate SignNow is designed for ease of use, making it simple to handle IRS 8865 documents. Our user-friendly interface allows both individuals and businesses to navigate the signing process effortlessly. You can focus on your compliance needs without worrying about complicated software.

-

What are the pricing options for using airSlate SignNow for IRS 8865 instructions?

airSlate SignNow offers competitive pricing plans tailored to meet various business needs, including those handling IRS 8865 instructions. You can choose from basic plans to more advanced options that provide additional features and support. Each plan is designed to deliver exceptional value at a reasonable cost.

-

What features does airSlate SignNow provide for IRS 8865 compliance?

airSlate SignNow includes features like document templates, audit trails, and customizable workflows that are particularly beneficial for IRS 8865 compliance. You can automate the signing process and keep track of all changes made to your documents easily. This ensures that you meet all IRS 8865 instructions efficiently.

-

Can airSlate SignNow integrate with other tools for IRS 8865 completion?

Absolutely, airSlate SignNow seamlessly integrates with a variety of tools and applications that assist in the completion of IRS 8865 forms. These integrations enhance your workflow and ensure that you can import and export data as needed. This flexibility can greatly simplify the process of adhering to IRS 8865 instructions.

-

What benefits does airSlate SignNow offer for businesses handling IRS 8865 forms?

Using airSlate SignNow for IRS 8865 forms provides several benefits, including time savings, reduced paperwork, and increased accuracy. Our platform helps streamline the documentation process, allowing you to focus more on your core business activities. With effective eSigning capabilities, compliance with IRS 8865 instructions becomes much simpler.

Get more for PDF Instructions For Form 8865 Internal Revenue Service

Find out other PDF Instructions For Form 8865 Internal Revenue Service

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself