About Form 8865, Return of US Persons with Respect to IRS 2019

What is the About Form 8865, Return Of US Persons With Respect To IRS

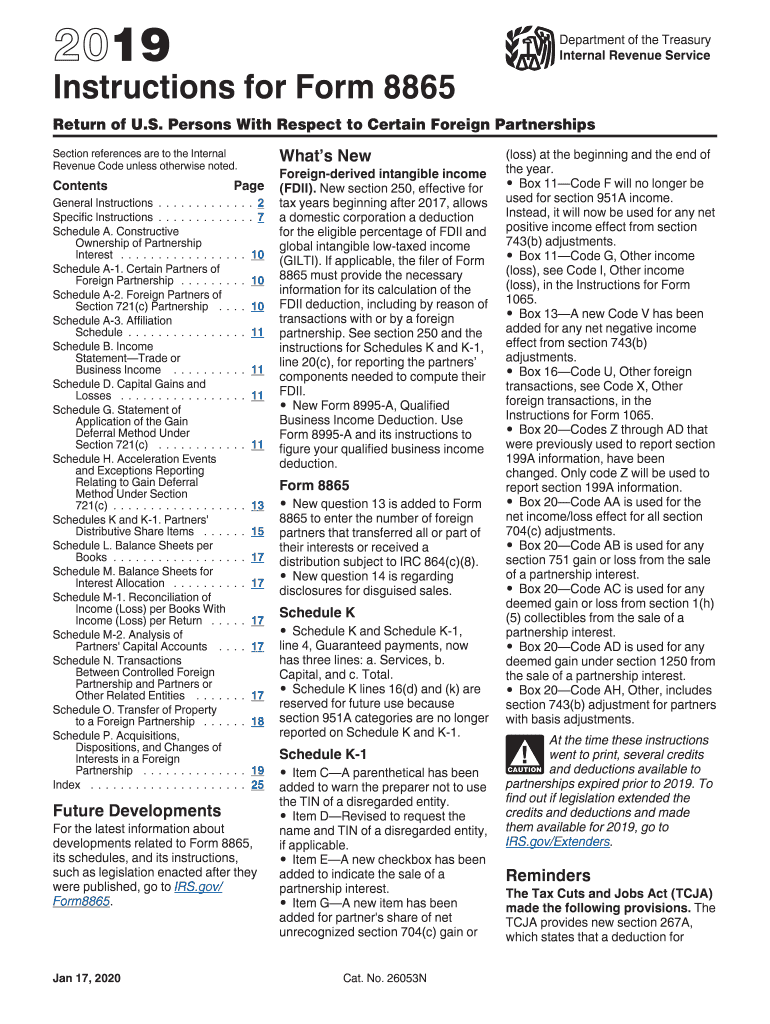

The About Form 8865, Return of US Persons With Respect to Certain Foreign Partnerships, is a tax form used by U.S. persons who have certain interests in foreign partnerships. This form is essential for reporting the income, deductions, and credits associated with these partnerships to the Internal Revenue Service (IRS). It helps ensure compliance with U.S. tax laws and provides transparency regarding foreign investments. Understanding the requirements and implications of this form is crucial for U.S. taxpayers involved in international business activities.

Steps to complete the About Form 8865, Return Of US Persons With Respect To IRS

Completing the About Form 8865 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to the foreign partnership, including financial statements and ownership details. Next, determine the appropriate schedules to complete based on your level of involvement with the partnership. Fill out the form carefully, providing detailed information about the partnership's income, deductions, and distributions. Finally, review the completed form for accuracy before submission. It is advisable to consult with a tax professional if you have questions about specific entries or requirements.

Legal use of the About Form 8865, Return Of US Persons With Respect To IRS

The legal use of the About Form 8865 is governed by IRS regulations that require U.S. persons to report their interests in foreign partnerships. Failure to file this form when required can lead to significant penalties, including fines and increased scrutiny from the IRS. The form must be filed annually, and it is important to adhere to the deadlines to avoid potential legal repercussions. Understanding the legal implications of this form is essential for maintaining compliance with U.S. tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the About Form 8865 typically align with the tax return deadlines for U.S. persons. Generally, the form is due on the same date as the individual's tax return, which is usually April 15. However, if an extension is filed for the tax return, the deadline for Form 8865 may also be extended. It is crucial to be aware of these dates to ensure timely submission and avoid penalties. Marking your calendar with these important deadlines can help maintain compliance.

Required Documents

When preparing to file the About Form 8865, several documents are necessary to ensure accurate reporting. These documents may include:

- Financial statements of the foreign partnership

- Ownership agreements or contracts

- Records of contributions and distributions

- Tax identification numbers for all partners

- Any prior year Form 8865 submissions, if applicable

Having these documents readily available will facilitate the completion of the form and help ensure compliance with IRS requirements.

Penalties for Non-Compliance

Non-compliance with the filing requirements of the About Form 8865 can result in severe penalties. The IRS imposes significant fines for failure to file, which can range from $10,000 to $50,000, depending on the circumstances. Additionally, the IRS may impose penalties for inaccurate information or late submissions. It is essential for U.S. persons with interests in foreign partnerships to understand these penalties and take proactive steps to ensure compliance to avoid financial repercussions.

Quick guide on how to complete about form 8865 return of us persons with respect to irs

Effortlessly Prepare About Form 8865, Return Of US Persons With Respect To IRS on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without interruptions. Manage About Form 8865, Return Of US Persons With Respect To IRS on any device with the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

The Easiest Way to Edit and Electronically Sign About Form 8865, Return Of US Persons With Respect To IRS with Ease

- Locate About Form 8865, Return Of US Persons With Respect To IRS and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a handwritten signature.

- Review all details and click the Done button to save your changes.

- Choose how you wish to submit your form—via email, SMS, or shareable link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting document copies. airSlate SignNow caters to your document management needs in just a few clicks from your selected device. Edit and electronically sign About Form 8865, Return Of US Persons With Respect To IRS to ensure exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 8865 return of us persons with respect to irs

Create this form in 5 minutes!

How to create an eSignature for the about form 8865 return of us persons with respect to irs

The way to make an eSignature for your PDF file online

The way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is Form 8865, Return Of US Persons With Respect To IRS?

Form 8865 is a tax form used by U.S. persons to report information regarding foreign partnerships. Understanding 'About Form 8865, Return Of US Persons With Respect To IRS' is crucial for compliance with U.S. tax laws and for reporting financial interests in foreign entities.

-

Who needs to file Form 8865?

Any U.S. person who has an interest in a foreign partnership must file Form 8865 according to IRS guidelines. It's essential to familiarize yourself with 'About Form 8865, Return Of US Persons With Respect To IRS' to ensure timely and accurate compliance, as penalties can arise from failure to file.

-

What are the penalties for not filing Form 8865?

The IRS imposes substantial penalties for failing to file Form 8865, which can include fines and interest on unpaid taxes. For comprehensive details 'About Form 8865, Return Of US Persons With Respect To IRS,' consult with a tax professional or advisor to avoid costly mistakes.

-

Can airSlate SignNow assist with the filing of Form 8865?

While airSlate SignNow primarily focuses on document management and e-signature solutions, it can streamline the process of preparing Form 8865. Learn more 'About Form 8865, Return Of US Persons With Respect To IRS' and utilize our platform for efficient document management.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow provides features such as document templates, automated workflows, and real-time collaboration to make signing documents easy. Understanding 'About Form 8865, Return Of US Persons With Respect To IRS' can be complemented by these features, ensuring your related documents are signed effortlessly.

-

What integrations does airSlate SignNow support?

airSlate SignNow integrates seamlessly with numerous applications, allowing you to manage documents directly from your preferred platforms. Familiarizing yourself 'About Form 8865, Return Of US Persons With Respect To IRS' can be enhanced by using our integrations for more efficient project management.

-

Is airSlate SignNow cost-effective for businesses?

Yes, airSlate SignNow offers a variety of pricing plans to suit different business needs, making it a cost-effective solution for document signing. By understanding 'About Form 8865, Return Of US Persons With Respect To IRS,' businesses can better allocate resources towards compliance while benefiting from our affordable pricing.

Get more for About Form 8865, Return Of US Persons With Respect To IRS

- 2022 california tax table 2022 california tax table form

- Desktop form 3514 california earned income tax credit

- Form y 204 yonkers nonresident partner allocation tax year

- 2022 form ftb 3582payment voucher for individual e filed returns 2022 form ftb 3582payment voucher for individual e filed

- State net operating loss provisionstax foundation form

- Ia 2440 disability income exclusion 41 127 form

- S corporation state business tax filing software taxact form

- Articles of incorporation general stock corporation form arts gs

Find out other About Form 8865, Return Of US Persons With Respect To IRS

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now