Fillable Online Registration Form Camp Galilee Fax Email 2020

IRS Guidelines for Completing the 8865 Instructions Form

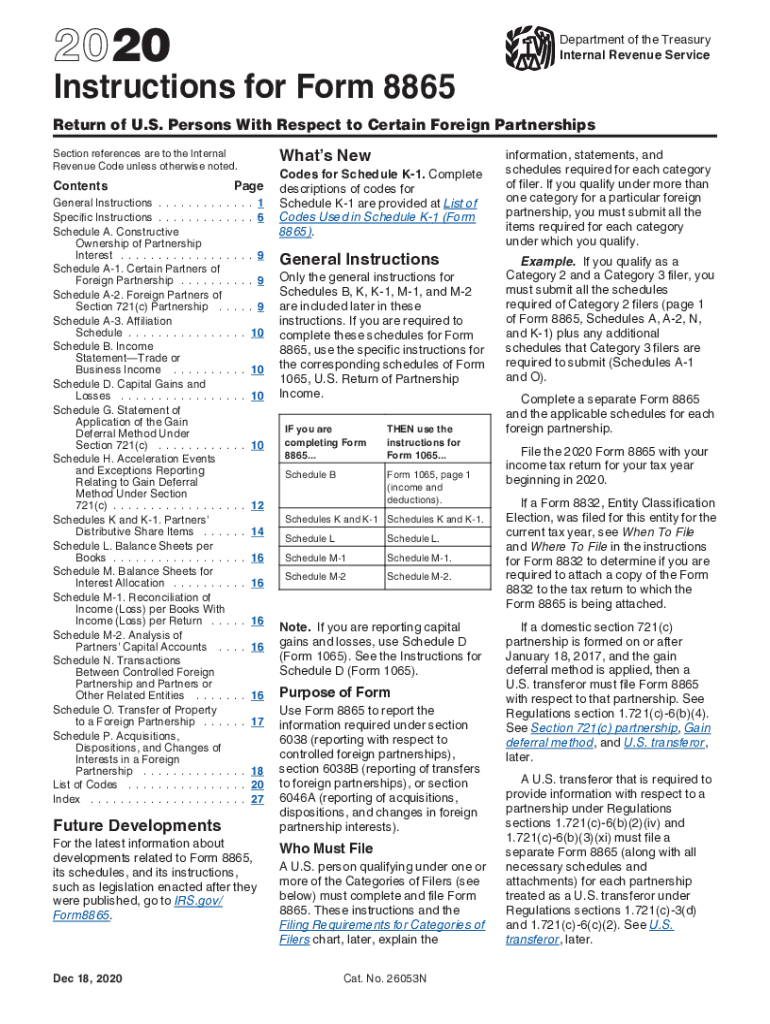

The IRS 8865 instructions form is essential for reporting certain foreign partnerships. Understanding the guidelines provided by the IRS is crucial for compliance. The form requires detailed information about the partnership, including its income, deductions, and credits. It is important to follow the IRS guidelines closely to avoid penalties and ensure accurate reporting. The instructions outline the necessary steps for completing the form, including how to report foreign income and the specific documentation required.

Filing Deadlines and Important Dates

Timely filing of the 8865 instructions form is critical. The deadlines for submission depend on the type of entity and the partnership's tax year. Generally, the form is due on the 15th day of the fourth month following the end of the partnership's tax year. If the partnership is on a calendar year, this typically means April 15. Extensions may be available, but it is important to file for an extension before the original due date to avoid penalties.

Required Documents for Submission

When completing the 8865 instructions form, several documents may be required to support the information provided. These documents include financial statements, partnership agreements, and any relevant foreign tax documentation. Having these documents readily available can streamline the filing process and ensure that all necessary information is accurately reported. It is advisable to keep copies of all submitted documents for your records.

Form Submission Methods

The 8865 instructions form can be submitted through various methods, including online and by mail. Electronic filing is encouraged as it can expedite processing and reduce the likelihood of errors. If submitting by mail, ensure that the form is sent to the correct IRS address and that it is postmarked by the filing deadline. It is also recommended to use a reliable mailing method that provides tracking to confirm receipt by the IRS.

Penalties for Non-Compliance

Failure to file the 8865 instructions form or providing inaccurate information can result in significant penalties. The IRS imposes fines for late filings and may assess additional penalties for underreporting income or failing to disclose foreign assets. Understanding these penalties emphasizes the importance of accurate and timely submission. It is advisable to review the IRS guidelines thoroughly to mitigate the risk of non-compliance.

Digital vs. Paper Version of the Form

Choosing between the digital and paper versions of the 8865 instructions form can impact the filing process. The digital version allows for easier completion and submission, often with built-in checks to reduce errors. Conversely, the paper version requires careful manual entry and may take longer to process. Evaluating the benefits of each method can help ensure a smoother filing experience.

Eligibility Criteria for Filing

Not all taxpayers are required to file the 8865 instructions form. Eligibility typically depends on the ownership interest in the foreign partnership and the partnership's activities. U.S. persons who own a certain percentage of a foreign partnership must file this form to report their share of the partnership's income and expenses. Understanding the eligibility criteria is essential to determine whether you need to complete the form.

Quick guide on how to complete fillable online registration form camp galilee fax email

Effortlessly Prepare Fillable Online Registration Form Camp Galilee Fax Email on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without any hold-ups. Handle Fillable Online Registration Form Camp Galilee Fax Email seamlessly across all devices with airSlate SignNow apps for Android or iOS and enhance any document-oriented task today.

How to Edit and Electronically Sign Fillable Online Registration Form Camp Galilee Fax Email with Ease

- Obtain Fillable Online Registration Form Camp Galilee Fax Email and click Get Form to begin.

- Make use of the tools available to fill out your form.

- Emphasize important sections of the documents or redact sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or mislaid documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Revise and electronically sign Fillable Online Registration Form Camp Galilee Fax Email to ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online registration form camp galilee fax email

Create this form in 5 minutes!

How to create an eSignature for the fillable online registration form camp galilee fax email

The way to generate an electronic signature for a PDF file online

The way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

The way to create an eSignature for a PDF document on Android devices

People also ask

-

What is the 8865 instructions form pdf and why do I need it?

The 8865 instructions form pdf is a document that provides guidelines for U.S. taxpayers regarding the filing of Form 8865, which pertains to foreign partnerships. Understanding this form is essential to ensure compliance with IRS regulations and avoid penalties. Utilizing airSlate SignNow, you can easily access and eSign these documents seamlessly.

-

How can airSlate SignNow help me with the 8865 instructions form pdf?

airSlate SignNow enables you to upload, fill, and eSign the 8865 instructions form pdf quickly. Our intuitive platform simplifies document management, ensuring that your forms are completed accurately and efficiently. This is especially beneficial for businesses managing international partnerships.

-

Is airSlate SignNow cost-effective for filing forms like the 8865 instructions form pdf?

Yes, airSlate SignNow offers a cost-effective solution for managing and eSigning documents, including the 8865 instructions form pdf. With flexible pricing plans tailored to your business needs, you can choose a plan that fits your budget while still receiving premium document management features.

-

Can I integrate airSlate SignNow with other software to manage my 8865 instructions form pdf?

Absolutely! airSlate SignNow offers various integration options with popular software tools that allow you to streamline your workflow and manage the 8865 instructions form pdf effortlessly. By integrating, you can centralize your documents and enhance productivity across your business operations.

-

What features does airSlate SignNow provide for handling the 8865 instructions form pdf?

airSlate SignNow offers a range of features for handling the 8865 instructions form pdf, including eSigning, templates, and document tracking. These features enhance your ability to manage forms efficiently and ensure that all parties are in sync throughout the signing process.

-

How secure is my information when using airSlate SignNow for my 8865 instructions form pdf?

Security is a top priority at airSlate SignNow. When you use our platform for the 8865 instructions form pdf, your data is protected with industry-standard encryption and secure storage solutions. This ensures that your sensitive information remains safe and confidential.

-

Is it easy to use airSlate SignNow for beginners working on the 8865 instructions form pdf?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for beginners to work on the 8865 instructions form pdf. With a simple interface and helpful tutorials, you will quickly learn how to upload, edit, and eSign documents without any hassle.

Get more for Fillable Online Registration Form Camp Galilee Fax Email

- 1350 state of south carolina department of revenue application for form

- 1350 state of south carolina sc w 4 department of revenue south form

- I got a letter saying i need to go to dorscgovverifycode intuit form

- For tax year sc department of revenue scgov form

- 2021 form sc pr 26 fill online printable fillable blank pdffiller

- Printable south carolina sales tax exemption certificates1350 state of south carolina sc w 4 department of revenueprintable form

- Reopening protocol for office based worksites appendix d form

- Group child care centers wisconsin department of children form

Find out other Fillable Online Registration Form Camp Galilee Fax Email

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple