US Tax Form 8865 Return of US Persons with Respect to 2020

What is the US Tax Form 8865 Return Of US Persons With Respect To

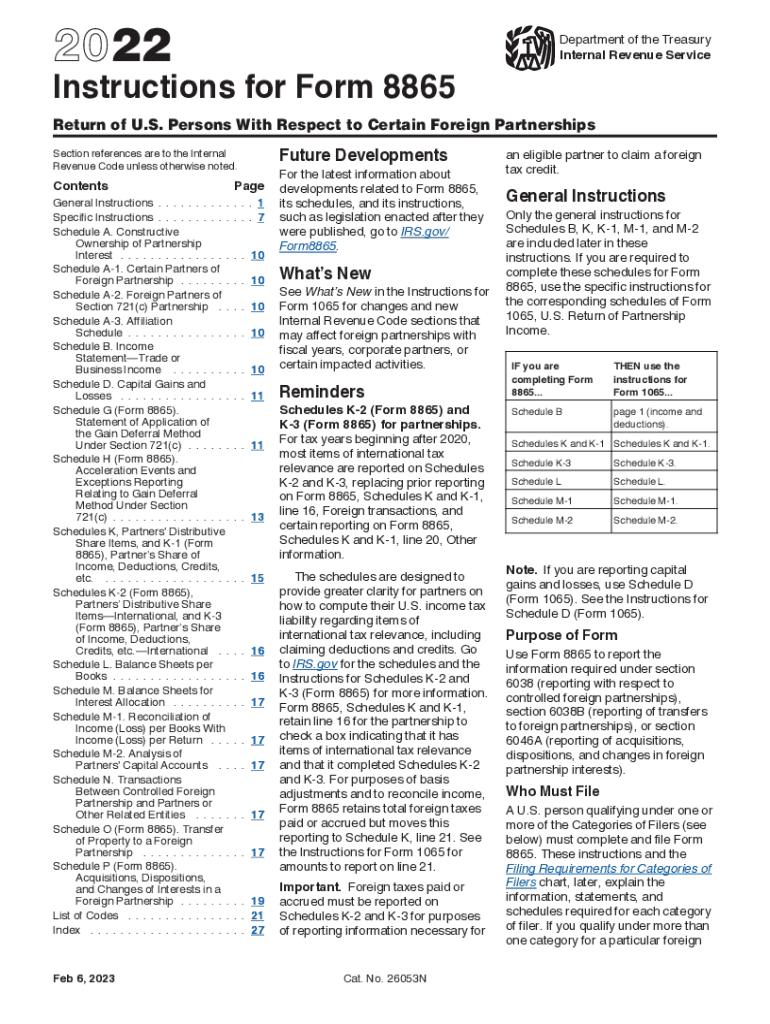

The US Tax Form 8865 is a crucial document for US persons who have an interest in a foreign partnership. This form is designed to report information regarding the activities and financial status of the partnership, ensuring compliance with IRS regulations. It is particularly relevant for individuals who own at least a ten percent interest in a foreign partnership or who are involved in certain transactions with such partnerships. The form helps the IRS track foreign income and assets, contributing to the overall transparency of international financial activities.

Steps to complete the US Tax Form 8865 Return Of US Persons With Respect To

Completing the US Tax Form 8865 involves several key steps:

- Gather necessary information about the foreign partnership, including its name, address, and Employer Identification Number (EIN).

- Determine your ownership percentage and the type of interest you hold in the partnership.

- Fill out the required sections of the form, which include details about the partnership's income, deductions, and credits.

- Provide any additional information required by the IRS, such as financial statements or schedules that support your reporting.

- Review the completed form for accuracy and completeness before submission.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the US Tax Form 8865 to avoid penalties. The form is generally due on the same date as your income tax return, including any extensions. For most taxpayers, this means the form is due on April fifteenth. If you are filing for a partnership that operates on a fiscal year, the form is due on the fifteenth day of the fourth month following the end of the partnership's tax year. Staying informed about these deadlines ensures timely compliance with IRS requirements.

Required Documents

To accurately complete the US Tax Form 8865, several documents are typically required:

- Financial statements of the foreign partnership, including balance sheets and income statements.

- Records of your ownership interest and any transactions with the partnership.

- Documentation of any foreign taxes paid related to the partnership.

- Previous year’s tax returns, if applicable, to ensure consistency and accuracy.

Penalties for Non-Compliance

Failure to file the US Tax Form 8865 can result in significant penalties. The IRS imposes a penalty of $10,000 for each year the form is not filed, which can escalate if the failure continues. Additionally, if the IRS determines that the non-compliance was willful, the penalties may increase substantially. It is crucial to file the form accurately and on time to avoid these financial repercussions.

Eligibility Criteria

Eligibility to file the US Tax Form 8865 is primarily determined by your relationship with the foreign partnership. You must be a US person, which includes citizens, residents, and entities created or organized in the United States. You must also have at least a ten percent ownership interest in the partnership or meet specific reporting requirements related to transactions with the partnership. Understanding these criteria helps ensure that you are filing the correct forms and providing the necessary information to the IRS.

Quick guide on how to complete us tax form 8865 return of us persons with respect to

Complete US Tax Form 8865 Return Of US Persons With Respect To effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage US Tax Form 8865 Return Of US Persons With Respect To on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and electronically sign US Tax Form 8865 Return Of US Persons With Respect To with ease

- Locate US Tax Form 8865 Return Of US Persons With Respect To and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive details with the tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your adjustments.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign US Tax Form 8865 Return Of US Persons With Respect To and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct us tax form 8865 return of us persons with respect to

Create this form in 5 minutes!

How to create an eSignature for the us tax form 8865 return of us persons with respect to

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the US Tax Form 8865 Return Of US Persons With Respect To?

The US Tax Form 8865 Return Of US Persons With Respect To is a tax form that US taxpayers must file if they have an interest in a foreign partnership. This form helps report your transactions and interests in foreign partnerships to the IRS, ensuring compliance with US tax regulations. Properly filing this form can prevent potential penalties and misunderstandings with tax authorities.

-

How does airSlate SignNow help with US Tax Form 8865 Return Of US Persons With Respect To?

airSlate SignNow streamlines the process of completing and eSigning the US Tax Form 8865 Return Of US Persons With Respect To. Our platform allows you to easily manage and send your tax documents securely, ensuring that all necessary signatures are obtained promptly. Additionally, our solution provides templates to simplify the preparation of this complex tax form.

-

What features does airSlate SignNow offer for tax form management?

With airSlate SignNow, you gain access to features that include document templates, eSignature capabilities, and secure cloud storage. These features make it easier to prepare and send the US Tax Form 8865 Return Of US Persons With Respect To. Furthermore, our audit trail ensures that all changes and signatures are recorded for compliance and verification purposes.

-

Is airSlate SignNow cost-effective for filing US Tax Form 8865 Return Of US Persons With Respect To?

Yes, airSlate SignNow is designed as a cost-effective solution for businesses looking to manage their document signing needs, including the US Tax Form 8865 Return Of US Persons With Respect To. Our pricing plans are structured to accommodate various needs, helping users save money while ensuring compliance with tax regulations. This allows businesses to focus their resources on growth instead of document management.

-

Can I integrate airSlate SignNow with other tax software?

Absolutely! airSlate SignNow integrates seamlessly with many popular tax software solutions. This integration allows users to easily import and export data related to the US Tax Form 8865 Return Of US Persons With Respect To, signNowly reducing the time spent on managing your tax documents. Our API also enables custom integrations to fit your specific needs.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents like the US Tax Form 8865 Return Of US Persons With Respect To offers numerous benefits. You can expedite the signing process, improve document tracking, and enhance security through encryption. Moreover, our user-friendly interface makes it accessible for all users, regardless of their tech-savvy level.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore all the features available for managing documents such as the US Tax Form 8865 Return Of US Persons With Respect To. This trial gives you the opportunity to experience the platform's ease of use and efficiency before committing to a subscription plan. Sign up today and discover how we can simplify your document management.

Get more for US Tax Form 8865 Return Of US Persons With Respect To

- Sunshine otc catalog form

- South dakota child custody modification forms

- Sponsorship template for an airline form

- Find the slope and y intercept for each equation answer key form

- Odm online registration form

- Mankind episode 1 answers form

- Conceptual framework template editable form

- Company credit card agreement template form

Find out other US Tax Form 8865 Return Of US Persons With Respect To

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement