PDF Form ST 140 Individual Purchaser's Annual Report of Sales and 2021

What is the PDF Form ST 140 Individual Purchaser's Annual Report Of Sales And

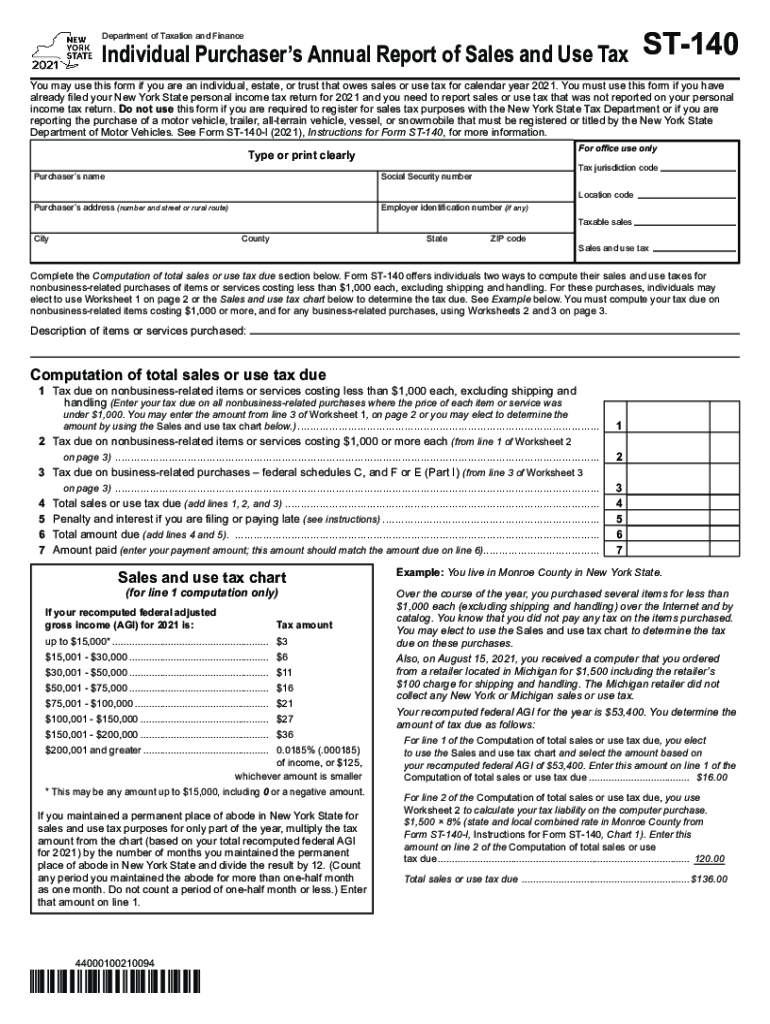

The PDF Form ST 140, also known as the Individual Purchaser's Annual Report of Sales and Use Tax, is a crucial document for individuals in New York who have made purchases that are subject to use tax. This form allows individuals to report and remit the use tax owed on items purchased for use in New York State where sales tax was not collected at the time of purchase. It is essential for maintaining compliance with state tax regulations and ensuring that all applicable taxes are paid accurately.

Steps to complete the PDF Form ST 140 Individual Purchaser's Annual Report Of Sales And

Completing the ST 140 form involves several important steps to ensure accuracy and compliance. First, gather all relevant purchase receipts and documentation that detail the items bought throughout the year. Next, fill out the form by providing your personal information, including your name, address, and taxpayer identification number. Then, list each purchase along with the corresponding amount and calculate the total use tax owed. Finally, review the form for completeness and accuracy before submitting it to the New York State Department of Taxation and Finance.

Legal use of the PDF Form ST 140 Individual Purchaser's Annual Report Of Sales And

The legal use of the ST 140 form is governed by New York State tax laws, which require individuals to report any taxable purchases made without sales tax collection. By filing this form, individuals fulfill their legal obligation to report use tax, thus avoiding potential penalties for non-compliance. The form serves as a formal declaration to the state, ensuring that all tax liabilities are met and that individuals remain in good standing with tax authorities.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the ST 140 form to avoid late fees and penalties. Typically, the form must be submitted by April fifteenth of the year following the tax year being reported. For example, for purchases made in the year 2022, the form should be filed by April fifteenth, 2023. Keeping track of these deadlines ensures timely compliance and helps individuals manage their tax responsibilities effectively.

Form Submission Methods (Online / Mail / In-Person)

The ST 140 form can be submitted through various methods to accommodate different preferences and circumstances. Individuals have the option to file the form online through the New York State Department of Taxation and Finance website, which allows for a convenient and efficient submission process. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each submission method has its own guidelines, so it is advisable to follow the instructions provided by the state.

Examples of using the PDF Form ST 140 Individual Purchaser's Annual Report Of Sales And

Examples of using the ST 140 form include situations where individuals purchase items from out-of-state retailers that do not charge New York sales tax. For instance, if a resident buys furniture from an online store based in another state, they are responsible for reporting and paying the use tax on that purchase. Other examples include purchases of equipment for a home office or items bought at garage sales where sales tax was not collected. These scenarios illustrate the importance of the ST 140 form in ensuring compliance with state tax laws.

Quick guide on how to complete pdf form st 140 individual purchasers annual report of sales and

Easily prepare PDF Form ST 140 Individual Purchaser's Annual Report Of Sales And on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage PDF Form ST 140 Individual Purchaser's Annual Report Of Sales And on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

How to modify and electronically sign PDF Form ST 140 Individual Purchaser's Annual Report Of Sales And effortlessly

- Find PDF Form ST 140 Individual Purchaser's Annual Report Of Sales And and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or conceal sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to finalize your changes.

- Choose how you wish to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Adjust and electronically sign PDF Form ST 140 Individual Purchaser's Annual Report Of Sales And to ensure superior communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf form st 140 individual purchasers annual report of sales and

Create this form in 5 minutes!

How to create an eSignature for the pdf form st 140 individual purchasers annual report of sales and

The way to create an electronic signature for your PDF document in the online mode

The way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What is form st 140?

Form ST-140 is a sales tax exemption certificate used in various states to exempt certain transactions from sales tax. It is critical for businesses that purchase goods or services exempt from tax to complete this form accurately. Utilizing airSlate SignNow can streamline the process of filling and signing form ST-140, making it easier for businesses to manage their tax exemptions.

-

How can airSlate SignNow help with form st 140?

airSlate SignNow provides an intuitive platform that allows users to complete, send, and eSign form ST-140 with ease. With features like customizable templates and secure cloud storage, businesses can efficiently manage their tax exemption documents. This reduces the risk of errors and speeds up the processing time signNowly.

-

Is airSlate SignNow affordable for small businesses needing form st 140?

Yes, airSlate SignNow offers cost-effective solutions that cater to small businesses needing form ST-140. With flexible pricing plans, you can choose an option that fits your budget while enjoying powerful features. Investing in airSlate SignNow not only simplifies your document signing process but also ensures compliance with tax regulations.

-

Does airSlate SignNow offer integrations for managing form st 140?

Absolutely! airSlate SignNow integrates seamlessly with popular business applications, allowing you to manage form ST-140 efficiently. Whether you use CRM systems or accounting software, these integrations ensure that your documents are organized and accessible. This enhances workflow efficiency and keeps your team on the same page.

-

What are the benefits of using airSlate SignNow for form st 140?

Using airSlate SignNow for form ST-140 comes with several benefits, including time savings and reduced paperwork. The platform enhances collaboration by enabling users to sign and send documents anytime, anywhere. Additionally, you gain access to audit trails that ensure compliance and provide peace of mind.

-

How secure is the process of signing form st 140 with airSlate SignNow?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption methods to protect your documents, including form ST-140, during transmission and storage. This ensures that sensitive information remains confidential and secure, giving you confidence in your electronic signing process.

-

Can I track the status of my form st 140 once sent with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for documents, including form ST-140. You can easily monitor who has signed and when, offering transparency throughout the signing process. This feature helps you stay organized and ensures that important forms are completed in a timely manner.

Get more for PDF Form ST 140 Individual Purchaser's Annual Report Of Sales And

- Louisiana revocation 497309037 form

- Motion and order to reduce bond and release on own recognizance louisiana form

- Rule divorce form

- Rule for divorce and to set visitation louisiana form

- Rule show cause form

- La restraining form

- Sale to be held in escrow louisiana form

- Louisiana sanity commission form

Find out other PDF Form ST 140 Individual Purchaser's Annual Report Of Sales And

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure