Form ST 140 Individual Purchasers Annual Report of Sales and Use Tax Tax Year 2020

What is the Form ST 140 Individual Purchasers Annual Report Of Sales And Use Tax Tax Year

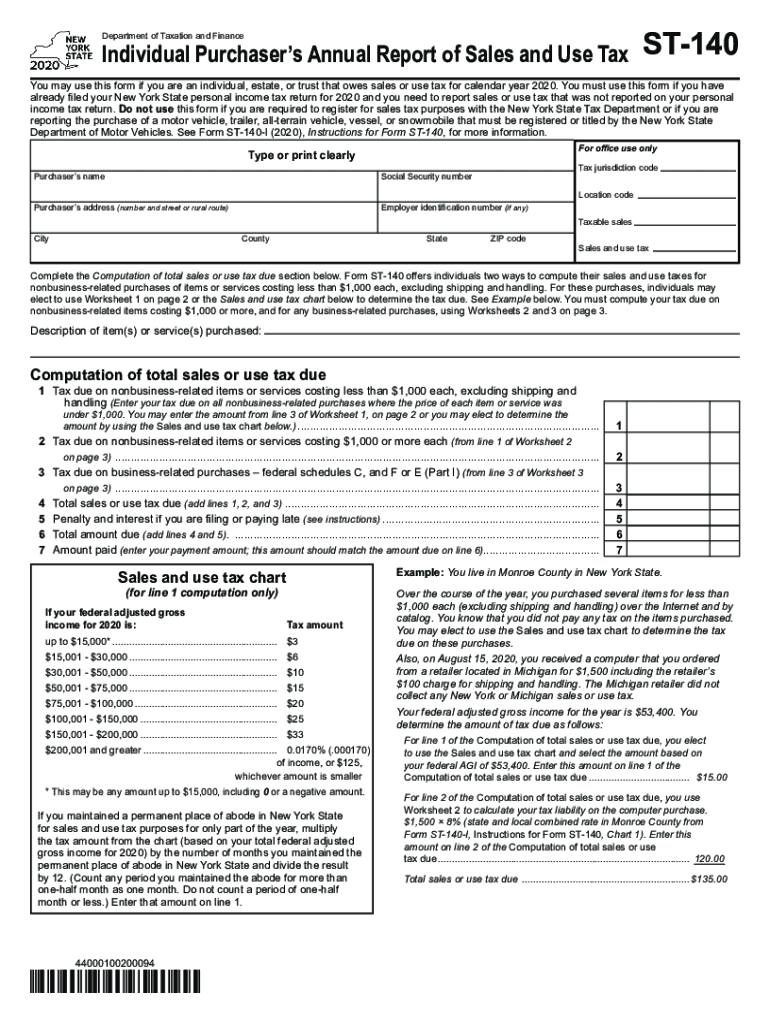

The Form ST 140 is a crucial document used by individuals in New York to report their annual sales and use tax obligations. This form is specifically designed for individual purchasers who have made taxable purchases throughout the tax year. It allows taxpayers to declare any sales tax they owe on items purchased for personal use that were not taxed at the point of sale. Filing this form ensures compliance with state tax regulations and helps maintain accurate records of tax liabilities.

How to use the Form ST 140 Individual Purchasers Annual Report Of Sales And Use Tax Tax Year

Using the Form ST 140 involves several steps to accurately report your sales and use tax. First, gather all receipts and records of taxable purchases made during the year. Next, complete the form by providing your personal information, including your name and address. You will also need to list the items purchased, their costs, and any applicable sales tax. Finally, calculate the total tax owed and submit the form to the appropriate state tax authority by the specified deadline.

Steps to complete the Form ST 140 Individual Purchasers Annual Report Of Sales And Use Tax Tax Year

Completing the Form ST 140 requires careful attention to detail. Follow these steps:

- Gather Documentation: Collect all receipts for taxable purchases made during the year.

- Fill Out Personal Information: Enter your name, address, and any other required personal details.

- List Purchases: Provide a detailed list of items purchased, including their costs and any sales tax paid.

- Calculate Total Tax: Sum the sales tax for all items listed to determine the total tax owed.

- Review and Submit: Double-check all information for accuracy before submitting the form to the state tax authority.

Legal use of the Form ST 140 Individual Purchasers Annual Report Of Sales And Use Tax Tax Year

The legal use of the Form ST 140 is essential for individuals to fulfill their tax obligations in New York. By accurately reporting sales and use tax, taxpayers comply with state laws and avoid potential penalties. The form serves as a formal declaration of tax liabilities and is recognized by the New York State Department of Taxation and Finance. Proper completion and timely submission of this form are vital to ensure that all purchases are accounted for in accordance with state tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form ST 140 are crucial for compliance. Typically, the form must be submitted by the end of the tax year, which is December thirty-first. Taxpayers should also be aware of any specific deadlines set by the New York State Department of Taxation and Finance for the current tax year. Timely filing helps avoid penalties and interest on unpaid taxes, making it important to mark these dates on your calendar.

Penalties for Non-Compliance

Failure to file the Form ST 140 or inaccuracies in reporting can lead to significant penalties. The New York State Department of Taxation and Finance may impose fines for late submissions or for underreporting sales tax liabilities. Additionally, interest may accrue on any unpaid tax amounts. It is essential for taxpayers to understand these consequences and ensure that the form is completed accurately and submitted on time to avoid financial repercussions.

Quick guide on how to complete form st 140 individual purchasers annual report of sales and use tax tax year 2020

Complete Form ST 140 Individual Purchasers Annual Report Of Sales And Use Tax Tax Year effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a fantastic eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents quickly without any delays. Manage Form ST 140 Individual Purchasers Annual Report Of Sales And Use Tax Tax Year on any device using the airSlate SignNow Android or iOS applications and simplify any document-based task today.

The easiest method to modify and electronically sign Form ST 140 Individual Purchasers Annual Report Of Sales And Use Tax Tax Year with ease

- Obtain Form ST 140 Individual Purchasers Annual Report Of Sales And Use Tax Tax Year and click on Get Form to begin.

- Utilize the tools we provide to submit your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow makes available specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review the information carefully and click on the Done button to save your changes.

- Select how you wish to send your form—via email, SMS, or invite link—or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form ST 140 Individual Purchasers Annual Report Of Sales And Use Tax Tax Year to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 140 individual purchasers annual report of sales and use tax tax year 2020

Create this form in 5 minutes!

How to create an eSignature for the form st 140 individual purchasers annual report of sales and use tax tax year 2020

The best way to generate an eSignature for your PDF file in the online mode

The best way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What is the NY 140 form and how can airSlate SignNow help?

The NY 140 form is essential for certain state tax processes in New York. airSlate SignNow provides a user-friendly platform that allows you to easily complete, sign, and send this form electronically. With our solution, you're able to streamline your document processing, ensuring compliance and accuracy.

-

How much does it cost to use airSlate SignNow for NY 140 documents?

The pricing for using airSlate SignNow is competitive and varies based on the subscription plan chosen. Our plans are designed to be budget-friendly, allowing businesses to manage their NY 140 documents cost-effectively without compromising on features and security.

-

What features does airSlate SignNow offer for handling NY 140 forms?

airSlate SignNow offers a variety of features for handling NY 140 forms, including eSigning, customizable templates, and automated workflow tools. Our platform ensures that all signatures are legally binding and compliant with New York regulations, making the signing process quick and efficient.

-

Is airSlate SignNow secure for signing sensitive NY 140 documents?

Yes, airSlate SignNow prioritizes the security of your documents through advanced encryption protocols. When dealing with sensitive NY 140 documents, you can trust our platform to keep your information safe and protected, ensuring a secure signing experience.

-

Can I integrate airSlate SignNow with other applications for NY 140 workflows?

Absolutely! airSlate SignNow offers integration capabilities with a range of popular applications and software. This allows for a seamless workflow management process when dealing with NY 140 forms and enhances productivity by streamlining data transfer between systems.

-

What are the benefits of using airSlate SignNow for NY 140 document management?

Using airSlate SignNow for NY 140 document management offers numerous benefits. These include time savings, enhanced accuracy, and the ability to track the status of your documents in real-time. Our solution empowers businesses to focus on their core activities while simplifying the management of essential forms.

-

Is customer support available for NY 140 form users of airSlate SignNow?

Yes, we offer comprehensive customer support for all airSlate SignNow users, including those dealing with NY 140 forms. Our support team is readily available to assist with any queries or issues, ensuring that you have the help you need to efficiently manage your documents.

Get more for Form ST 140 Individual Purchasers Annual Report Of Sales And Use Tax Tax Year

- Certificate of physical fitness by a single medical officer form

- Grade 3 english papers form

- Floral wedding contract form

- Electrical panel template form

- Authentic threads accounting simulation answers pdf form

- Annie apple letterland worksheets form

- Credit card authorization form my portal ramada by

- Veterinary treatment authorization my pet39s friend form

Find out other Form ST 140 Individual Purchasers Annual Report Of Sales And Use Tax Tax Year

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document