Instructions for Form ST 140 Tax NY Gov 2022

Understanding the ST 140 Form

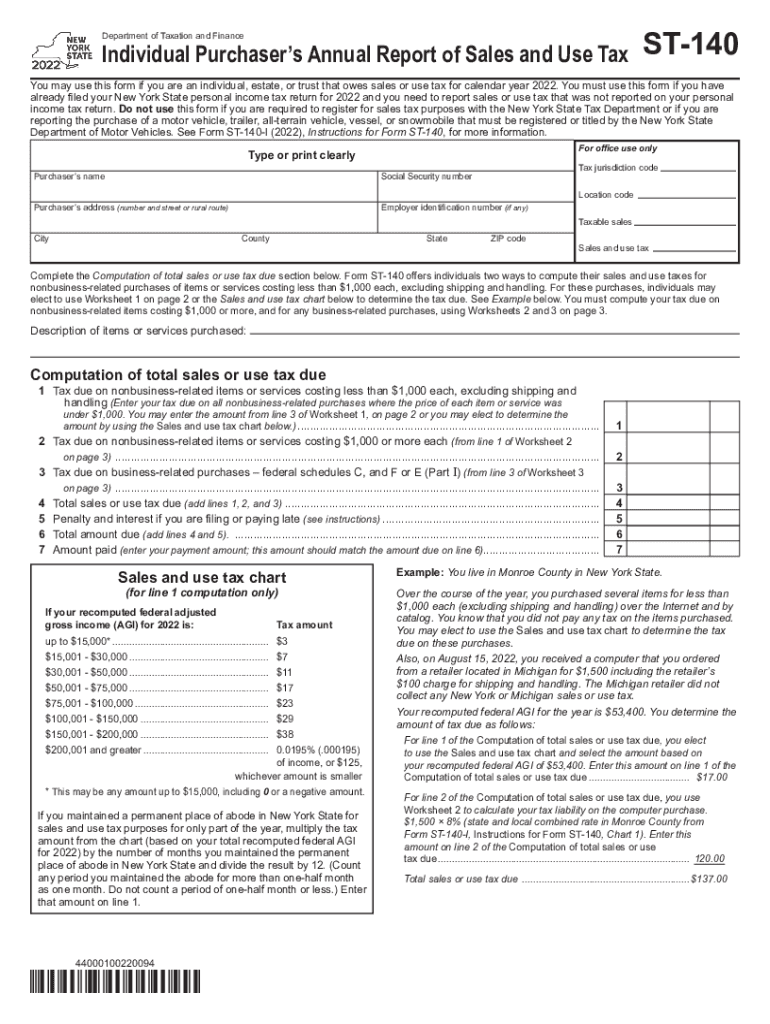

The ST 140 form, also known as the New York State Use Tax Return, is essential for individuals and businesses that have purchased goods outside of New York State and are subject to use tax. This form allows taxpayers to report and pay the use tax owed on these purchases. It is particularly relevant for those who have made online purchases or acquired goods from out-of-state vendors without paying New York sales tax. Understanding the purpose and requirements of the ST 140 form is crucial for compliance with state tax laws.

Steps to Complete the ST 140 Form

Completing the ST 140 form involves several key steps to ensure accuracy and compliance. Here are the main steps:

- Gather relevant information about your purchases, including dates, amounts, and descriptions of the items.

- Calculate the total amount of use tax owed based on the purchase price and applicable tax rates.

- Fill out the ST 140 form with your personal information, including your name, address, and taxpayer identification number.

- Detail each purchase on the form, ensuring that all information is accurate and complete.

- Review the completed form for any errors before submission.

Following these steps will help ensure that your ST 140 form is filled out correctly and submitted on time.

Legal Use of the ST 140 Form

The ST 140 form is legally binding when completed and submitted according to New York State tax regulations. It is crucial to provide accurate information, as discrepancies can lead to penalties or audits. The form serves as a declaration of use tax liability, and by signing it, you affirm that the information provided is true and complete. Compliance with state laws regarding use tax is essential for avoiding legal issues and ensuring that you fulfill your tax obligations.

Filing Deadlines for the ST 140 Form

Timely filing of the ST 140 form is important to avoid penalties. The form is typically due on the same date as your income tax return, which is usually April fifteenth for most taxpayers. If you are unable to file by this date, you may request an extension, but it is essential to pay any use tax owed by the original deadline to avoid interest and penalties. Keeping track of these deadlines will help ensure compliance with New York State tax laws.

Required Documents for the ST 140 Form

When completing the ST 140 form, certain documents may be necessary to substantiate your claims. These documents include:

- Receipts or invoices for purchases made outside of New York State.

- Records of any sales tax paid to other jurisdictions.

- Documentation of any exemptions that may apply to your purchases.

Having these documents on hand will facilitate the accurate completion of the ST 140 form and support your tax filings.

Who Issues the ST 140 Form

The ST 140 form is issued by the New York State Department of Taxation and Finance. This agency is responsible for administering tax laws and ensuring compliance among taxpayers. If you have questions or need assistance regarding the ST 140 form, the Department of Taxation and Finance provides resources and support to help you navigate the process.

Quick guide on how to complete instructions for form st 140 taxnygov

Easily Prepare Instructions For Form ST 140 Tax NY gov on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents promptly without delays. Manage Instructions For Form ST 140 Tax NY gov on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

Effortlessly Modify and Electronically Sign Instructions For Form ST 140 Tax NY gov

- Find Instructions For Form ST 140 Tax NY gov and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which only takes a few seconds and carries the same legal validity as a typical wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Instructions For Form ST 140 Tax NY gov and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form st 140 taxnygov

Create this form in 5 minutes!

How to create an eSignature for the instructions for form st 140 taxnygov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st 140 form used for?

The st 140 form is primarily used for sales tax exemption in various states. It allows eligible organizations to exempt purchases from sales tax, benefiting nonprofits and government entities. Utilizing the airSlate SignNow platform, businesses can easily fill out and eSign the st 140 form, streamlining their application process.

-

How does airSlate SignNow simplify the st 140 signing process?

airSlate SignNow offers a user-friendly interface that simplifies the signing process for the st 140 form. Users can fill out the form digitally, which eliminates the need for printing, scanning, or mailing. Additionally, each signature is legally binding and securely stored, enhancing the overall efficiency.

-

What are the costs associated with using airSlate SignNow for st 140?

airSlate SignNow provides a cost-effective solution for businesses needing to manage documents like the st 140 form. Pricing plans vary based on the scale of usage and additional features, making it flexible for different budgets. A transparent pricing structure ensures that users can choose a plan that fits their specific needs.

-

Is there a free trial available for airSlate SignNow's st 140 services?

Yes, airSlate SignNow offers a free trial that allows users to explore the platform's capabilities, including handling the st 140 form. During the trial period, users can test the eSigning features and assess how the solution can streamline their document management. This is a great way to determine its value before committing.

-

Can I integrate airSlate SignNow with other software for managing the st 140 form?

Absolutely! airSlate SignNow provides integration options with numerous business applications, allowing you to manage the st 140 form seamlessly. Whether you use CRM platforms, cloud storage, or project management tools, the integrations enhance workflows and ensure that all data remains synchronized.

-

What security measures does airSlate SignNow implement for the st 140 form?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like the st 140 form. The platform uses encryption for data transmission and storage, ensuring that all information remains secure. Additionally, comprehensive audit trails maintain compliance and transparency throughout the signing process.

-

What features does airSlate SignNow offer for completing the st 140 form?

airSlate SignNow provides a range of features for efficiently completing the st 140 form. Users can customize templates, set signing orders, and add fields for required information. These features save time and improve accuracy, making the eSigning process smoother for all parties involved.

Get more for Instructions For Form ST 140 Tax NY gov

- Brick mason contract for contractor missouri form

- Missouri contractor form

- Electrical contract for contractor missouri form

- Sheetrock drywall contract for contractor missouri form

- Flooring contract for contractor missouri form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract missouri form

- Notice of intent to enforce forfeiture provisions of contact for deed missouri form

- Final notice of forfeiture and request to vacate property under contract for deed missouri form

Find out other Instructions For Form ST 140 Tax NY gov

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe