Nys Annual St 101 Form 2017

What is the NYS Annual ST-101 Form

The NYS Annual ST-101 Form is a crucial document used for reporting sales and use tax in New York State. This form is primarily utilized by businesses that are registered to collect sales tax. It allows these businesses to report their taxable sales, exempt sales, and the amount of sales tax they have collected during the year. Understanding the purpose and requirements of the ST-101 form is essential for compliance with New York State tax regulations.

Steps to Complete the NYS Annual ST-101 Form

Completing the NYS Annual ST-101 Form involves several key steps to ensure accuracy and compliance:

- Gather necessary information: Collect all relevant sales data, including total sales, exempt sales, and sales tax collected.

- Fill out the form: Enter the required information in the designated fields, ensuring that all figures are accurate.

- Calculate the total tax due: Use the provided formulas to determine the total sales tax owed based on your reported sales.

- Review for accuracy: Double-check all entries to avoid errors that could lead to penalties.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person.

Legal Use of the NYS Annual ST-101 Form

The NYS Annual ST-101 Form is legally binding and must be completed accurately to comply with New York State tax laws. Filing this form is essential for businesses to meet their tax obligations. Failure to submit the form or inaccuracies in the reported information can result in penalties, interest, and potential audits by the New York State Department of Taxation and Finance. It is vital for businesses to maintain accurate records and ensure that the form is submitted by the deadline.

Filing Deadlines / Important Dates

Businesses must adhere to specific deadlines when filing the NYS Annual ST-101 Form. The form is typically due on the last day of the month following the end of the tax year. For example, if your tax year ends on December 31, the form must be filed by January 31 of the following year. Staying informed about these deadlines is crucial to avoid late fees and penalties.

Form Submission Methods

The NYS Annual ST-101 Form can be submitted through various methods, providing flexibility for businesses:

- Online: Many businesses prefer to file electronically through the New York State Department of Taxation and Finance website.

- By Mail: The form can be printed and mailed to the appropriate address provided by the state.

- In Person: Businesses may also choose to submit the form in person at designated tax offices.

Required Documents

To complete the NYS Annual ST-101 Form, businesses should have the following documents ready:

- Sales records for the reporting period

- Exemption certificates for any exempt sales

- Proof of sales tax collected

Having these documents organized will facilitate a smoother filing process and ensure compliance with state regulations.

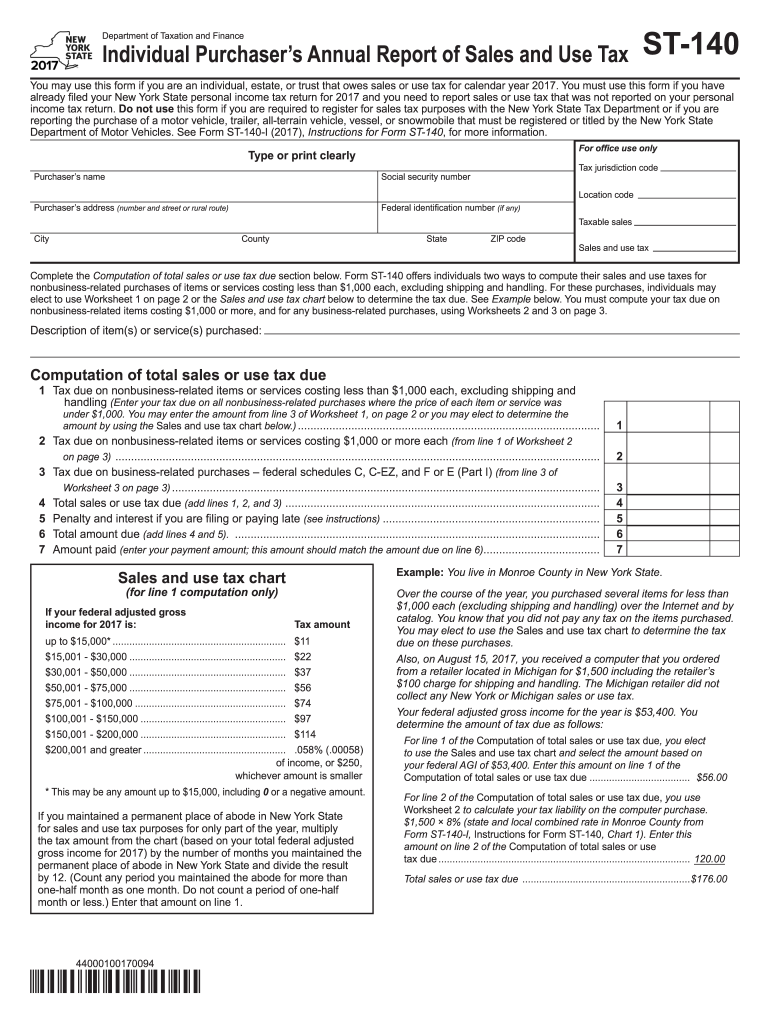

Quick guide on how to complete st 140 2017 2019 form

Complete Nys Annual St 101 Form effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Nys Annual St 101 Form on any device with the airSlate SignNow Android or iOS applications and simplify any document-related operation today.

The easiest way to modify and eSign Nys Annual St 101 Form with ease

- Obtain Nys Annual St 101 Form and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Nys Annual St 101 Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct st 140 2017 2019 form

Create this form in 5 minutes!

How to create an eSignature for the st 140 2017 2019 form

How to generate an eSignature for the St 140 2017 2019 Form online

How to generate an electronic signature for your St 140 2017 2019 Form in Chrome

How to generate an electronic signature for signing the St 140 2017 2019 Form in Gmail

How to generate an electronic signature for the St 140 2017 2019 Form straight from your smartphone

How to create an electronic signature for the St 140 2017 2019 Form on iOS devices

How to create an eSignature for the St 140 2017 2019 Form on Android

People also ask

-

What is the Nys Annual St 101 Form and why do I need it?

The Nys Annual St 101 Form is a tax form used by businesses in New York State to report and remit sales tax. Completing this form accurately is crucial for compliance with state tax regulations. Using airSlate SignNow, you can easily fill out and eSign your Nys Annual St 101 Form, ensuring timely submission.

-

How does airSlate SignNow help with the Nys Annual St 101 Form?

airSlate SignNow provides a user-friendly platform to create, manage, and eSign your Nys Annual St 101 Form seamlessly. Our solution allows you to collaborate with team members in real-time, ensuring everyone has the latest information. Plus, you can store your completed forms securely in one place.

-

Is there a cost associated with using airSlate SignNow for the Nys Annual St 101 Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Our plans are cost-effective, enabling you to manage your Nys Annual St 101 Form and other documents without breaking the bank. Check out our pricing page for detailed information on our subscription options.

-

Can I integrate airSlate SignNow with other platforms for managing the Nys Annual St 101 Form?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, including CRM systems and document management tools. This allows you to streamline your workflow when preparing and submitting your Nys Annual St 101 Form, enhancing overall efficiency.

-

What are the benefits of using airSlate SignNow for my Nys Annual St 101 Form?

Using airSlate SignNow for your Nys Annual St 101 Form offers numerous benefits, including increased efficiency and reduced paperwork. Our platform simplifies the signing process, allowing you to eSign forms from anywhere. Additionally, with our secure storage options, you'll never lose an important document.

-

How do I get started with airSlate SignNow for the Nys Annual St 101 Form?

Getting started with airSlate SignNow for your Nys Annual St 101 Form is simple. Sign up for a free trial on our website, explore the features, and start creating your forms. Our intuitive interface will guide you through the process of filling out and eSigning your Nys Annual St 101 Form.

-

Can I track the status of my Nys Annual St 101 Form with airSlate SignNow?

Yes, airSlate SignNow offers tracking features that allow you to monitor the status of your Nys Annual St 101 Form. You’ll receive notifications when your form is opened, signed, and completed, ensuring you stay informed throughout the process.

Get more for Nys Annual St 101 Form

Find out other Nys Annual St 101 Form

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple