100 2021-2025 Form

What is the Form 100 California Corporation Franchise or Income Tax Return?

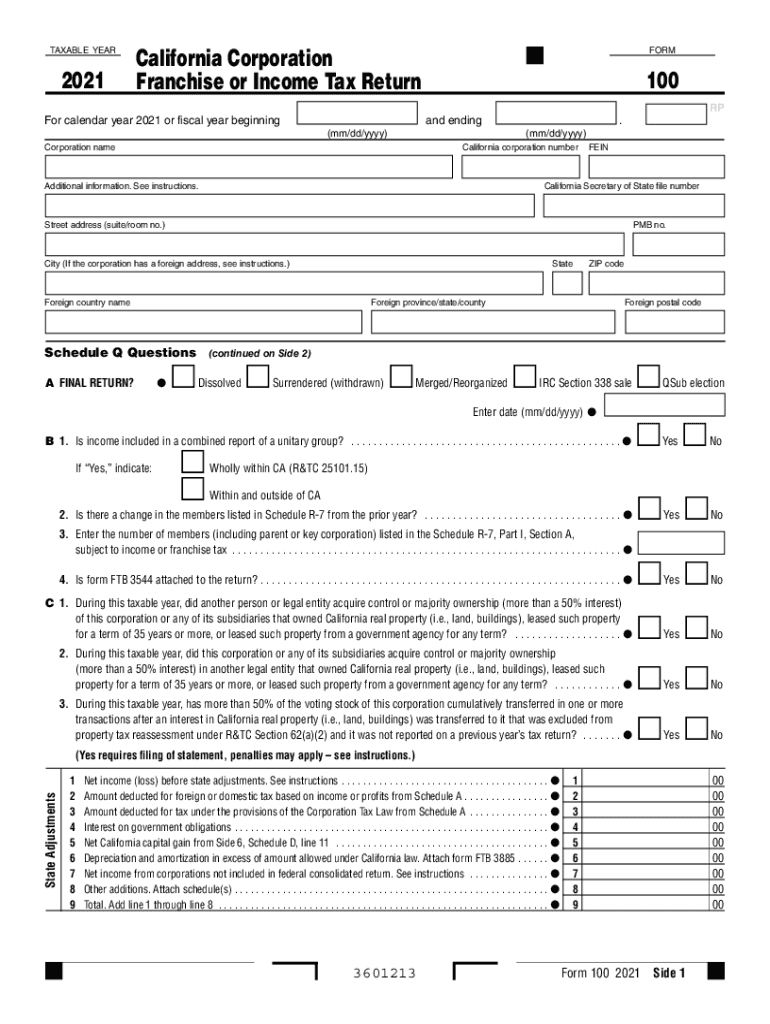

The Form 100 is a crucial document for corporations operating in California, serving as the official Franchise or Income Tax Return. This form is used by corporations to report their income, calculate their tax liability, and fulfill their obligations under California tax law. The California Franchise Tax Board (FTB) requires this form to assess the tax owed by corporations based on their net income and other relevant financial data. Understanding the purpose of Form 100 is essential for compliance and accurate reporting.

Steps to Complete the Form 100 California Corporation Franchise or Income Tax Return

Completing the Form 100 involves several important steps. First, gather all necessary financial documents, including income statements, balance sheets, and prior tax returns. Next, fill out the form by providing accurate information regarding your corporation's income, deductions, and credits. Pay special attention to sections that require detailed financial disclosures. After completing the form, review it for accuracy and ensure all calculations are correct. Finally, submit the form to the California Franchise Tax Board by the specified deadline to avoid penalties.

Legal Use of the Form 100 California Corporation Franchise or Income Tax Return

The legal use of Form 100 is governed by California tax law, which mandates that all corporations must file this return annually. The form must be completed accurately to ensure compliance with state regulations. Failure to file or incorrect filings can result in penalties, interest on unpaid taxes, and potential legal issues. It is important for corporations to understand their legal obligations regarding this form to avoid complications with the Franchise Tax Board.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for Form 100 to remain compliant with California tax law. Generally, the due date for filing is the 15th day of the fourth month following the close of the corporation's fiscal year. For corporations operating on a calendar year, this typically falls on April 15. It is crucial to be aware of these deadlines to avoid late fees and ensure timely processing of your tax return.

Required Documents for Form 100

To complete the Form 100, corporations must prepare and submit several key documents. These typically include:

- Income statements detailing revenue and expenses

- Balance sheets showing assets, liabilities, and equity

- Prior year tax returns for reference

- Documentation of any deductions or credits claimed

Having these documents ready will facilitate a smoother completion of the form and ensure all required information is accurately reported.

Form Submission Methods (Online / Mail / In-Person)

Corporations have multiple options for submitting Form 100 to the California Franchise Tax Board. The form can be filed online through the FTB's e-file system, which is often the fastest and most efficient method. Alternatively, corporations may choose to mail a paper copy of the form to the appropriate address provided by the FTB. In some cases, in-person submissions may be possible, but it is advisable to check with the FTB for specific guidelines and availability.

Penalties for Non-Compliance with Form 100

Non-compliance with the filing requirements for Form 100 can lead to significant penalties. Corporations that fail to file by the deadline may incur late fees and interest on any unpaid taxes. Additionally, persistent non-compliance can result in more severe consequences, including audits and legal action by the California Franchise Tax Board. It is essential for corporations to understand these risks and prioritize timely and accurate filing of Form 100.

Quick guide on how to complete california form 100

Complete california form 100 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage form 100 on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to edit and eSign ca form 100 instructions effortlessly

- Locate california form 100 instructions 2021 and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize crucial parts of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information thoroughly and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign ca form 100 and ensure effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california form 100 2021

Related searches to form 100 2021

Create this form in 5 minutes!

How to create an eSignature for the california form 100 instructions pdf

The way to generate an e-signature for a PDF online

The way to generate an e-signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

The way to generate an e-signature right from your smartphone

The way to create an e-signature for a PDF on iOS

The way to generate an e-signature for a PDF on Android

People also ask california form 100 instructions

-

What is form 100 and how can airSlate SignNow help?

Form 100 is a crucial document used widely for various applications. With airSlate SignNow, you can easily fill, sign, and send Form 100 digitally, streamlining your workflow while ensuring compliance and security.

-

Is airSlate SignNow suitable for businesses needing to manage form 100?

Absolutely! airSlate SignNow provides businesses with a robust tool for managing Form 100. Our platform allows you to customize, send, and track Form 100, enhancing productivity and facilitating smooth document management.

-

What are the pricing options for airSlate SignNow regarding form 100 usage?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs. Depending on your usage of Form 100, you can choose from various tiers that provide essential features at competitive prices.

-

Can I integrate airSlate SignNow with other applications for form 100 management?

Yes, airSlate SignNow seamlessly integrates with numerous applications to enhance your Form 100 management. These integrations allow you to automate workflows and improve efficiency by connecting with tools you already use.

-

What features does airSlate SignNow offer for signing form 100?

airSlate SignNow includes features like eSigning, document templates, and real-time tracking specifically designed for Form 100. These tools ensure that you can manage your document signing process efficiently and securely.

-

How does airSlate SignNow ensure the security of my form 100?

Security is a top priority at airSlate SignNow. Our platform protects your Form 100 and other documents with encryption and compliant security measures, ensuring that your sensitive information remains safe throughout the signing process.

-

Are there any limitations when using airSlate SignNow for form 100?

While airSlate SignNow offers extensive features for managing Form 100, users should be aware of certain limits based on their chosen plan. Review our pricing options to understand any restrictions that may affect your usage.

Get more for ca 100 instructions 2021

- Employment application and consent form state employees credit ncsecu

- Project information form greenville county greenvillecounty

- Cv 470 form

- Certificate of completion fire extinguisher form

- F r e e m a n invoice page informacin corporativa fen informacioncorporativa fen uchile

- To download the partnership and exhibition prospectus aaee 2016 form

- Walmartmoneycard dispute form

- Certificate of permanent location for a manufactured home form

Find out other ca 100

- Help Me With Electronic signature Oregon Doctors Form

- How Can I Electronic signature Oregon Doctors Form

- How To Electronic signature Oregon Doctors Document

- Can I Electronic signature Oregon Doctors Form

- How Do I Electronic signature Oregon Doctors Document

- How To Electronic signature Oregon Doctors Document

- Help Me With Electronic signature Oregon Doctors Document

- How Do I Electronic signature Oregon Doctors Document

- How To Electronic signature Oregon Doctors Document

- Help Me With Electronic signature Oregon Doctors Document

- How Can I Electronic signature Oregon Doctors Document

- Can I Electronic signature Oregon Doctors Document

- How Can I Electronic signature Oregon Doctors Document

- How Do I Electronic signature Oregon Doctors Document

- Can I Electronic signature Oregon Doctors Document

- How To Electronic signature Oregon Doctors Form

- Help Me With Electronic signature Oregon Doctors Document

- Help Me With Electronic signature Oregon Doctors Form

- How Do I Electronic signature Oregon Doctors Form

- How Can I Electronic signature Oregon Doctors Form