Form 100 California Franchise Tax Board Ftb Ca 2012

What is the Form 100 California Franchise Tax Board Ftb Ca

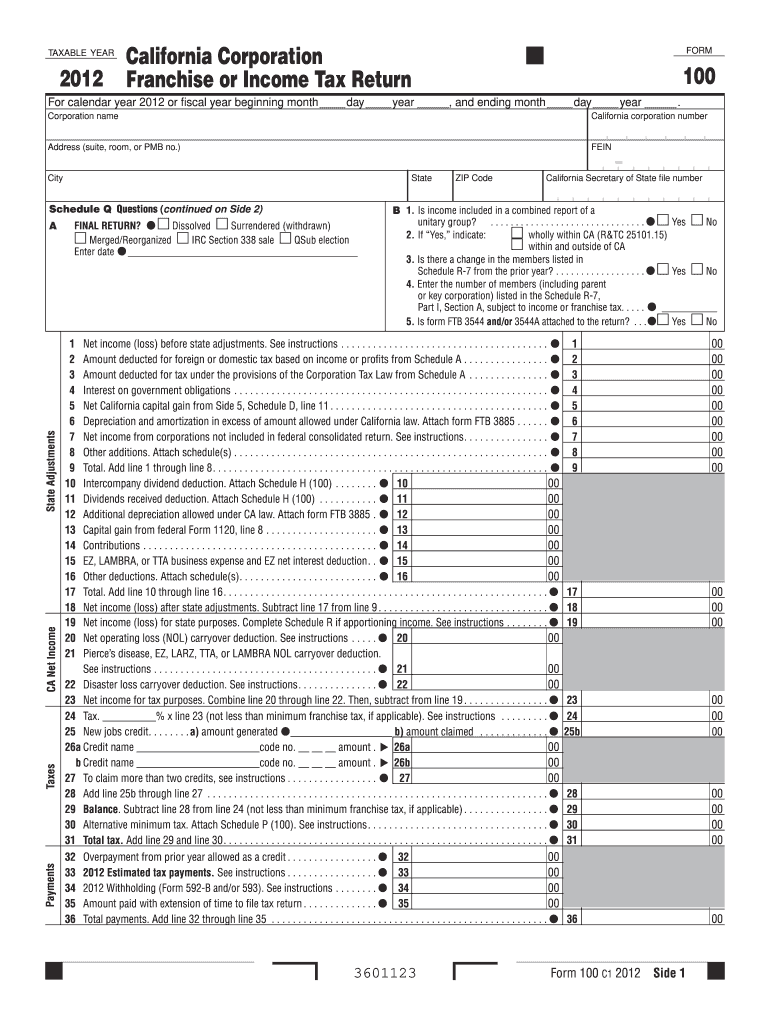

The Form 100 is a crucial document used by corporations in California to report their income and calculate their franchise tax obligations. This form is mandated by the California Franchise Tax Board (FTB) and is essential for both domestic and foreign corporations doing business in the state. The form captures various financial details, including gross receipts, deductions, and credits, to determine the tax liability for the corporation. It is important for businesses to accurately complete this form to ensure compliance with California tax laws.

How to use the Form 100 California Franchise Tax Board Ftb Ca

Using the Form 100 involves several steps that ensure accurate reporting of financial information. First, gather all necessary financial documents, including income statements and balance sheets. Next, fill out the form by entering your corporation's details, such as the name, address, and federal employer identification number (EIN). Be sure to accurately report all income, deductions, and applicable credits. After completing the form, review it thoroughly for any errors before submission to the California Franchise Tax Board.

Steps to complete the Form 100 California Franchise Tax Board Ftb Ca

Completing the Form 100 requires careful attention to detail. Follow these steps:

- Gather financial documents, including previous tax returns, income statements, and balance sheets.

- Enter your corporation's basic information, including name, address, and EIN.

- Report total income, including gross receipts from sales and services.

- Detail any deductions your corporation is eligible for, such as business expenses and losses.

- Calculate the franchise tax based on the information provided.

- Review the completed form for accuracy and completeness.

- Submit the form to the California Franchise Tax Board by the applicable deadline.

Legal use of the Form 100 California Franchise Tax Board Ftb Ca

The Form 100 is legally binding and must be completed in accordance with California tax law. Accurate reporting is essential, as any discrepancies can lead to penalties or audits by the Franchise Tax Board. The form serves as a formal declaration of a corporation's financial activities and tax obligations, making it vital for legal compliance. Corporations should ensure that all information provided is truthful and substantiated by proper documentation.

Filing Deadlines / Important Dates

Filing deadlines for the Form 100 are critical for compliance. Generally, the form is due on the 15th day of the fourth month after the close of the corporation's taxable year. For corporations operating on a calendar year, this means the form is typically due by April 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Corporations should be aware of these dates to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form 100 can be submitted through various methods to accommodate different preferences. Corporations have the option to file online through the California Franchise Tax Board's e-file system, which is often the fastest and most efficient method. Alternatively, the form can be mailed to the FTB using the address specified in the form instructions. In-person submissions are also accepted at designated FTB offices, providing another avenue for businesses to ensure their forms are filed correctly.

Quick guide on how to complete 2012 form 100 california franchise tax board ftb ca

Effortlessly Prepare Form 100 California Franchise Tax Board Ftb Ca on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, enabling you to access the correct forms and securely store them in the cloud. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly without delays. Handle Form 100 California Franchise Tax Board Ftb Ca on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign Form 100 California Franchise Tax Board Ftb Ca with Ease

- Find Form 100 California Franchise Tax Board Ftb Ca and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important parts of the documents or obscure private information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just moments and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misfiled documents, cumbersome form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 100 California Franchise Tax Board Ftb Ca to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 form 100 california franchise tax board ftb ca

Create this form in 5 minutes!

How to create an eSignature for the 2012 form 100 california franchise tax board ftb ca

How to generate an electronic signature for your PDF in the online mode

How to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is Form 100 for the California Franchise Tax Board (FTB Ca)?

Form 100 is the California Corporation Franchise or Income Tax Return, required by the California Franchise Tax Board (FTB Ca). This form is used by corporations to report their income, including the calculation of taxes owed. Understanding and completing Form 100 accurately is crucial for compliance with state tax laws.

-

Who needs to file Form 100 California Franchise Tax Board (FTB Ca)?

Any corporation doing business in California or earning income from California sources must file Form 100 with the California Franchise Tax Board (FTB Ca). This includes both domestic and foreign corporations. Ensuring compliance by filing the appropriate forms is essential for avoiding penalties and interest.

-

How can airSlate SignNow assist with completing Form 100 California Franchise Tax Board (FTB Ca)?

airSlate SignNow provides a streamlined platform that allows users to fill out, sign, and send Form 100 efficiently. Our intuitive platform makes document management simple, ensuring that all necessary signatures are collected easily. With airSlate SignNow, you can confidently file your Form 100 with the FTB Ca.

-

What are the pricing options for airSlate SignNow when managing Form 100 California Franchise Tax Board (FTB Ca)?

airSlate SignNow offers various pricing plans to suit different business needs. Each plan includes features for document signing and management, which can simplify the submission process for Form 100 to the California Franchise Tax Board (FTB Ca). Explore our pricing page to choose the best option for your organization's requirements.

-

What features does airSlate SignNow offer for Form 100 California Franchise Tax Board (FTB Ca) management?

Our platform includes features such as customizable templates, secure eSigning, and document tracking specifically designed to assist with Form 100 submissions. With airSlate SignNow, you can automate workflows and ensure that all necessary parties are engaged during the filing process. Accessing and managing your documents securely has never been easier.

-

Can airSlate SignNow integrate with other tools for Form 100 California Franchise Tax Board (FTB Ca)?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, enhancing your ability to manage Form 100 with ease. This integration allows you to sync data directly from your business systems, eliminating manual entry and reducing errors. Integrating with airSlate SignNow simplifies the filing process with the FTB Ca.

-

What are the benefits of using airSlate SignNow for Form 100 California Franchise Tax Board (FTB Ca)?

Using airSlate SignNow for Form 100 provides numerous benefits, including time savings, enhanced compliance, and ease of use. Our platform streamlines the eSigning and document management process, ensuring you can focus on your business while fulfilling your tax obligations with the California Franchise Tax Board (FTB Ca). Enjoy peace of mind with our secure solution.

Get more for Form 100 California Franchise Tax Board Ftb Ca

- Download summary record of quarterly groundwater surface water withdrawal form

- Do you need a replacement ssa 1099 for tax purposes ssa form

- Oakland county sheriff s residential alarm registration rochesterhills form

- Worksheet momentum word problems chapter 8 momentum answer key form

- Nycers post retirement death benefit form

- How to fill out local traffic crash report ohio form

- Members form

- Fee tail form

Find out other Form 100 California Franchise Tax Board Ftb Ca

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself