Ca 100 2024-2025 Form

What is the Form 100 California Corporation Franchise Or Income Tax Return

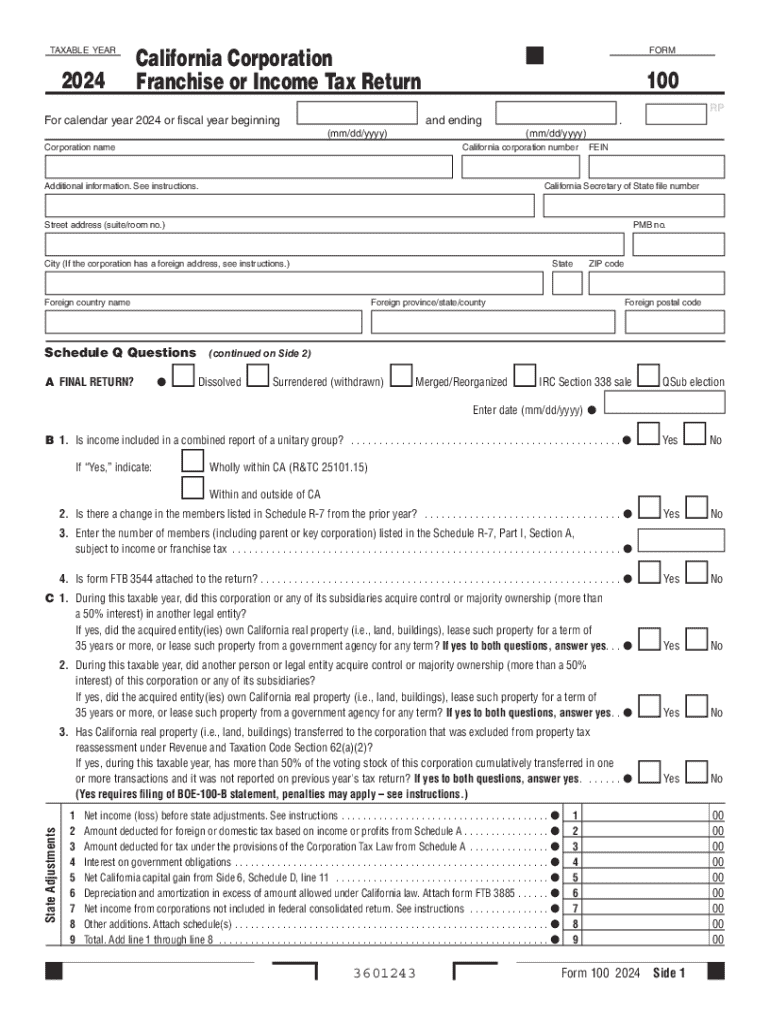

The Form 100, also known as the California Corporation Franchise or Income Tax Return, is a tax document required for corporations operating in California. This form is used to report income, calculate tax liability, and ensure compliance with state tax laws. Corporations must file this form annually to disclose their financial activities and pay any owed taxes to the California Franchise Tax Board (FTB). The form is essential for both C corporations and S corporations, as it helps determine the amount of franchise tax owed based on the corporation's net income.

Steps to complete the Form 100 California Corporation Franchise Or Income Tax Return

Completing the Form 100 involves several key steps to ensure accurate reporting. First, gather all necessary financial documents, including income statements, balance sheets, and any relevant deductions. Next, fill out the form by entering your corporation's identifying information, such as the name, address, and federal employer identification number (EIN). Then, report your total income and applicable deductions to calculate your taxable income. After calculating your tax liability, ensure all sections of the form are completed, including any required schedules. Finally, review the form for accuracy before submission.

Key elements of the Form 100 California Corporation Franchise Or Income Tax Return

The Form 100 includes several key elements that are crucial for accurate tax reporting. These elements consist of the corporation's identifying information, total income, deductions, and tax calculations. Additionally, the form requires the inclusion of specific schedules that detail various income sources, credits, and deductions. Understanding these components is vital for ensuring compliance and maximizing potential tax benefits. Each section must be filled out carefully to reflect the corporation's financial status and obligations accurately.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Form 100 to avoid penalties. The standard due date for filing is the 15th day of the third month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is due by March 15. If additional time is needed, corporations may file for an automatic six-month extension, but any taxes owed must still be paid by the original due date to avoid interest and penalties. Staying informed about these deadlines is crucial for compliance.

Form Submission Methods (Online / Mail / In-Person)

The Form 100 can be submitted through various methods, providing flexibility for corporations. Corporations may choose to file online through the California Franchise Tax Board's e-file system, which offers a streamlined process and faster processing times. Alternatively, the form can be mailed to the appropriate FTB address, ensuring it is postmarked by the due date. In-person submissions are also accepted at FTB offices, allowing for direct assistance if needed. Each method has its advantages, and corporations should select the one that best suits their needs.

Penalties for Non-Compliance

Failure to file the Form 100 on time or to pay the required taxes can result in significant penalties. The California Franchise Tax Board imposes a late filing penalty, which is typically a percentage of the unpaid tax amount. Additionally, interest accrues on any unpaid taxes from the due date until payment is made. Non-compliance can also lead to further legal actions, including liens against the corporation's assets. It is essential for corporations to understand these penalties and prioritize timely filing and payment to avoid financial repercussions.

Create this form in 5 minutes or less

Find and fill out the correct california form 100 instructions 2024

Related searches to ca 100

Create this form in 5 minutes!

How to create an eSignature for the california form 100 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask california 100 return

-

What is the 2024 CA Form 100 and why is it important?

The 2024 CA Form 100 is the California Corporation Franchise or Income Tax Return that corporations must file annually. It is crucial for compliance with state tax regulations and helps businesses report their income accurately. Understanding this form ensures that your business meets its tax obligations and avoids penalties.

-

How can airSlate SignNow help with the 2024 CA Form 100?

airSlate SignNow simplifies the process of preparing and signing the 2024 CA Form 100 by providing an intuitive platform for document management. You can easily upload, edit, and eSign your tax documents, ensuring that everything is completed accurately and on time. This streamlines your workflow and reduces the stress associated with tax season.

-

What features does airSlate SignNow offer for managing the 2024 CA Form 100?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically designed for forms like the 2024 CA Form 100. These tools enhance efficiency and ensure that all necessary signatures are collected promptly. Additionally, the platform allows for easy collaboration among team members.

-

Is airSlate SignNow cost-effective for filing the 2024 CA Form 100?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to file the 2024 CA Form 100. With competitive pricing plans, you can choose a package that fits your budget while still accessing essential features. This affordability makes it an attractive option for businesses of all sizes.

-

Can I integrate airSlate SignNow with other software for the 2024 CA Form 100?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, making it easier to manage the 2024 CA Form 100. This connectivity allows for a smoother workflow, as you can import data directly from your existing systems, reducing manual entry and potential errors.

-

What are the benefits of using airSlate SignNow for the 2024 CA Form 100?

Using airSlate SignNow for the 2024 CA Form 100 provides numerous benefits, including enhanced security, ease of use, and time savings. The platform ensures that your documents are securely stored and easily accessible, while its user-friendly interface allows for quick completion of forms. This efficiency can lead to faster filing and peace of mind during tax season.

-

How does airSlate SignNow ensure the security of the 2024 CA Form 100?

airSlate SignNow prioritizes security with features like encryption, secure cloud storage, and compliance with industry standards. When handling sensitive documents like the 2024 CA Form 100, you can trust that your information is protected. This commitment to security helps businesses maintain confidentiality and integrity in their tax filings.

Get more for 2024 form 100

Find out other form 100 2024

- eSign Washington Orthodontists Emergency Contact Form Simple

- eSign Oregon Plumbing Lease Template Easy

- eSign Washington Orthodontists Separation Agreement Later

- eSign Washington Orthodontists Separation Agreement Myself

- eSign Washington Orthodontists Separation Agreement Free

- eSign Washington Orthodontists Separation Agreement Secure

- eSign Oregon Plumbing Lease Template Safe

- eSign Washington Orthodontists Emergency Contact Form Easy

- eSign Washington Orthodontists Separation Agreement Fast

- eSign Washington Orthodontists Separation Agreement Simple

- eSign Washington Orthodontists Separation Agreement Easy

- eSign Washington Orthodontists Separation Agreement Safe

- eSign Washington Orthodontists Emergency Contact Form Safe

- eSign Rhode Island Plumbing Moving Checklist Online

- eSign Washington Orthodontists Business Associate Agreement Online

- eSign Washington Orthodontists Business Associate Agreement Computer

- eSign Washington Orthodontists Business Associate Agreement Mobile

- eSign Rhode Island Plumbing Moving Checklist Computer

- eSign Washington Orthodontists Business Associate Agreement Now

- eSign Washington Orthodontists Business Associate Agreement Later