Form 3581 Tax Deposit Refund and Transfer Request 2022

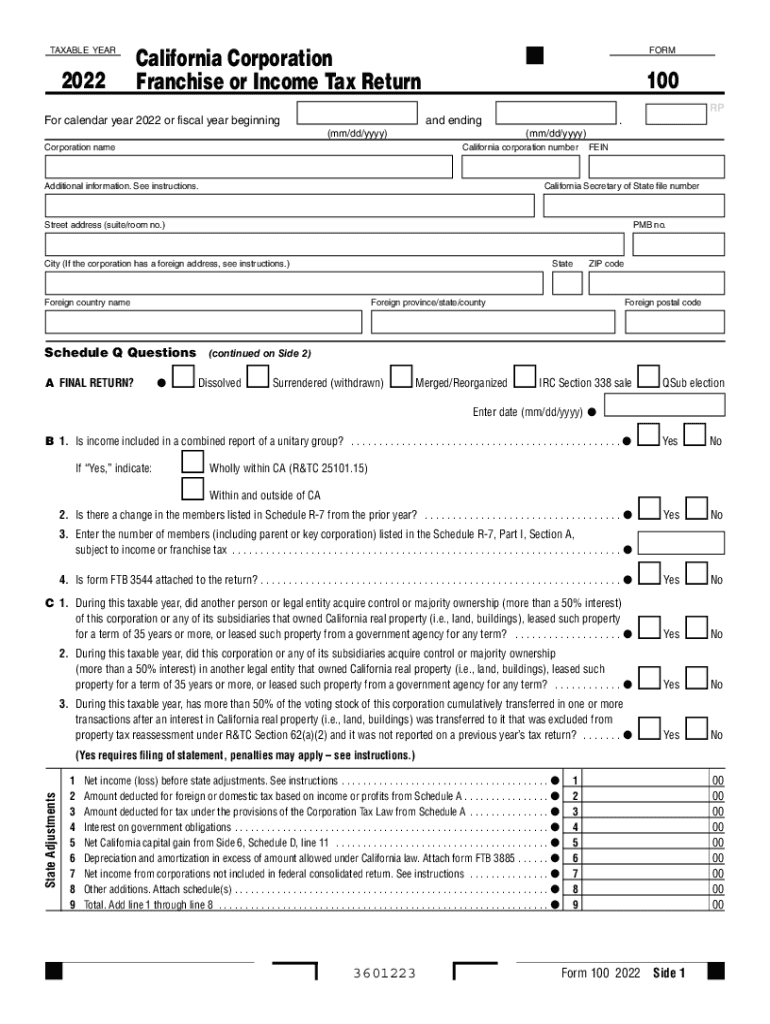

What is the California Form 100?

The California Form 100, also known as the California Corporation Franchise or Income Tax Return, is a critical document for corporations operating within the state. This form is used to report income, calculate tax liability, and ensure compliance with California tax laws. The form is essential for both C corporations and S corporations, providing the necessary information to the California Franchise Tax Board (FTB). Understanding the purpose and requirements of the California Form 100 is vital for maintaining good standing with state tax authorities.

Key Elements of the California Form 100

The California Form 100 includes several key elements that corporations must accurately complete. These elements typically cover:

- Business Information: This section requires details about the corporation, including its name, address, and federal employer identification number (EIN).

- Income Reporting: Corporations must report their total income, including gross receipts and any other sources of income.

- Deductions: The form allows for various deductions, which can reduce the overall taxable income. Common deductions include business expenses, depreciation, and other allowable costs.

- Tax Calculation: The form includes a section for calculating the tax owed based on the reported income and applicable tax rates.

- Signatures: Authorized representatives of the corporation must sign the form, confirming the accuracy of the information provided.

Steps to Complete the California Form 100

Completing the California Form 100 involves several steps to ensure accuracy and compliance. Here is a simplified process:

- Gather all necessary financial documents, including income statements and expense reports.

- Fill out the business information section, ensuring all details are accurate.

- Report total income and calculate allowable deductions.

- Complete the tax calculation section to determine the total tax liability.

- Review the form for completeness and accuracy before submission.

- Sign and date the form, ensuring it is submitted by the deadline.

Filing Deadlines for the California Form 100

Corporations must be aware of the filing deadlines associated with the California Form 100 to avoid penalties. Typically, the form is due on the 15th day of the third month after the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is due on March 15. Extensions may be available, but it is essential to file the necessary extension request to avoid late fees.

Form Submission Methods

The California Form 100 can be submitted through various methods, providing flexibility for corporations. Options include:

- Online Submission: Corporations can file electronically through the California Franchise Tax Board's website, which is often the fastest method.

- Mail: The completed form can be printed and mailed to the appropriate FTB address, ensuring it is postmarked by the due date.

- In-Person: Corporations may also choose to deliver the form in person at designated FTB offices, although this method may require an appointment.

Penalties for Non-Compliance

Failure to file the California Form 100 on time or inaccuracies in reporting can result in significant penalties. Common penalties include:

- Late Filing Penalty: Corporations may incur a penalty for each month the form is late, up to a maximum amount.

- Accuracy-Related Penalties: If the FTB identifies discrepancies or underreported income, additional penalties may apply.

- Interest on Unpaid Taxes: Interest accrues on any unpaid taxes from the original due date until the balance is paid in full.

Quick guide on how to complete 2021 form 3581 tax deposit refund and transfer request

Complete Form 3581 Tax Deposit Refund And Transfer Request seamlessly on any gadget

Web-based document management has becoming increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can locate the appropriate template and securely save it online. airSlate SignNow equips you with all the resources you require to create, amend, and eSign your documents swiftly without interruptions. Manage Form 3581 Tax Deposit Refund And Transfer Request on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign Form 3581 Tax Deposit Refund And Transfer Request effortlessly

- Locate Form 3581 Tax Deposit Refund And Transfer Request and click Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow offers exclusively for that purpose.

- Craft your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form-finding, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your needs in document management in just a few clicks from any device of your choice. Edit and eSign Form 3581 Tax Deposit Refund And Transfer Request and ensure excellent communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 3581 tax deposit refund and transfer request

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 3581 tax deposit refund and transfer request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'form 100' and how can airSlate SignNow help?

The 'form 100' is a standard document format that many businesses use for varying purposes. airSlate SignNow streamlines the process by allowing you to easily create, send, and eSign your form 100, making document management more efficient and secure.

-

Is there a cost associated with using form 100 in airSlate SignNow?

Yes, while airSlate SignNow offers a range of pricing plans, utilizing the 'form 100' is included within these plans. Users can choose a plan that fits their budget and needs without hidden fees for managing their form 100 documents.

-

What features does airSlate SignNow offer for handling form 100?

airSlate SignNow provides essential features for form 100, such as customizable templates, easy eSigning options, and secure cloud storage. These features ensure that your document handling is both professional and efficient.

-

Can I integrate airSlate SignNow with other software for my form 100 needs?

Absolutely! airSlate SignNow offers integrations with popular software tools such as CRM systems and project management applications. This capability enhances your workflow, making it easier to manage your form 100 alongside other business processes.

-

How does airSlate SignNow ensure security for my form 100?

Security is a priority at airSlate SignNow, especially for sensitive documents like form 100. The platform employs advanced encryption methods and complies with industry regulations to ensure that your data remains safe throughout the signing process.

-

What are the benefits of using airSlate SignNow for form 100?

Using airSlate SignNow for your form 100 brings signNow benefits such as increased efficiency, reduced paperwork, and improved collaboration. This leads to quicker turnaround times and a more streamlined operation for your business.

-

How can I track the status of my form 100 in airSlate SignNow?

airSlate SignNow provides a robust tracking feature that allows you to monitor the status of your form 100 in real-time. You’ll receive notifications as recipients view and sign the document, ensuring you stay informed throughout the process.

Get more for Form 3581 Tax Deposit Refund And Transfer Request

Find out other Form 3581 Tax Deposit Refund And Transfer Request

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form