California Franchise Income 2018

What is the California Franchise Income?

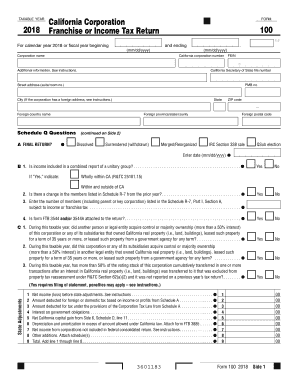

The California Franchise Income refers to the income tax imposed on corporations operating within the state of California. This tax is calculated based on the corporation's net income, which is the total revenue minus allowable deductions. The California Franchise Tax Board (FTB) administers this tax, ensuring compliance among businesses registered in the state. Understanding this tax is essential for corporations to meet their financial obligations and avoid penalties.

Steps to Complete the California Franchise Income

Completing the California Franchise Income form involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Determine your corporation's total income for the tax year.

- Calculate allowable deductions to arrive at your net income.

- Fill out California Form 100, ensuring all information is accurate and complete.

- Review the form for any errors before submission.

- Submit the completed form to the California Franchise Tax Board by the designated deadline.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the California Franchise Income tax. Typically, the due date for Form 100 is the 15th day of the third month after the end of the corporation's tax year. For most corporations operating on a calendar year, this means the deadline is March 15. It's crucial to be aware of these dates to avoid late fees and penalties.

Required Documents

When completing the California Franchise Income form, certain documents are essential for accurate reporting:

- Income statements detailing revenue generated during the tax year.

- Expense records to support deductions claimed.

- Previous year's tax returns for reference.

- Any relevant financial statements, such as balance sheets.

Penalties for Non-Compliance

Failure to comply with California Franchise Income tax regulations can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential legal action. It is vital for corporations to file their forms accurately and on time to avoid these consequences and maintain good standing with the California Franchise Tax Board.

Form Submission Methods (Online / Mail / In-Person)

Corporations have several options for submitting their California Franchise Income form. These include:

- Online submission through the California Franchise Tax Board's e-file system, which is efficient and secure.

- Mailing a printed copy of the completed form to the appropriate address specified by the FTB.

- In-person submission at designated FTB offices, allowing for immediate confirmation of receipt.

Eligibility Criteria

To be eligible for filing the California Franchise Income tax, a corporation must be registered and doing business in California. This includes corporations that have physical presence, employees, or sales in the state. Additionally, foreign corporations that operate within California must also comply with the state's tax regulations.

Quick guide on how to complete california franchise income

Complete California Franchise Income effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, enabling you to find the needed form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage California Franchise Income on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign California Franchise Income effortlessly

- Obtain California Franchise Income and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information using the tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign California Franchise Income and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california franchise income

Create this form in 5 minutes!

How to create an eSignature for the california franchise income

How to generate an electronic signature for a PDF document in the online mode

How to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is California Form 100 and why is it important?

California Form 100 is the state's corporate income tax return form. It is crucial for businesses operating in California as it reports income and calculates the tax owed to the state. Ensuring accurate completion of California Form 100 can help companies avoid penalties and comply with tax regulations.

-

How can airSlate SignNow help me with California Form 100?

With airSlate SignNow, you can easily prepare and eSign your California Form 100. Our platform streamlines the process, allowing you to fill out, sign, and submit the form efficiently. This not only saves time but also reduces the risk of errors during tax preparation.

-

What are the pricing plans for airSlate SignNow to manage California Form 100?

airSlate SignNow offers various pricing plans suitable for different business sizes. You can choose a plan that fits your needs while managing California Form 100 seamlessly. Each plan provides essential features to help you handle documents effectively without breaking the bank.

-

Does airSlate SignNow offer features specifically for tax forms like California Form 100?

Yes, airSlate SignNow includes features designed to assist with tax forms, including California Form 100. You can utilize templates, automated workflows, and secure eSigning, ensuring that your forms are prepared correctly and submitted on time.

-

What are the benefits of using airSlate SignNow for California Form 100 eSigning?

Using airSlate SignNow for eSigning California Form 100 provides numerous benefits, including enhanced security, ease of use, and faster processing times. With our platform, you can track the signing process in real time and ensure compliance, making your tax preparation hassle-free.

-

Is it safe to use airSlate SignNow for submitting California Form 100?

Absolutely! airSlate SignNow prioritizes security and employs advanced encryption methods to protect your data. This ensures that your California Form 100 and other sensitive documents are safe while being signed and stored.

-

Can I integrate airSlate SignNow with other accounting software for California Form 100 filing?

Yes, airSlate SignNow supports integration with various accounting software solutions. This allows you to manage your California Form 100 filings more efficiently by syncing data and streamlining your workflow without the need for manual data entry.

Get more for California Franchise Income

Find out other California Franchise Income

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free