Instructions for Form 2210 Internal Revenue Service Fill 2021

What is the Arkansas AR2210A Form?

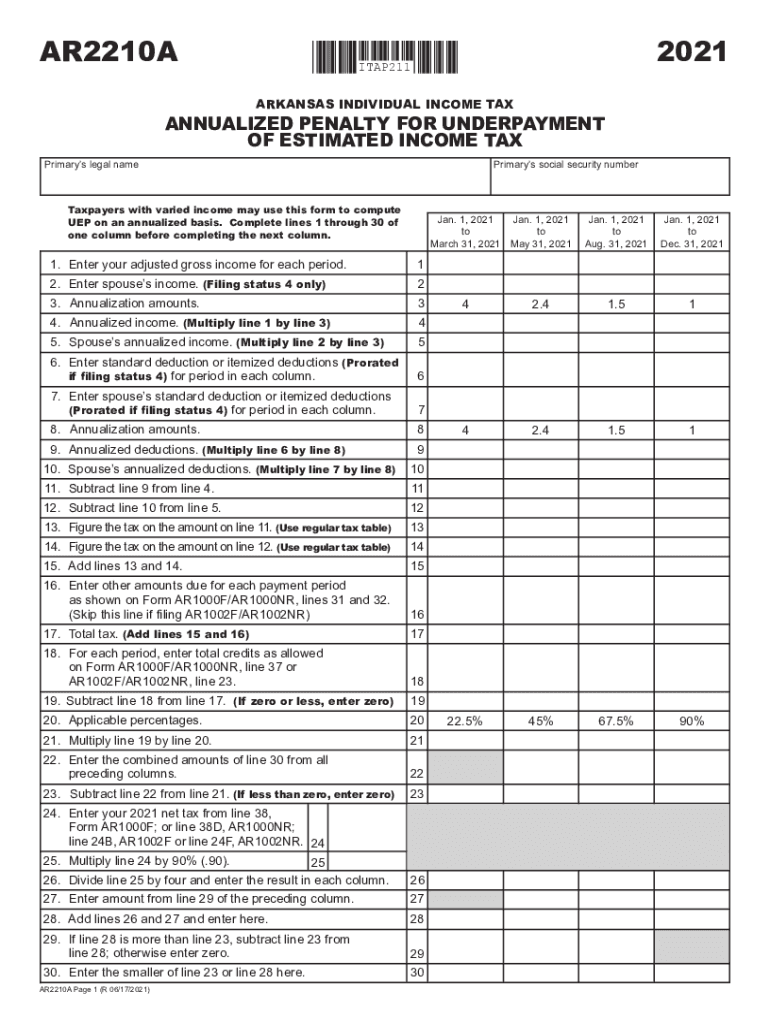

The Arkansas AR2210A form is a tax document used by residents of Arkansas to calculate their underpayment of estimated tax. This form is essential for individuals who do not meet the required tax payment thresholds throughout the year. By completing the AR2210A, taxpayers can determine if they owe any penalties for underpayment and how much they need to pay to remain compliant with state tax laws.

Steps to Complete the Arkansas AR2210A Form

Completing the Arkansas AR2210A form involves several key steps:

- Gather necessary financial information, including income details and previous tax payments.

- Calculate your total tax liability for the year to determine if you have underpaid.

- Follow the instructions on the AR2210A to fill out the form accurately, ensuring all calculations are correct.

- Review the completed form for accuracy and completeness before submission.

Legal Use of the Arkansas AR2210A Form

The Arkansas AR2210A form is legally binding when filled out correctly and submitted to the Arkansas Department of Finance and Administration. It is crucial for taxpayers to ensure compliance with all state tax laws to avoid penalties. The form serves as a formal declaration of any underpayment and outlines the necessary steps to rectify the situation.

Filing Deadlines for the Arkansas AR2210A Form

Taxpayers must be aware of the filing deadlines associated with the Arkansas AR2210A form. Typically, this form should be submitted along with your annual tax return. It is advisable to check the Arkansas Department of Finance and Administration's website for specific dates, as they may vary each tax year. Missing the deadline can result in additional penalties.

Who Issues the Arkansas AR2210A Form?

The Arkansas AR2210A form is issued by the Arkansas Department of Finance and Administration. This state agency is responsible for overseeing tax collection and compliance, ensuring that residents fulfill their tax obligations. Taxpayers can obtain the form directly from the agency's website or through authorized tax preparation services.

Examples of Using the Arkansas AR2210A Form

There are various scenarios in which a taxpayer might need to use the Arkansas AR2210A form. For example:

- A self-employed individual who did not make estimated tax payments throughout the year may need to file this form to calculate any penalties.

- A retiree with fluctuating income may find that they underpaid their taxes and must use the AR2210A to address the shortfall.

Quick guide on how to complete instructions for form 2210 internal revenue service fill

Effortlessly Prepare Instructions For Form 2210 Internal Revenue Service Fill on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing for proper forms to be obtained and securely stored online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly and without hold-ups. Handle Instructions For Form 2210 Internal Revenue Service Fill on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Instructions For Form 2210 Internal Revenue Service Fill without hassle

- Locate Instructions For Form 2210 Internal Revenue Service Fill and then click Get Form to begin.

- Utilize the features we offer to complete your form.

- Mark important sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Instructions For Form 2210 Internal Revenue Service Fill to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 2210 internal revenue service fill

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 2210 internal revenue service fill

The way to generate an e-signature for a PDF document online

The way to generate an e-signature for a PDF document in Google Chrome

How to generate an e-signature for signing PDFs in Gmail

The way to generate an e-signature from your smart phone

The way to create an e-signature for a PDF document on iOS

The way to generate an e-signature for a PDF file on Android OS

People also ask

-

What is the Arkansas AR2210A form and why is it important?

The Arkansas AR2210A form is crucial for businesses in Arkansas to report their estimated tax payments. By accurately completing the Arkansas AR2210A, you can avoid penalties and interest by ensuring timely tax payments. airSlate SignNow simplifies this process by allowing you to eSign and send your documents securely.

-

How does airSlate SignNow support the completion of the Arkansas AR2210A?

airSlate SignNow streamlines the process of filling out the Arkansas AR2210A form by providing an intuitive platform for electronic signatures. Users can easily upload their documents, fill in the necessary details, and eSign them directly from anywhere. This ensures that your form is completed accurately and submitted on time.

-

What are the pricing options for using airSlate SignNow to manage the Arkansas AR2210A?

airSlate SignNow offers flexible pricing plans to suit various business needs, making it affordable for managing documents like the Arkansas AR2210A. These plans include monthly and annual subscriptions that include access to features like eSigning, document templates, and storage. You can select a plan that best fits your budget while ensuring compliance with tax regulations.

-

Can I integrate airSlate SignNow with my existing accounting software for the Arkansas AR2210A?

Yes, airSlate SignNow offers seamless integrations with various accounting software, allowing for efficient management of documents like the Arkansas AR2210A. You can easily synchronize your data, automate workflows, and eSign documents without disrupting your processes. This integration enhances productivity and accuracy in handling tax-related forms.

-

What security features does airSlate SignNow provide for the Arkansas AR2210A?

AirSlate SignNow prioritizes the security of your documents, including the Arkansas AR2210A form, by employing advanced encryption and secure data storage. These features ensure that sensitive financial information remains protected throughout the eSigning process. You can have peace of mind knowing your documents are secure and compliant with legal standards.

-

Is there a mobile application for completing the Arkansas AR2210A using airSlate SignNow?

Absolutely! airSlate SignNow has a mobile application that allows you to complete and eSign your Arkansas AR2210A form on the go. Whether you’re in the office or traveling, you can access your documents, edit them, and send them securely right from your smartphone or tablet.

-

How can airSlate SignNow benefit small businesses dealing with the Arkansas AR2210A?

For small businesses, airSlate SignNow provides a cost-effective way to manage the Arkansas AR2210A form efficiently. The user-friendly platform helps save time and reduce paperwork, allowing owners to focus on growing their business. With features like remote eSigning, small businesses can ensure compliance without added stress.

Get more for Instructions For Form 2210 Internal Revenue Service Fill

Find out other Instructions For Form 2210 Internal Revenue Service Fill

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors