Penalty and Interest RatesDepartment of Revenue 2021

Understanding Penalty and Interest Rates

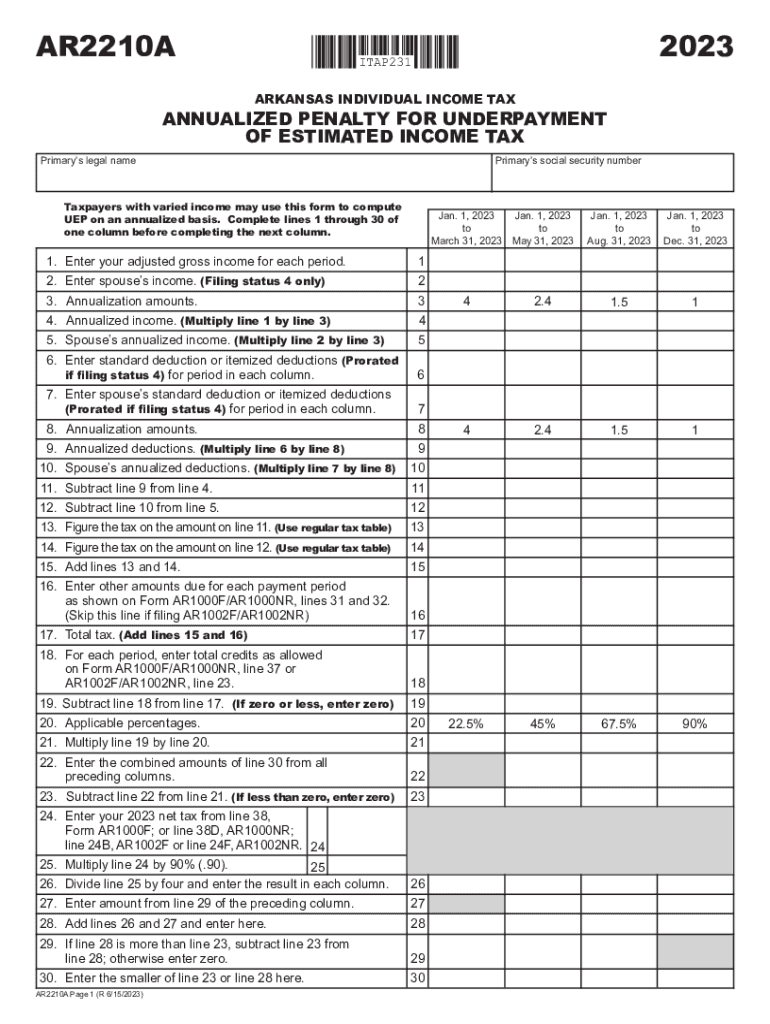

The penalty and interest rates associated with the Arkansas AR2210A form are crucial for taxpayers to understand. These rates apply when there is a failure to pay the correct amount of tax owed by the due date. The Arkansas Department of Revenue sets these rates, which can vary based on the duration of the delay in payment. Knowing these rates helps taxpayers calculate potential costs associated with late payments.

How to Calculate Penalty and Interest

To calculate the penalty and interest on unpaid taxes, start by determining the amount owed and the length of time the payment is overdue. The Arkansas Department of Revenue provides specific formulas for calculating penalties, which typically involve a percentage of the unpaid tax amount. Interest accrues daily, so it is essential to keep track of the number of days the payment is late. Using these calculations, taxpayers can estimate the total amount due, including penalties and interest.

Filing Deadlines for the AR2210A Form

Filing deadlines for the AR2210A form are essential for compliance. Typically, the form must be submitted by the due date of the tax return, which is usually April 15 for individual taxpayers. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to be aware of these deadlines to avoid penalties and interest charges.

Required Documents for Submission

When preparing to submit the AR2210A form, certain documents are necessary. Taxpayers should gather their previous tax returns, any relevant income statements, and records of estimated tax payments made throughout the year. These documents support the information reported on the form and ensure accuracy in calculations. Having all required documentation ready can streamline the filing process.

Consequences of Non-Compliance

Failing to comply with the requirements of the AR2210A form can lead to significant penalties. The Arkansas Department of Revenue may impose fines based on the amount of tax owed and the length of time the payment is overdue. Additionally, interest will accrue on any unpaid balance, increasing the total amount due. Understanding these consequences emphasizes the importance of timely filing and payment.

Eligibility Criteria for Using the AR2210A Form

Eligibility to use the AR2210A form generally includes individuals who have underpaid their estimated tax obligations. Taxpayers must meet specific income thresholds and filing statuses to qualify. Understanding these criteria is vital for determining whether the AR2210A is the appropriate form to use for reporting and calculating penalties and interest.

Quick guide on how to complete penalty and interest ratesdepartment of revenue

Effortlessly prepare Penalty And Interest RatesDepartment Of Revenue on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents quickly, without delays. Handle Penalty And Interest RatesDepartment Of Revenue on any platform using airSlate SignNow applications for Android or iOS and simplify any document-related task today.

How to edit and electronically sign Penalty And Interest RatesDepartment Of Revenue easily

- Find Penalty And Interest RatesDepartment Of Revenue and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

No more concerns about lost or misfiled documents, tedious form searches, or errors requiring new copies. airSlate SignNow meets all your document management needs in just a few clicks from your selected device. Edit and electronically sign Penalty And Interest RatesDepartment Of Revenue and guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct penalty and interest ratesdepartment of revenue

Create this form in 5 minutes!

How to create an eSignature for the penalty and interest ratesdepartment of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ar2210a and how does it work?

The ar2210a is a robust document management tool available through airSlate SignNow. It allows users to easily send, sign, and store important documents securely online. The intuitive interface makes it simple for businesses to streamline their document workflows.

-

What are the pricing options for the ar2210a?

airSlate SignNow offers competitive pricing plans for the ar2210a, designed to meet the needs of businesses of all sizes. Depending on the features you require, you can choose from a range of plans that provide excellent value for money, ensuring access to essential functionalities without breaking the bank.

-

What features does the ar2210a offer?

The ar2210a includes a variety of features such as customizable templates, audit trails, and multi-party signing. These tools enable efficient document management and enhance the overall signing experience. The versatility of ar2210a helps businesses tailor their document processes to their specific needs.

-

How can the ar2210a benefit my business?

Using the ar2210a can signNowly improve your business operations by reducing the time spent on document handling. This solution enhances productivity and facilitates faster decision-making through instant electronic signatures. Additionally, it minimizes paper waste, contributing to a more sustainable work environment.

-

Is the ar2210a easy to integrate with other software?

Yes, the ar2210a is designed to seamlessly integrate with many popular applications, including CRM and project management tools. This makes it easy for businesses to incorporate it into their existing workflows. The integration process is straightforward, saving you time and resources.

-

How secure is the ar2210a for document signing?

The ar2210a prioritizes document security, employing advanced encryption and authentication measures to protect your data. Signatures created through ar2210a are legally binding and compliant with industry standards. This ensures that your business documents remain safe and secure throughout the signing process.

-

Can I customize documents with the ar2210a?

Absolutely! The ar2210a allows users to customize documents using various templates and branding options, enabling businesses to reflect their identity. This feature ensures a personalized touch when sending out important documents for signing, enhancing professionalism and engagement.

Get more for Penalty And Interest RatesDepartment Of Revenue

Find out other Penalty And Interest RatesDepartment Of Revenue

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself