Instructions for Form 2210 Internal Revenue Service 2020

What is the Instructions For Form 2210 Internal Revenue Service

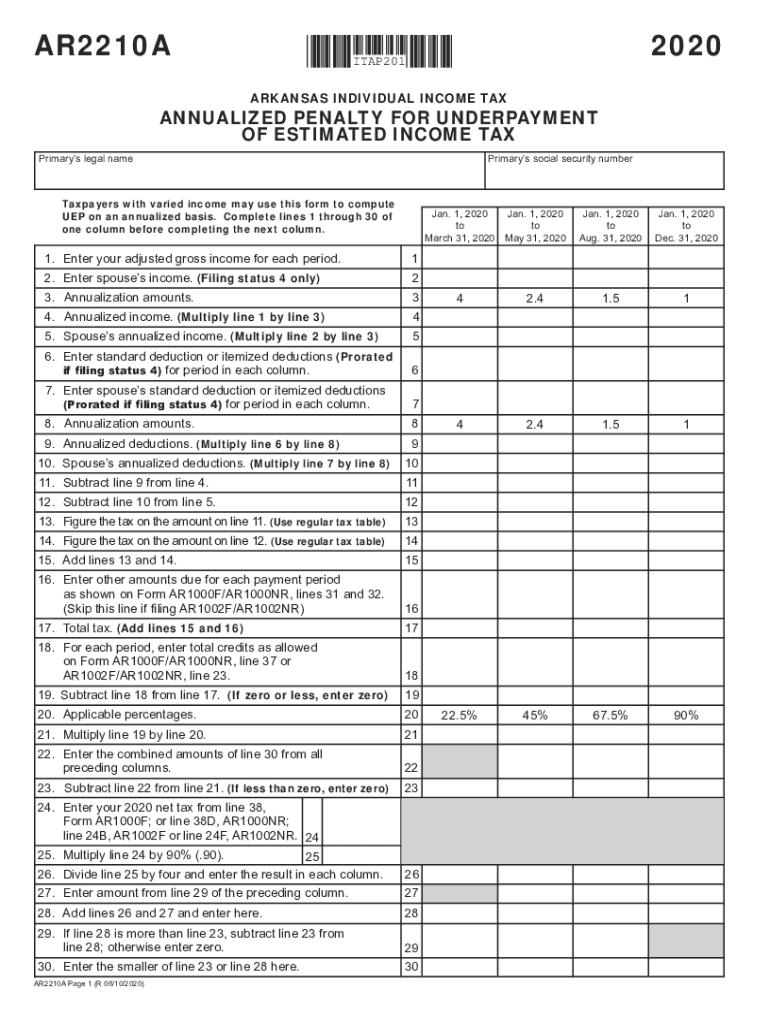

The Instructions for Form 2210 are essential guidelines provided by the Internal Revenue Service (IRS) for taxpayers who need to determine whether they owe a penalty for underpayment of estimated tax. This form is particularly relevant for individuals who do not have enough tax withheld from their income throughout the year. Understanding these instructions helps taxpayers accurately assess their tax obligations and avoid potential penalties.

Steps to Complete the Instructions For Form 2210 Internal Revenue Service

Completing the Instructions for Form 2210 involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Review your total tax liability for the year and compare it to the amount withheld or paid in estimated taxes.

- Determine if you meet the criteria for underpayment by calculating your required annual payment.

- Fill out the form accurately, ensuring all calculations are correct to avoid errors.

- Submit the completed form along with your tax return or as a standalone document if necessary.

Legal Use of the Instructions For Form 2210 Internal Revenue Service

The legal use of the Instructions for Form 2210 is crucial for ensuring compliance with federal tax laws. Taxpayers must adhere to these guidelines to avoid penalties associated with underpayment of taxes. The IRS recognizes electronically signed documents as legally binding, provided they meet specific requirements. Utilizing a reliable eSignature solution can facilitate the secure completion and submission of Form 2210, ensuring that all legal standards are met.

Filing Deadlines / Important Dates

Filing deadlines for Form 2210 are typically aligned with the annual tax return deadlines. For most taxpayers, the deadline to file is April 15 of the following year. If you are unable to meet this deadline, you may file for an extension, but it is essential to ensure that any estimated taxes owed are paid by the original due date to avoid penalties. Keeping track of these important dates helps maintain compliance and avoid unnecessary fees.

Who Issues the Form

The Form 2210 is issued by the Internal Revenue Service (IRS), the U.S. government agency responsible for tax collection and tax law enforcement. The IRS provides this form to assist taxpayers in calculating any penalties for underpayment of estimated tax. It is important for taxpayers to refer to the official IRS website or publications for the most current version of the form and its instructions.

Examples of Using the Instructions For Form 2210 Internal Revenue Service

Examples of using the Instructions for Form 2210 can illustrate various taxpayer scenarios. For instance, a self-employed individual may use the form to determine if they owe a penalty due to insufficient estimated tax payments throughout the year. Similarly, retirees who rely on pension income may find themselves needing to complete this form if their withholding does not cover their tax liability. These examples highlight the importance of understanding the instructions to ensure accurate tax reporting.

Quick guide on how to complete 2020 instructions for form 2210 internal revenue service

Effortlessly Prepare Instructions For Form 2210 Internal Revenue Service on Any Device

Digital document management has gained immense popularity among enterprises and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to efficiently create, edit, and eSign your documents promptly without delays. Manage Instructions For Form 2210 Internal Revenue Service on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Method to Edit and eSign Instructions For Form 2210 Internal Revenue Service with Ease

- Obtain Instructions For Form 2210 Internal Revenue Service and then click Get Form to begin.

- Utilize the features we offer to complete your form.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Instructions For Form 2210 Internal Revenue Service and ensure smooth communication at all stages of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 instructions for form 2210 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the 2020 instructions for form 2210 internal revenue service

How to make an electronic signature for your PDF online

How to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to create an eSignature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The best way to create an eSignature for a PDF on Android

People also ask

-

What is Form 2210 and why do I need it?

Form 2210 is used to determine if you owe a penalty for not paying enough tax throughout the year. It’s essential for taxpayers who did not meet the required payment thresholds. Using airSlate SignNow, you can easily prepare and eSign Form 2210, streamlining your tax filing process.

-

How can airSlate SignNow help me with Form 2210?

airSlate SignNow allows you to quickly generate, edit, and eSign Form 2210. Our platform’s user-friendly interface ensures that even those unfamiliar with tax forms can complete the process effortlessly. Additionally, you can track the status of your Form 2210 once shared with others.

-

Is airSlate SignNow suitable for individuals needing to file Form 2210?

Yes, airSlate SignNow is perfect for individuals needing to file Form 2210, offering an affordable and accessible solution. Our platform provides all the tools necessary for quick document preparation, secure eSigning, and efficient filing. You don't need to be a tax expert to complete Form 2210 with us.

-

What are the pricing options for using airSlate SignNow with Form 2210?

airSlate SignNow offers competitive pricing plans that cater to both individuals and businesses. Our flexible subscription options ensure you only pay for what you need, making it cost-effective for filing Form 2210. Check our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other software for managing Form 2210?

Absolutely! airSlate SignNow offers seamless integrations with various productivity and accounting tools, enhancing your workflow when managing Form 2210. This integration capability allows you to connect with your favorite applications to streamline your tax preparation process.

-

What features make airSlate SignNow the best choice for handling Form 2210?

airSlate SignNow provides an array of features tailored for handling Form 2210, including an intuitive drag-and-drop editor, secure document storage, and real-time tracking of eSigned documents. These features simplify the process of preparing and submitting your tax paperwork efficiently.

-

Is my data safe when using airSlate SignNow for Form 2210?

Yes, security is our top priority at airSlate SignNow. When you prepare and eSign Form 2210, your personal information is protected with industry-standard encryption. We comply with all relevant regulations to ensure your data remains confidential and secure.

Get more for Instructions For Form 2210 Internal Revenue Service

Find out other Instructions For Form 2210 Internal Revenue Service

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure