2024AR2210ABC PDF 2024-2026

What is the 2024AR2210ABC pdf

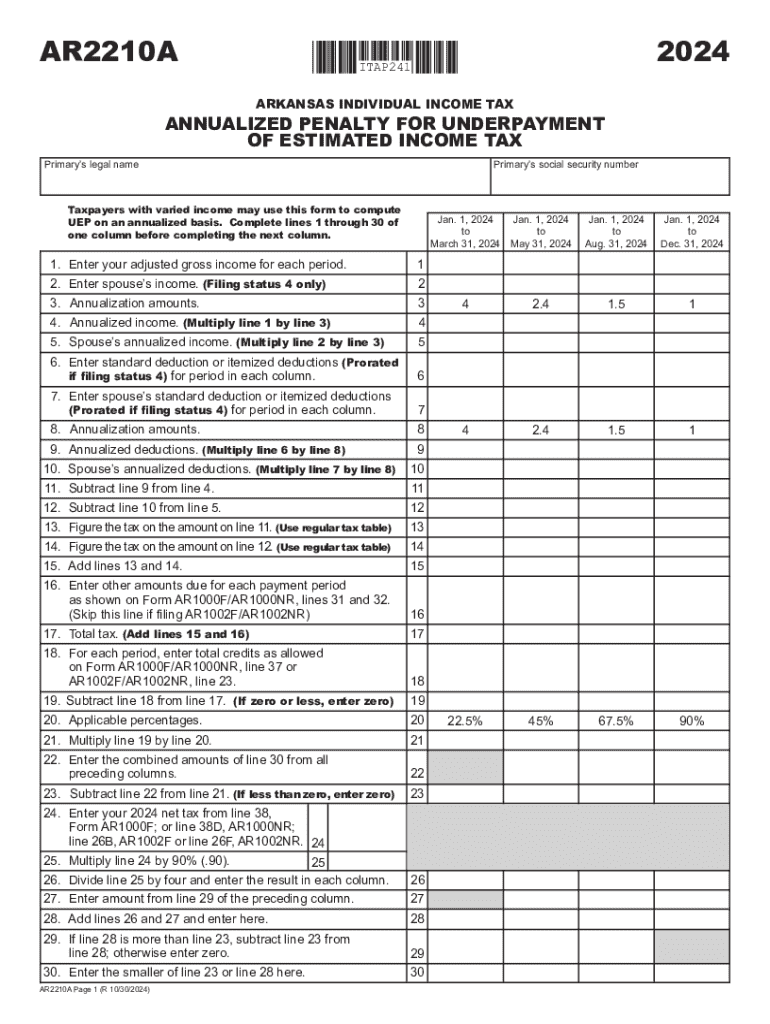

The 2024AR2210ABC pdf is a tax form used by individuals and businesses in the United States to report and calculate their estimated tax payments for the year. This form is particularly relevant for taxpayers who expect to owe tax of one thousand dollars or more when they file their return. It helps ensure that taxpayers meet their tax obligations throughout the year, rather than facing a large bill at tax time.

How to use the 2024AR2210ABC pdf

Using the 2024AR2210ABC pdf involves several steps. First, taxpayers need to gather their financial information, including income, deductions, and credits. Next, they should fill out the form by entering their estimated income and calculating the expected tax liability. The form also includes sections for reporting any prior payments made. Once completed, the form can be submitted electronically or printed for mailing.

Steps to complete the 2024AR2210ABC pdf

Completing the 2024AR2210ABC pdf requires careful attention to detail. Follow these steps:

- Gather all necessary financial documents, such as W-2s and 1099s.

- Calculate your expected income for the year.

- Determine your deductions and credits.

- Fill out the form, entering your estimated income and tax liability.

- Review the form for accuracy before submission.

- Submit the form electronically or print and mail it to the appropriate tax authority.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the 2024AR2210ABC pdf. Typically, estimated tax payments are due quarterly, with specific dates set by the IRS. For the tax year 2024, these deadlines are usually in April, June, September, and January of the following year. Missing these deadlines may result in penalties and interest on unpaid taxes.

Legal use of the 2024AR2210ABC pdf

The 2024AR2210ABC pdf is legally recognized as a valid document for reporting estimated taxes. Taxpayers must ensure that they use the most current version of the form to comply with IRS regulations. Proper completion and submission of this form help avoid issues with tax compliance and potential legal repercussions.

Who Issues the Form

The 2024AR2210ABC pdf is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers have the necessary resources to fulfill their tax obligations.

Create this form in 5 minutes or less

Find and fill out the correct 2024ar2210abc pdf

Create this form in 5 minutes!

How to create an eSignature for the 2024ar2210abc pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024AR2210ABC pdf and how can it benefit my business?

The 2024AR2210ABC pdf is a crucial document for businesses that need to file their annual reports. By utilizing airSlate SignNow, you can easily eSign and send this document, ensuring compliance and timely submission. This streamlined process saves time and reduces the risk of errors.

-

How much does it cost to use airSlate SignNow for the 2024AR2210ABC pdf?

airSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose a plan that fits your budget while ensuring you have access to features that simplify the handling of the 2024AR2210ABC pdf. Check our pricing page for detailed information.

-

What features does airSlate SignNow offer for managing the 2024AR2210ABC pdf?

With airSlate SignNow, you can easily upload, eSign, and share the 2024AR2210ABC pdf. Our platform also includes features like templates, reminders, and tracking, which enhance your document management experience. These tools help ensure that your documents are processed efficiently.

-

Can I integrate airSlate SignNow with other software for the 2024AR2210ABC pdf?

Yes, airSlate SignNow offers seamless integrations with various software applications, making it easy to manage the 2024AR2210ABC pdf alongside your existing tools. This integration capability enhances your workflow and ensures that all your documents are in sync.

-

Is it secure to eSign the 2024AR2210ABC pdf using airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your eSignatures on the 2024AR2210ABC pdf are legally binding and protected. We use advanced encryption and authentication methods to safeguard your sensitive information.

-

How can airSlate SignNow help with the timely submission of the 2024AR2210ABC pdf?

airSlate SignNow streamlines the process of preparing and submitting the 2024AR2210ABC pdf, allowing you to send reminders and track the status of your documents. This ensures that you meet deadlines without the hassle of manual follow-ups, enhancing your efficiency.

-

What are the benefits of using airSlate SignNow for the 2024AR2210ABC pdf compared to traditional methods?

Using airSlate SignNow for the 2024AR2210ABC pdf offers numerous benefits over traditional methods, including faster processing times, reduced paper usage, and enhanced collaboration. This digital approach not only saves time but also contributes to a more sustainable business practice.

Get more for 2024AR2210ABC pdf

- Pennsylvania psrs 100 part form

- Sweetwater community center form

- Tennessee pardon application form

- Tennessee boat bill of sale template pdf form

- 447 oil grit gravity separator knox county tennessee knoxcounty form

- Irs physicians statement fillable 2009 form

- Vehicle checklist form

- Handitran application form

Find out other 2024AR2210ABC pdf

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself