AR AR2210 Fill and Sign Printable Template 2021

What is the AR2210 form?

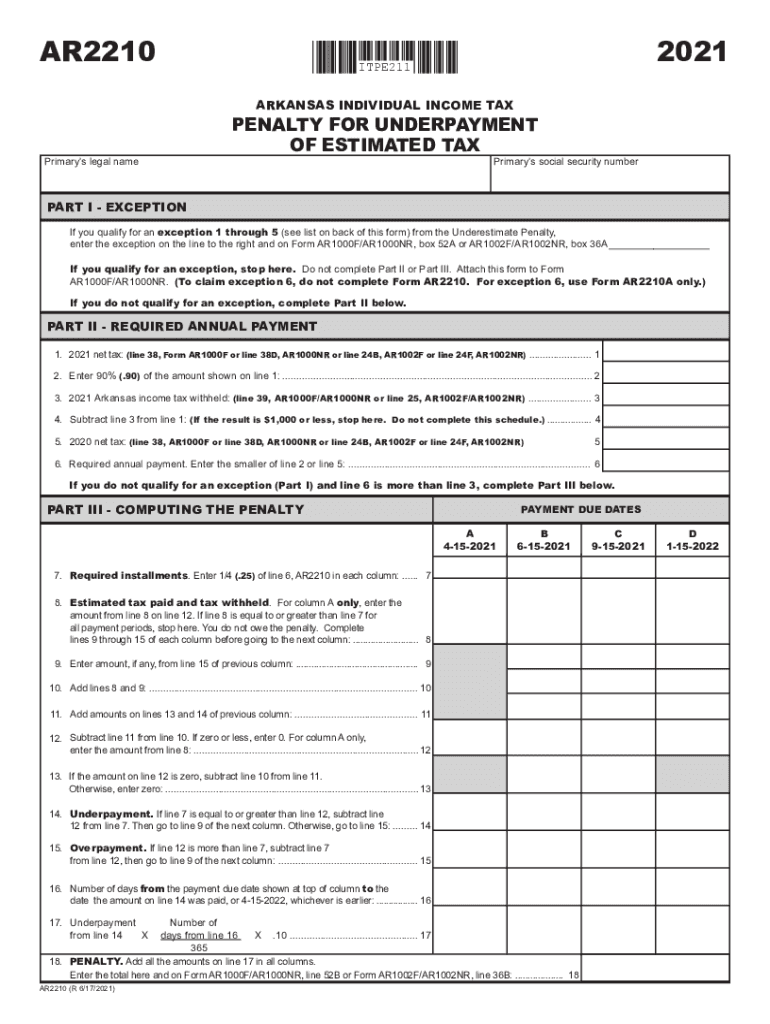

The AR2210 form, also known as the Arkansas Underpayment of Estimated Tax form, is used by taxpayers in Arkansas to calculate any penalties for underpayment of estimated taxes. This form is particularly relevant for individuals and businesses that do not pay enough tax throughout the year, either through withholding or estimated tax payments. It helps determine if a penalty applies and how much it may be, ensuring compliance with state tax laws.

Steps to complete the AR2210 form

Completing the AR2210 form involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your total tax liability for the year to determine if you have underpaid.

- Fill out the AR2210 form, providing accurate income and payment information.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified deadline, either online or via mail.

Legal use of the AR2210 form

The AR2210 form is legally binding when filled out correctly and submitted according to Arkansas state tax regulations. It is essential for taxpayers to understand that failing to file this form when required may result in penalties. The form must be signed and dated by the taxpayer to ensure its validity. Compliance with eSignature laws can also enhance the form's legal standing when submitted electronically.

Filing deadlines for the AR2210 form

Taxpayers must adhere to specific filing deadlines for the AR2210 form to avoid penalties. Generally, the form is due on the same date as the annual income tax return. For most individuals, this is typically April 15. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is crucial to stay informed about any changes to deadlines that may occur due to state regulations.

Penalties for non-compliance with the AR2210 form

Failure to file the AR2210 form or to pay the required estimated taxes can result in penalties imposed by the Arkansas Department of Finance and Administration. These penalties may include a percentage of the underpaid amount, which can accumulate over time. Understanding the potential consequences of non-compliance is essential for taxpayers to avoid unnecessary financial burdens.

Examples of using the AR2210 form

The AR2210 form can be utilized in various scenarios, such as:

- A self-employed individual who has not made sufficient estimated tax payments throughout the year.

- A business that has experienced fluctuating income and failed to adjust its estimated tax payments accordingly.

- Taxpayers who have received unexpected income, such as bonuses or investment gains, leading to underpayment of taxes.

Quick guide on how to complete ar ar2210 2020 2022 fill and sign printable template

Complete AR AR2210 Fill And Sign Printable Template seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, since you can locate the necessary form and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents promptly without delay. Handle AR AR2210 Fill And Sign Printable Template on any platform using airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to modify and eSign AR AR2210 Fill And Sign Printable Template effortlessly

- Obtain AR AR2210 Fill And Sign Printable Template and click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or obscure sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and hit the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign AR AR2210 Fill And Sign Printable Template and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ar ar2210 2020 2022 fill and sign printable template

Create this form in 5 minutes!

How to create an eSignature for the ar ar2210 2020 2022 fill and sign printable template

The way to generate an e-signature for your PDF in the online mode

The way to generate an e-signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an e-signature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

The way to generate an e-signature for a PDF document on Android OS

People also ask

-

What is ar2210 and how does it enhance document signing?

The ar2210 is a feature of airSlate SignNow that streamlines the eSigning process, making it faster and more efficient. It allows users to easily create, send, and manage documents electronically. With the ar2210, businesses can save time and ensure better document tracking.

-

How much does it cost to use airSlate SignNow with ar2210?

Pricing for airSlate SignNow using the ar2210 feature varies based on the subscription plan chosen. Generally, it offers flexible pricing tiers to fit different business needs. This cost-effective solution ensures you only pay for the features that best suit your organization's eSigning requirements.

-

What are the key features of ar2210 in airSlate SignNow?

The ar2210 includes features such as document templates, advanced security options, and seamless integration with various applications. It allows users to customize workflows to fit their specific needs. This ensures a comprehensive and user-friendly eSigning experience.

-

Can I integrate ar2210 with other software applications?

Yes, airSlate SignNow with ar2210 can be easily integrated with other software such as CRM systems, cloud storage, and productivity tools. This integration capability enhances workflow efficiency by allowing you to manage documents across multiple platforms. Leveraging ar2210 ensures a smoother operational process.

-

What benefits does using ar2210 provide for businesses?

Using the ar2210 with airSlate SignNow signNowly speeds up the document signing process, enabling quicker transaction speeds. It also increases accuracy by reducing manual errors associated with traditional signing methods. Additionally, it boosts overall productivity for teams by simplifying the eSigning workflow.

-

Is ar2210 secure for sending sensitive documents?

Absolutely, the ar2210 feature in airSlate SignNow prioritizes security with advanced encryption and authentication measures. This ensures that sensitive documents remain confidential during the eSigning process. Businesses can confidently use ar2210 knowing that their information is protected.

-

How user-friendly is the ar2210 functionality in airSlate SignNow?

The ar2210 functionality is designed to be intuitive and easy to navigate, allowing users to eSign documents without extensive training. With a straightforward interface, users can quickly adopt ar2210 and start sending documents for signatures. This user-friendliness is a major advantage for teams looking to enhance their workflow.

Get more for AR AR2210 Fill And Sign Printable Template

Find out other AR AR2210 Fill And Sign Printable Template

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free