Ar2210 Form Fill Out and Sign Printable PDF 2021

Understanding the AR2210 Form

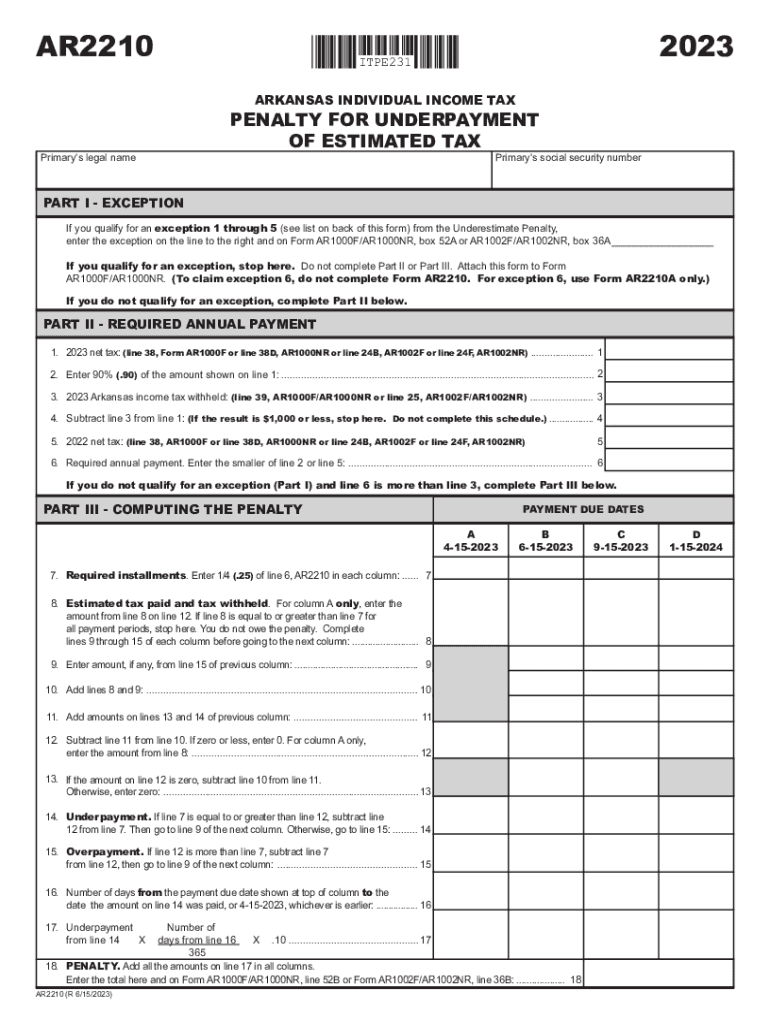

The AR2210 form is essential for Arkansas taxpayers who may have underpaid their estimated taxes. This form is used to calculate any penalties for underpayment and to determine if you owe additional taxes. It is particularly relevant for individuals who do not meet the required tax payment thresholds throughout the year. Understanding the purpose and structure of the AR2210 is crucial for accurate tax reporting and compliance.

Steps to Complete the AR2210 Form

Filling out the AR2210 form involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your total tax liability for the year.

- Determine the amount of tax you have already paid through withholding and estimated payments.

- Use the form to calculate any underpayment penalties based on your tax liability and payments made.

- Complete the AR2210 form by following the instructions provided, ensuring all calculations are accurate.

- Review the form for completeness before submission.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines associated with the AR2210 form to avoid penalties. Typically, the AR2210 must be filed with your state tax return by April 15 of the following year. If you are unable to meet this deadline, consider filing for an extension. However, any taxes owed should still be paid by the original due date to avoid additional penalties.

Penalties for Non-Compliance

Failing to file the AR2210 form or underpaying your taxes can result in significant penalties. The state of Arkansas imposes penalties based on the amount of underpayment and the duration of the underpayment period. Understanding these penalties can help you avoid unexpected financial burdens and ensure compliance with state tax regulations.

Who Issues the AR2210 Form

The Arkansas Department of Finance and Administration is responsible for issuing the AR2210 form. This state agency provides the necessary forms and instructions for taxpayers to correctly report their tax obligations. For any updates or changes to the form, it is advisable to check the official website of the department or consult a tax professional.

Examples of Using the AR2210 Form

There are various scenarios in which a taxpayer might need to utilize the AR2210 form. For instance, if an individual is self-employed and has not made sufficient estimated tax payments throughout the year, they may need to file this form to assess any penalties. Similarly, retirees or individuals with fluctuating income may also find themselves needing to complete the AR2210 to ensure compliance with Arkansas tax laws.

Quick guide on how to complete ar2210 form fill out and sign printable pdf

Complete Ar2210 Form Fill Out And Sign Printable PDF effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Ar2210 Form Fill Out And Sign Printable PDF on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The easiest way to modify and electronically sign Ar2210 Form Fill Out And Sign Printable PDF with ease

- Obtain Ar2210 Form Fill Out And Sign Printable PDF and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, either via email, text message (SMS), invitation link, or download it to your PC.

Eliminate the hassles of lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Ar2210 Form Fill Out And Sign Printable PDF to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ar2210 form fill out and sign printable pdf

Create this form in 5 minutes!

How to create an eSignature for the ar2210 form fill out and sign printable pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Arkansas underpayment, and how does it affect businesses?

Arkansas underpayment refers to the discrepancy when a taxpayer pays less than what is owed in terms of state taxes. For businesses in Arkansas, underpayment can lead to penalties and interest charges, making it crucial to stay compliant. Utilizing tools like airSlate SignNow can help streamline document signing processes, ensuring all tax-related forms are accurately completed and submitted on time.

-

How can airSlate SignNow help with Arkansas underpayment issues?

airSlate SignNow assists businesses in managing their documentation efficiently, which is vital regarding Arkansas underpayment. With electronic signatures and secure document sharing, businesses can ensure timely submissions of tax documents. This reduces the likelihood of errors that could lead to underpayment concerns.

-

What pricing options does airSlate SignNow offer for managing Arkansas underpayment documentation?

airSlate SignNow provides flexible pricing plans tailored to fit different business needs, including those dealing with Arkansas underpayment concerns. The cost-effective solutions allow businesses to efficiently manage their document processes without overspending. By choosing the right plan, companies can avoid costly penalties associated with underpayment.

-

Are there any features that specifically address Arkansas underpayment documentation?

Yes, airSlate SignNow includes features that make managing Arkansas underpayment documentation more straightforward. With automated reminders for tax submissions and templates for necessary forms, users can focus on compliance rather than paperwork hassles. These tools reduce the chance of underpayment by ensuring timely action is taken.

-

What are the benefits of using airSlate SignNow for addressing Arkansas underpayment?

The benefits of using airSlate SignNow for Arkansas underpayment issues include improved compliance, reduced errors, and enhanced efficiency. The easy-to-use system allows businesses to manage signatures and documents in one place, ensuring nothing is overlooked. Streamlining these processes helps prevent potential underpayment penalties.

-

Can airSlate SignNow integrate with other software to help with Arkansas underpayment management?

Yes, airSlate SignNow offers integrations with various software that can be useful for managing Arkansas underpayment. Whether it's accounting software or tax preparation tools, these integrations provide a seamless workflow. This connectivity ensures that all necessary documentation is handled efficiently, reducing the risk of underpayment.

-

Is it easy to set up airSlate SignNow for managing Arkansas underpayment documentation?

Absolutely! Setting up airSlate SignNow for Arkansas underpayment management is straightforward and user-friendly. The platform allows for quick onboarding, enabling businesses to start organizing their documentation almost immediately. This ease of use is vital for those needing to tackle potential underpayment issues swiftly.

Get more for Ar2210 Form Fill Out And Sign Printable PDF

- Control number tx 085 78 form

- Individual to two trusts form

- Estate to two individual beneficiaries form

- Grantee the following lands and property together with all improvements located thereon lying in the form

- General partnership to limited liability form

- Corporation to two corporations form

- Trust to two individuals as jtros form

- Subsurface rights only form

Find out other Ar2210 Form Fill Out And Sign Printable PDF

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form