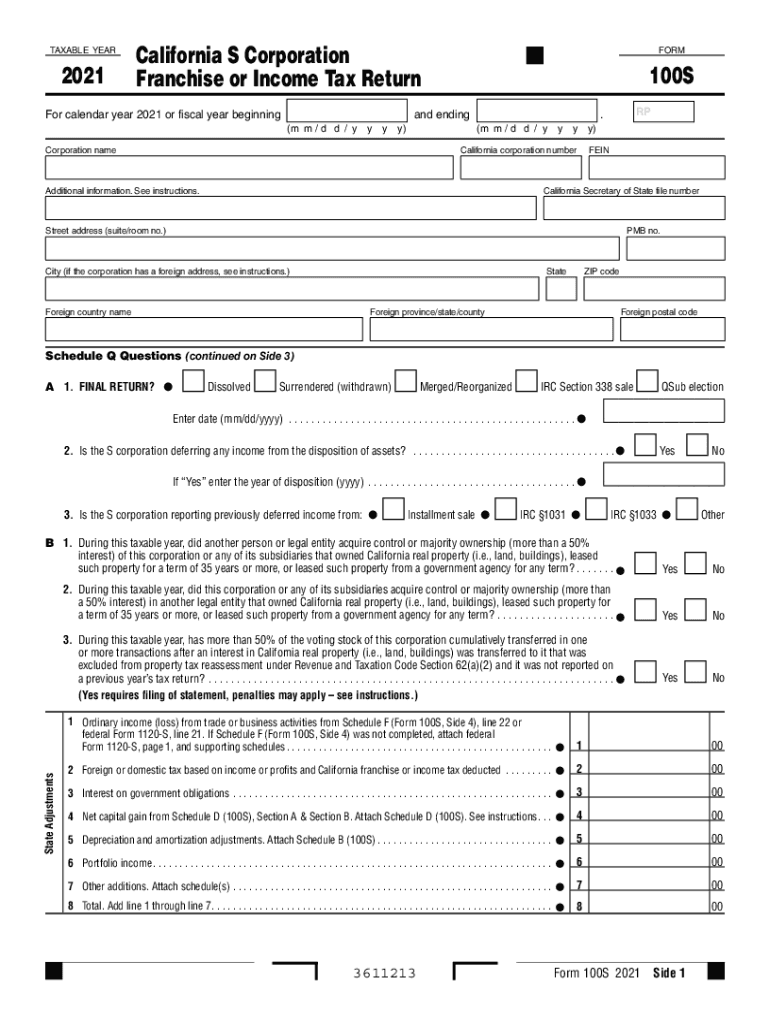

Forms and PublicationsFTB Ca Gov Franchise Tax Board 2021

Steps to complete the 2019 S Tax Form

Completing the 2019 S tax form involves several essential steps to ensure accuracy and compliance with IRS regulations. Start by gathering all necessary documents, including income statements, expense records, and any relevant deductions. It is crucial to have your previous year’s tax return handy for reference.

Next, carefully read the instructions provided with the form. This will guide you through the various sections and requirements specific to the 2019 S tax form. Fill out the form in a clear and legible manner, ensuring all information is accurate to avoid delays or penalties.

After completing the form, review it thoroughly for any errors or omissions. Consider using digital tools for electronic filing, as they often include checks for common mistakes. Once satisfied, submit the form by the designated deadline to avoid any late filing penalties.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 2019 S tax form is critical to avoid penalties. The standard due date for most taxpayers is April 15, 2020. However, if you filed for an extension, you may have until October 15, 2020, to submit your form. Be aware that extensions only extend the time to file, not the time to pay any taxes owed.

Mark these dates on your calendar and set reminders to ensure timely submission. Missing these deadlines can result in significant penalties and interest on any unpaid taxes.

Required Documents

To complete the 2019 S tax form accurately, gather all required documents beforehand. Essential documents include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Receipts for deductible expenses, such as business-related costs

- Records of any other income sources

- Previous year’s tax return for reference

Having these documents organized will streamline the process and help ensure that you do not miss any potential deductions or credits.

Form Submission Methods (Online / Mail / In-Person)

When it comes to submitting the 2019 S tax form, you have several options. You can file online using approved e-filing software, which often simplifies the process and provides instant confirmation of receipt. Alternatively, you can print the completed form and mail it to the appropriate IRS address based on your location.

If you prefer to submit your form in person, you can visit a local IRS office. However, be sure to check the office hours and whether you need to make an appointment. Each submission method has its advantages, so choose the one that best fits your needs.

Penalties for Non-Compliance

Failing to comply with the requirements of the 2019 S tax form can result in various penalties. If you miss the filing deadline, you may incur a late filing penalty, which is typically a percentage of the taxes owed for each month the return is late. Additionally, if you fail to pay any taxes owed, interest will accrue on the unpaid balance.

It is essential to understand these potential penalties and take proactive steps to file accurately and on time. If you are unable to pay your taxes, consider contacting the IRS to discuss payment options.

IRS Guidelines

Familiarizing yourself with IRS guidelines for the 2019 S tax form is crucial for compliance. The IRS provides detailed instructions on how to complete the form, including information on allowable deductions, credits, and filing requirements. Regularly reviewing these guidelines can help you stay informed about any changes in tax laws that may affect your filing.

Additionally, the IRS offers resources and assistance for taxpayers, including FAQs and contact information for support. Utilizing these resources can help clarify any uncertainties you may have during the filing process.

Quick guide on how to complete forms and publicationsftbcagov franchise tax board

Effortlessly Prepare Forms And PublicationsFTB ca gov Franchise Tax Board on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the required format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Forms And PublicationsFTB ca gov Franchise Tax Board on any platform with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to Modify and eSign Forms And PublicationsFTB ca gov Franchise Tax Board with Ease

- Locate Forms And PublicationsFTB ca gov Franchise Tax Board and select Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to finalize your modifications.

- Select how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Forms And PublicationsFTB ca gov Franchise Tax Board and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct forms and publicationsftbcagov franchise tax board

Create this form in 5 minutes!

How to create an eSignature for the forms and publicationsftbcagov franchise tax board

How to create an e-signature for your PDF file online

How to create an e-signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

How to generate an e-signature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

How to generate an e-signature for a PDF on Android devices

People also ask

-

What is airSlate SignNow's pricing structure for the 2019 s tax documents?

airSlate SignNow offers flexible pricing plans suitable for various business needs. For handling 2019 s tax documents, you can choose from monthly or annual subscription options, with discounts available for longer-term commitments. Each plan includes essential features for eSigning and document management, ensuring you stay compliant with tax requirements.

-

Can airSlate SignNow help with document security for 2019 s tax submissions?

Absolutely! airSlate SignNow prioritizes document security, especially when dealing with sensitive data like 2019 s tax information. The platform utilizes industry-standard encryption and authentication measures to ensure your documents are safe, giving you peace of mind while you manage your tax submissions.

-

What features does airSlate SignNow provide for managing 2019 s tax documents?

airSlate SignNow includes a wide range of features specifically designed for managing 2019 s tax documents. You can easily eSign, send, and track documents, ensuring that all necessary parties are notified and reminded. Additionally, it allows you to create templates for commonly used tax forms, simplifying your workflow.

-

How does airSlate SignNow integrate with other tools for 2019 s tax preparation?

airSlate SignNow seamlessly integrates with various accounting and tax preparation software, making it easier to manage your 2019 s tax-related documents. This connectivity helps streamline your workflow, allowing you to import and export documents without hassle. Popular integrations include platforms like QuickBooks and Xero.

-

What are the benefits of using airSlate SignNow for eSigning 2019 s tax documents?

Using airSlate SignNow for eSigning your 2019 s tax documents offers numerous benefits. The platform enhances efficiency by reducing the time spent on manual signatures and paperwork. Plus, it provides a complete audit trail, ensuring compliance and transparency for your tax submissions.

-

Is airSlate SignNow suitable for both individuals and businesses handling 2019 s tax?

Yes, airSlate SignNow is designed to cater to the needs of both individuals and businesses dealing with 2019 s tax documents. Whether you're a freelancer or a large corporation, the platform’s versatile features and pricing plans make it a suitable choice for all users.

-

How can I get started with airSlate SignNow for my 2019 s tax documents?

Getting started with airSlate SignNow for your 2019 s tax documents is quick and easy. Simply sign up for a free trial on our website, and you can begin sending and signing documents immediately. Our intuitive interface will guide you through the process, allowing you to focus on your tax preparations.

Get more for Forms And PublicationsFTB ca gov Franchise Tax Board

- Massachusetts rent paid form

- Massachusetts tenant landlord form

- Letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by expiration 497309701 form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497309702 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement massachusetts form

- Letter from tenant to landlord about insufficient notice of change in rental agreement for other than rent increase form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants massachusetts form

- Utility shut off notice template form

Find out other Forms And PublicationsFTB ca gov Franchise Tax Board

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast