California S Corporation Tax Everything You Need to Know 2020

What is the California S Corporation Tax?

The California S Corporation Tax is a tax imposed on S corporations operating within the state of California. Unlike traditional corporations, S corporations pass their income, losses, deductions, and credits directly to shareholders, who then report this information on their personal tax returns. However, California requires S corporations to pay a minimum franchise tax, which is currently set at eight hundred dollars annually. This tax is applicable regardless of whether the corporation is profitable or not.

Steps to Complete the California S Corporation Tax

Completing the California S Corporation Tax involves several steps to ensure compliance with state regulations. Here are the essential steps:

- Gather necessary financial documents, including income statements and balance sheets.

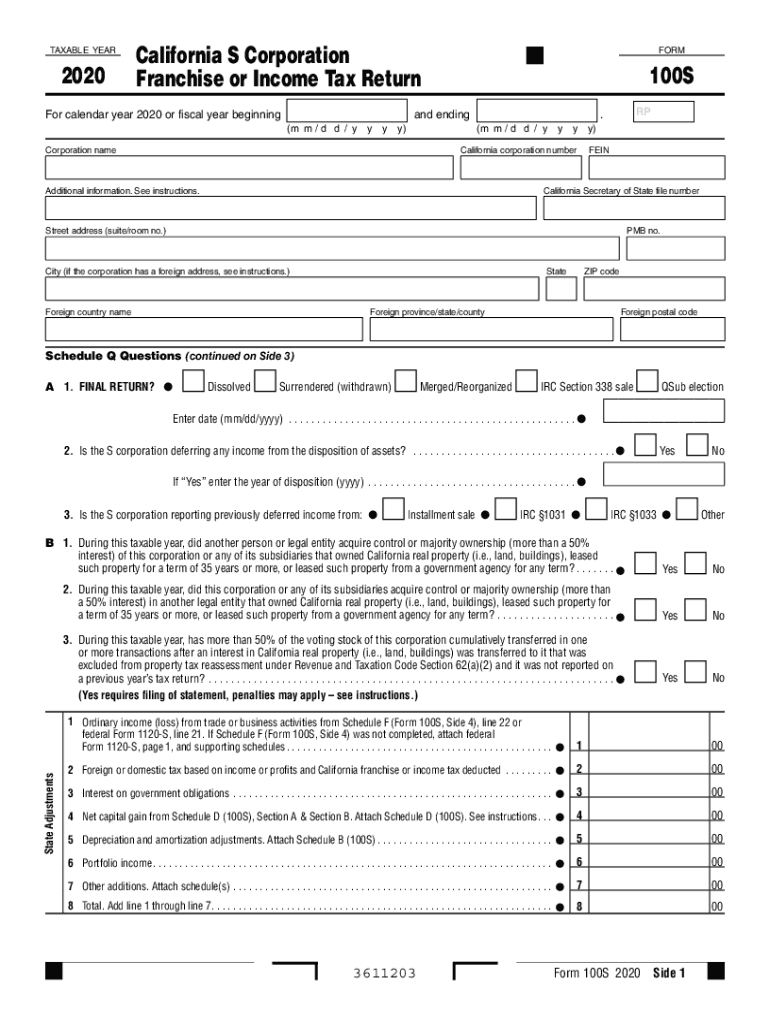

- Complete the California Form 100S, which is specifically designed for S corporations.

- Calculate the total income and any applicable deductions to determine the taxable income.

- Report the calculated income on Form 100S and ensure all required schedules are attached.

- Submit the completed form to the California Franchise Tax Board either electronically or by mail.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the California S Corporation Tax to avoid penalties. Typically, the tax return is due on the fifteenth day of the third month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the deadline is March 15. Extensions may be available, but they do not extend the payment deadline for any taxes owed.

Required Documents

To file the California S Corporation Tax, specific documents must be prepared and submitted. These include:

- California Form 100S, which serves as the primary tax return.

- Schedule B, which outlines the income and deductions of the corporation.

- Schedule K-1 for each shareholder, detailing their share of income, deductions, and credits.

- Any additional schedules required based on the corporation's activities and income sources.

Penalties for Non-Compliance

Failure to comply with the California S Corporation Tax requirements can result in significant penalties. These may include:

- Late filing penalties, which can be a percentage of the unpaid tax amount.

- Interest on any unpaid taxes, accruing from the original due date until payment is made.

- Potential loss of S corporation status if required filings are not maintained.

Digital vs. Paper Version

When filing the California S Corporation Tax, businesses have the option to submit their forms digitally or via paper. The digital submission process is often quicker and may provide immediate confirmation of receipt. Additionally, electronic filing can reduce the risk of errors that may occur when manually completing paper forms. However, some businesses may prefer the traditional paper method for record-keeping purposes.

Quick guide on how to complete california s corporation tax everything you need to know

Effortlessly Prepare California S Corporation Tax Everything You Need To Know on Any Device

The management of documents online has become increasingly popular among both businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow equips you with everything needed to rapidly create, modify, and electronically sign your documents without delays. Manage California S Corporation Tax Everything You Need To Know on any platform using airSlate SignNow's Android or iOS applications and streamline any document-driven process today.

Easily Modify and eSign California S Corporation Tax Everything You Need To Know

- Obtain California S Corporation Tax Everything You Need To Know and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign California S Corporation Tax Everything You Need To Know while ensuring clear communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california s corporation tax everything you need to know

Create this form in 5 minutes!

How to create an eSignature for the california s corporation tax everything you need to know

The way to create an electronic signature for a PDF online

The way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

The way to make an eSignature for a PDF on Android

People also ask

-

What are the key franchise tax board California forms available through airSlate SignNow?

The airSlate SignNow platform offers a variety of franchise tax board California forms, including the CA 540, CA 540NR, and various business entity forms. These templates are designed to simplify the process of filling out and submitting tax documents electronically. Users can easily access these forms and utilize them in their workflow.

-

How does airSlate SignNow handle pricing for franchise tax board California forms?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, allowing you to access franchise tax board California forms without hidden fees. Depending on your needs, you can choose a plan that includes essential features for managing your document signing and storage. Transparent pricing helps you make informed decisions.

-

What user-friendly features does airSlate SignNow provide for completing franchise tax board California forms?

airSlate SignNow provides various user-friendly features, such as an intuitive interface, drag-and-drop functionality, and robust editing tools that facilitate completing franchise tax board California forms. Additionally, features like automatic reminders and document tracking enhance the user experience by ensuring a smooth signing process.

-

Can I integrate airSlate SignNow with other applications when managing franchise tax board California forms?

Yes, airSlate SignNow offers seamless integrations with popular applications such as Google Drive, Dropbox, and CRM systems. This ensures that you can manage your franchise tax board California forms efficiently across different platforms, streamlining your workflow and enhancing productivity.

-

What benefits does airSlate SignNow offer for using franchise tax board California forms?

Using airSlate SignNow for your franchise tax board California forms provides signNow benefits, including time savings, improved accuracy, and enhanced compliance. The electronic signing process minimizes the chance of errors and allows for quick submission, helping you meet deadlines effectively.

-

Is there customer support available for questions regarding franchise tax board California forms?

Absolutely! airSlate SignNow offers dedicated customer support to assist users with inquiries about franchise tax board California forms. Support is accessible via various channels, including live chat, email, and phone, ensuring that you receive timely assistance when needed.

-

Are there any security measures in place for franchises using airSlate SignNow for California forms?

Yes, airSlate SignNow prioritizes the security of your documents, including franchise tax board California forms. The platform employs advanced encryption and compliance with industry standards to keep your information safe during storage and transmission.

Get more for California S Corporation Tax Everything You Need To Know

- Check for win reimbursement form

- Delta skymiles child enrollment form

- Dietary department orientation form

- Kaiser grievance process form

- Rpli death claim form

- Iowa 4 h horse lease agreement green county green uwex form

- Cristalbarajas blogspot com202204alaska divorce certificate request form download

- Death certificate alaska form

Find out other California S Corporation Tax Everything You Need To Know

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself