California Form 100 S California S Corporation Franchise or 2019

What is the California Form 100 S?

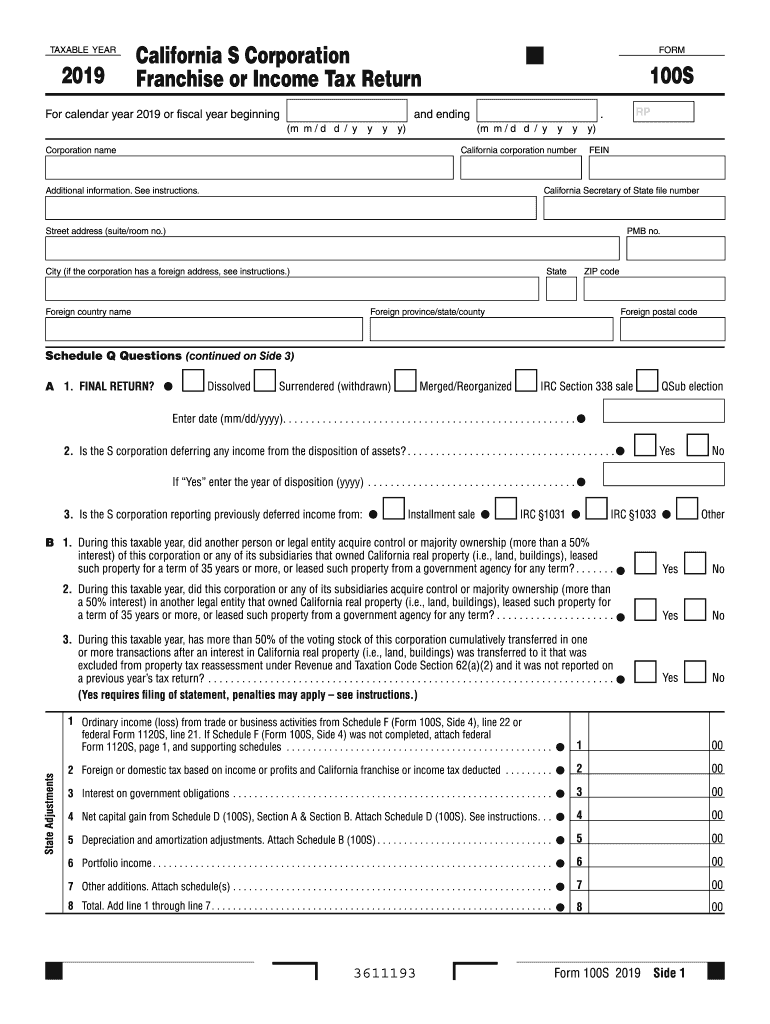

The California Form 100 S is a tax form specifically designed for S corporations operating in California. This form is used to report the income, deductions, and credits of an S corporation, which is a type of business entity that allows income to pass through to shareholders without being subject to federal corporate income tax. The California Franchise Tax Board requires this form to ensure compliance with state tax laws and to determine the tax obligations of S corporations within the state.

How to use the California Form 100 S

Using the California Form 100 S involves several important steps. First, gather all necessary financial information, including income statements, balance sheets, and records of deductions. Next, complete each section of the form accurately, ensuring that all figures are correct and that you follow the specific instructions provided by the Franchise Tax Board. After filling out the form, review it thoroughly for any errors before submission. It is essential to keep a copy of the completed form for your records.

Steps to complete the California Form 100 S

Completing the California Form 100 S requires careful attention to detail. Start by entering the corporation's identifying information, including the name, address, and federal employer identification number (EIN). Next, report the total income and deductions for the tax year. Follow this by calculating the taxable income and any applicable credits. Finally, sign and date the form, ensuring that it is submitted by the appropriate deadline to avoid penalties. Utilizing electronic filing options can streamline this process significantly.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the California Form 100 S is crucial for compliance. Typically, the form is due on the 15th day of the third month after the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by March 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is advisable to file early to avoid last-minute issues and ensure timely processing.

Penalties for Non-Compliance

Failure to file the California Form 100 S on time can result in significant penalties. The Franchise Tax Board imposes a late filing penalty, which can be a percentage of the unpaid tax amount. Additionally, interest accrues on any unpaid taxes from the due date until payment is made. Corporations that consistently fail to comply may also face further scrutiny and potential audits. It is essential to adhere to all filing requirements to avoid these consequences.

Required Documents

When preparing to file the California Form 100 S, certain documents are necessary to ensure accurate reporting. These include financial statements, such as profit and loss statements and balance sheets, as well as documentation of any deductions and credits being claimed. Additionally, the corporation's federal tax return may be required for reference. Having these documents organized and readily available will facilitate a smoother filing process.

Form Submission Methods

The California Form 100 S can be submitted through various methods, providing flexibility for businesses. Corporations may choose to file electronically via the Franchise Tax Board's online portal, which is often faster and more efficient. Alternatively, the form can be mailed to the appropriate address specified by the Franchise Tax Board. In-person submissions may also be possible at designated locations. Each method has its own processing times, so it is important to choose the one that best fits your needs.

Quick guide on how to complete california form 100 s california s corporation franchise or

Complete California Form 100 S California S Corporation Franchise Or effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your papers swiftly without delays. Manage California Form 100 S California S Corporation Franchise Or on any device using airSlate SignNow's Android or iOS applications and streamline any document-based task today.

How to alter and electronically sign California Form 100 S California S Corporation Franchise Or with ease

- Find California Form 100 S California S Corporation Franchise Or and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that task.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Modify and eSign California Form 100 S California S Corporation Franchise Or and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california form 100 s california s corporation franchise or

Create this form in 5 minutes!

How to create an eSignature for the california form 100 s california s corporation franchise or

The best way to create an electronic signature for a PDF in the online mode

The best way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

How to generate an eSignature for a PDF on Android OS

People also ask

-

What are the franchise tax board California forms required for business compliance?

The franchise tax board California forms include several essential documents necessary for maintaining compliance with state tax regulations. These forms encompass various tax filings, including income tax forms and informational returns. By utilizing airSlate SignNow, businesses can efficiently manage and send these forms digitally, ensuring timely submissions.

-

How can airSlate SignNow help with completing franchise tax board California forms?

airSlate SignNow simplifies the process of completing franchise tax board California forms by providing an intuitive interface for filling out required fields. Users can easily input their information, attach necessary documents, and eSign the forms directly within the platform. This streamlines the submission process and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for franchise tax board California forms?

Yes, there are various pricing plans available for using airSlate SignNow, allowing businesses to choose one that suits their needs for managing franchise tax board California forms. The plans are competitively priced and often include features like unlimited eSignatures and document storage. This makes it a cost-effective solution for companies of all sizes.

-

What features does airSlate SignNow offer for managing franchise tax board California forms?

AirSlate SignNow offers features such as template creation, document tracking, and automated workflows specifically designed for managing franchise tax board California forms. With robust security measures and customization options, users can ensure their documents are secure and tailored to their business needs. These features enhance efficiency and accuracy in form management.

-

Can I integrate airSlate SignNow with other software for handling franchise tax board California forms?

Yes, airSlate SignNow offers seamless integrations with various software solutions to enhance your experience when handling franchise tax board California forms. Whether you use accounting software or HR platforms, integrating airSlate SignNow can streamline your documentation processes. This connectivity allows for a more cohesive workflow across different applications.

-

What are the benefits of using airSlate SignNow for franchise tax board California forms?

Using airSlate SignNow for franchise tax board California forms provides numerous benefits, including increased efficiency, reduced turnaround times, and enhanced accuracy. The digital platform eliminates the need for paper-based processes, saving time and resources. Additionally, the eSigning feature ensures compliance and security while keeping your business organized.

-

How does airSlate SignNow ensure the security of my franchise tax board California forms?

AirSlate SignNow prioritizes the security of your franchise tax board California forms by utilizing advanced encryption technologies and secure cloud storage. This ensures that sensitive information is protected during transmission and storage. Compliance with industry standards also gives users peace of mind regarding the safety of their documents.

Get more for California Form 100 S California S Corporation Franchise Or

Find out other California Form 100 S California S Corporation Franchise Or

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation