Form 100S California S Corporation Franchise or Income Tax 2023-2026

What is the Form 100S California S Corporation Franchise Or Income Tax

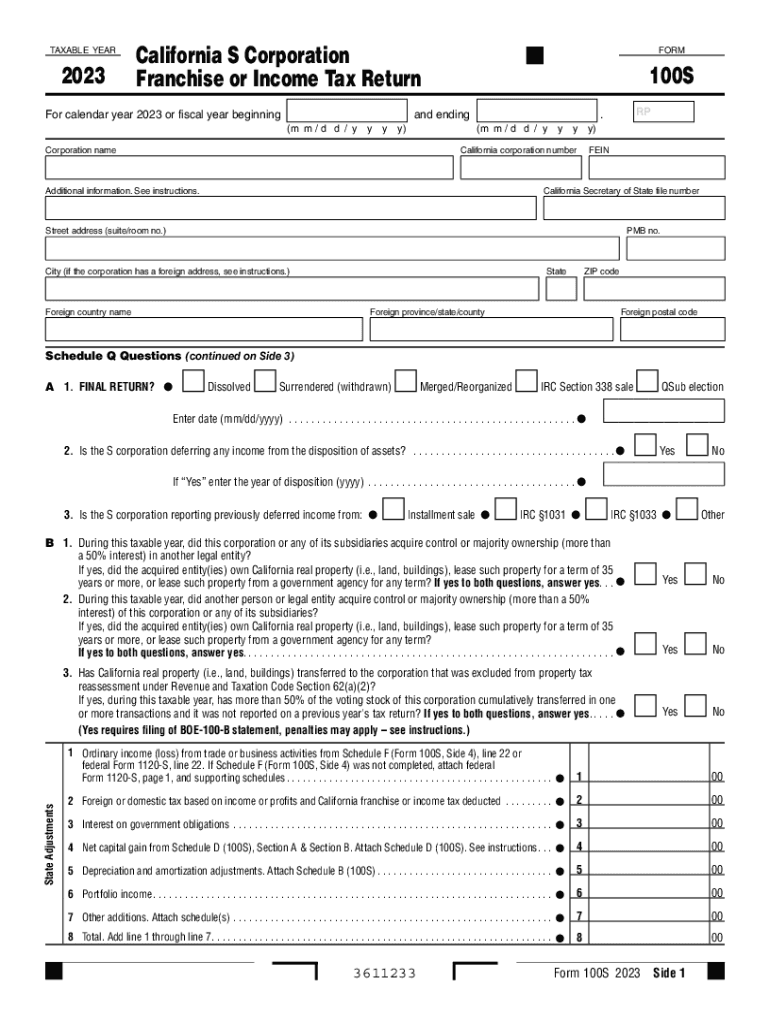

The Form 100S is a tax form used by S corporations in California to report their income, deductions, and other relevant financial information. This form is specifically designed for S corporations that have elected to be taxed as pass-through entities, meaning that the income is passed through to shareholders and taxed at the individual level rather than at the corporate level. The California Franchise Tax Board (FTB) requires this form to assess the franchise tax owed by the corporation based on its net income.

How to use the Form 100S California S Corporation Franchise Or Income Tax

Using the Form 100S involves several steps that ensure accurate reporting of the corporation's financial activities. First, gather all necessary financial documents, including income statements, balance sheets, and any supporting schedules. Next, complete the form by entering the corporation's income, deductions, and credits as outlined in the instructions. It is essential to ensure that all information is accurate to avoid penalties. Once completed, the form must be submitted to the California Franchise Tax Board by the specified deadline.

Steps to complete the Form 100S California S Corporation Franchise Or Income Tax

To complete the Form 100S, follow these steps:

- Gather all financial records, including income and expense reports.

- Fill out the basic information section, including the corporation's name and identification number.

- Report total income on the designated lines, ensuring to include all sources of revenue.

- Deduct any allowable expenses, such as operating costs and salaries.

- Calculate the net income or loss, which will determine the tax liability.

- Complete any additional schedules required for specific deductions or credits.

- Review the entire form for accuracy before submission.

Legal use of the Form 100S California S Corporation Franchise Or Income Tax

The Form 100S must be used in compliance with California tax law. It is legally required for all S corporations operating in the state to file this form annually, even if there is no tax owed. Failure to file can result in penalties and interest on any unpaid taxes. It is important for corporations to understand their obligations under state law and ensure timely and accurate filing to maintain good standing with the Franchise Tax Board.

Filing Deadlines / Important Dates

The filing deadline for the Form 100S is typically the 15th day of the third month after the close of the corporation's tax year. For corporations operating on a calendar year, this means the form is due on March 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. It is crucial for corporations to be aware of these dates to avoid late fees and penalties.

Required Documents

When preparing to file the Form 100S, several documents are necessary to ensure accurate reporting. These may include:

- Income statements detailing revenue and expenses.

- Balance sheets showing assets, liabilities, and equity.

- Supporting schedules for deductions and credits claimed.

- Prior year tax returns for reference.

Having these documents organized and ready will facilitate a smoother filing process.

Create this form in 5 minutes or less

Find and fill out the correct form 100s california s corporation franchise or income tax 729669752

Create this form in 5 minutes!

How to create an eSignature for the form 100s california s corporation franchise or income tax 729669752

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of form 100s in California?

Form 100s in California is used by corporations to report their income and calculate their state taxes. This form is essential for ensuring compliance with California tax laws. By accurately completing form 100s, businesses can avoid penalties and ensure they are paying the correct amount of taxes.

-

How can airSlate SignNow help with form 100s California?

airSlate SignNow simplifies the process of completing and submitting form 100s California by providing an easy-to-use platform for eSigning and document management. With our solution, businesses can streamline their tax filing process, ensuring that all necessary documents are signed and submitted on time. This efficiency can save time and reduce stress during tax season.

-

What features does airSlate SignNow offer for managing form 100s California?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for form 100s California. These tools help businesses manage their tax documents efficiently and ensure that all signatures are collected promptly. Additionally, our platform allows for easy collaboration among team members.

-

Is airSlate SignNow cost-effective for handling form 100s California?

Yes, airSlate SignNow is a cost-effective solution for managing form 100s California. Our pricing plans are designed to fit various business sizes and budgets, allowing companies to choose the plan that best meets their needs. By reducing the time spent on paperwork, businesses can save money and improve their overall efficiency.

-

Can I integrate airSlate SignNow with other software for form 100s California?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easy to manage form 100s California alongside your existing tools. This seamless integration helps streamline your workflow and ensures that all your documents are in one place, enhancing productivity.

-

What are the benefits of using airSlate SignNow for form 100s California?

Using airSlate SignNow for form 100s California provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for sensitive documents. Our platform allows for quick eSigning and easy access to all your tax documents, ensuring that you stay organized and compliant with California tax regulations.

-

How secure is airSlate SignNow when handling form 100s California?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your form 100s California and other sensitive documents. Our platform complies with industry standards to ensure that your data remains safe and confidential. You can trust us to handle your tax documents with the utmost care.

Get more for Form 100S California S Corporation Franchise Or Income Tax

- Trading licence application forms

- Nmu degree certificate online application 2022 form

- Sa332a 43738962 form

- How to fill itf scarf form

- Louisiana act of donation of immovable property form

- Gift card sign off sheet form

- Versatube engineering order form combustion llc

- Request for msha individual identification number miin msha form 5000 46

Find out other Form 100S California S Corporation Franchise Or Income Tax

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online