Use VoiceOver with Buttons, Checkboxes, and More on Mac 2021

Understanding the Illinois Schedule 1299-C

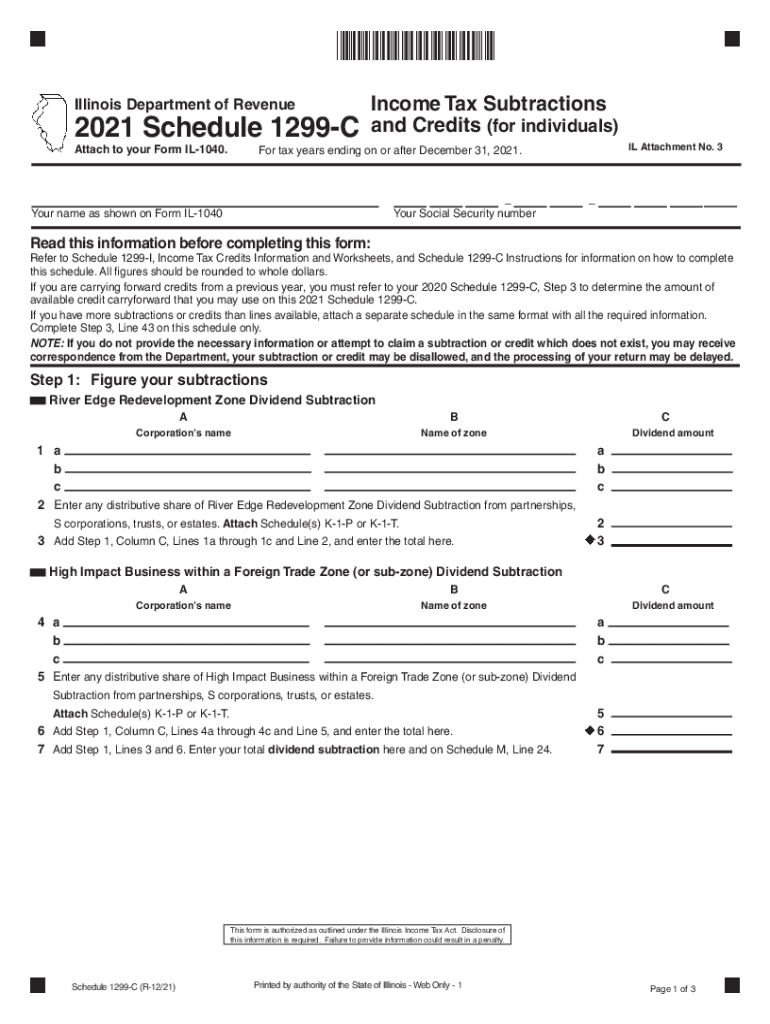

The Illinois Schedule 1299-C is a crucial form used for reporting certain tax credits and adjustments for individuals and businesses. This form is specifically designed for taxpayers who wish to claim credits such as the Earned Income Credit or the Property Tax Credit. It is essential to fill out this form accurately to ensure compliance with state tax regulations and to maximize potential tax benefits.

Filing Deadlines for the Illinois Schedule 1299-C

Timely submission of the Illinois Schedule 1299-C is vital to avoid penalties. The deadline for filing this form typically aligns with the individual income tax return deadline, which is usually April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should be aware of any changes in deadlines, especially during tax season, to ensure their submissions are timely.

Key Elements of the Illinois Schedule 1299-C

When completing the Illinois Schedule 1299-C, several key elements must be included:

- Taxpayer Information: Include your name, address, and Social Security number.

- Credit Information: Specify the type of credit being claimed, such as the Property Tax Credit or the Earned Income Credit.

- Income Details: Report your total income and any adjustments that may affect your eligibility for credits.

- Signature: Ensure that the form is signed and dated to validate its authenticity.

Submission Methods for the Illinois Schedule 1299-C

The Illinois Schedule 1299-C can be submitted through various methods to accommodate different taxpayer preferences:

- Online: Many taxpayers choose to file electronically through approved tax software, which often simplifies the process and ensures accuracy.

- Mail: You can also print the completed form and mail it to the appropriate address provided by the Illinois Department of Revenue.

- In-Person: Some taxpayers prefer to deliver their forms in person at local tax offices, where assistance may be available.

Eligibility Criteria for Claiming Credits on the Illinois Schedule 1299-C

To successfully claim credits on the Illinois Schedule 1299-C, taxpayers must meet specific eligibility criteria. Generally, these criteria include:

- Residency: You must be a resident of Illinois for the tax year in question.

- Income Limits: Your total income must fall within specified limits to qualify for certain credits.

- Filing Status: Your filing status may affect your eligibility for various credits, so it is important to review the requirements based on your situation.

Penalties for Non-Compliance with the Illinois Schedule 1299-C

Failure to comply with the requirements of the Illinois Schedule 1299-C can lead to significant penalties. These may include:

- Late Filing Penalties: If the form is not submitted by the deadline, penalties may apply.

- Interest Charges: Unpaid taxes or credits claimed incorrectly may accrue interest until resolved.

- Audit Risks: Inaccuracies or omissions may trigger an audit by the Illinois Department of Revenue, leading to further complications.

Quick guide on how to complete use voiceover with buttons checkboxes and more on mac

Effortlessly Prepare Use VoiceOver With Buttons, Checkboxes, And More On Mac on Any Device

Managing documents online has become popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly and without delays. Handle Use VoiceOver With Buttons, Checkboxes, And More On Mac on any platform with the airSlate SignNow apps for Android or iOS, and enhance any document-related process today.

Easily Modify and eSign Use VoiceOver With Buttons, Checkboxes, And More On Mac with Minimal Effort

- Find Use VoiceOver With Buttons, Checkboxes, And More On Mac and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information using tools specifically designed for this purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes only seconds and carries the same legal validity as a handwritten signature.

- Review all details, then click the Done button to save your modifications.

- Choose your preferred method of delivering your form: via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device of your choice. Alter and eSign Use VoiceOver With Buttons, Checkboxes, And More On Mac to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct use voiceover with buttons checkboxes and more on mac

Create this form in 5 minutes!

How to create an eSignature for the use voiceover with buttons checkboxes and more on mac

The way to make an electronic signature for a PDF online

The way to make an electronic signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

The way to generate an e-signature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the Illinois Schedule 1299 C used for?

The Illinois Schedule 1299 C is used to report and claim tax credits for businesses in Illinois. It is essential for ensuring that you are taking advantage of available tax incentives, which can improve your overall financial health. By properly completing the Illinois Schedule 1299 C, you can maximize your eligible credits efficiently.

-

How can airSlate SignNow help with completing the Illinois Schedule 1299 C?

airSlate SignNow simplifies the process of completing the Illinois Schedule 1299 C by allowing users to eSign and send documents securely. You can easily upload, edit, and finalize your forms, ensuring accuracy before submission. This streamlines your workflow and reduces the chances of errors in your Illinois Schedule 1299 C.

-

Is there a cost associated with using airSlate SignNow for the Illinois Schedule 1299 C?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, making it a cost-effective solution for handling documents, including the Illinois Schedule 1299 C. The plans are designed to fit varying budgets, ensuring businesses can manage their document needs without overspending. You can explore our pricing options on our website for more details.

-

What features does airSlate SignNow offer for managing the Illinois Schedule 1299 C?

airSlate SignNow provides several features for managing the Illinois Schedule 1299 C, including templating, eSignature, and secured document storage. These tools help you prepare your forms accurately and share them with stakeholders effortlessly. With real-time tracking and notifications, you'll stay updated on the status of your documents.

-

Can I integrate airSlate SignNow with other software to assist with the Illinois Schedule 1299 C?

Absolutely! airSlate SignNow supports integrations with a range of business applications. This allows you to seamlessly connect with platforms you already use, enhancing your workflow while preparing your Illinois Schedule 1299 C and other essential documents.

-

What are the benefits of using airSlate SignNow for the Illinois Schedule 1299 C?

Using airSlate SignNow for the Illinois Schedule 1299 C enables businesses to streamline their document workflows and enhance collaboration. The platform’s user-friendly interface ensures that even those with limited tech skills can navigate it easily. Additionally, the secure eSigning feature protects sensitive information while allowing for rapid turnaround times.

-

Are there customer support options available for issues related to the Illinois Schedule 1299 C?

Yes, airSlate SignNow offers robust customer support to assist you with any issues related to the Illinois Schedule 1299 C. Our dedicated support team is available through multiple channels, ensuring you have access to help when you need it most. This commitment to support helps ensure your process is smooth and efficient.

Get more for Use VoiceOver With Buttons, Checkboxes, And More On Mac

- Illinois husband wife 497306089 form

- Illinois 60 day notice 497306090 form

- Illinois lien 497306092 form

- Quitclaim deed by two individuals to llc illinois form

- Warranty deed from two individuals to llc illinois form

- General contractors lien notice of lien mechanic liens corporation or llc illinois form

- Il labor form

- Quitclaim deed by two individuals to corporation illinois form

Find out other Use VoiceOver With Buttons, Checkboxes, And More On Mac

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter