How to Control Your Mouse Using a Keyboard on Windows 10 How to Move Your Mouse Cursor Without a MouseUse Mouse Keys to Move the 2020

IRS Guidelines for the 1299 Tax Form

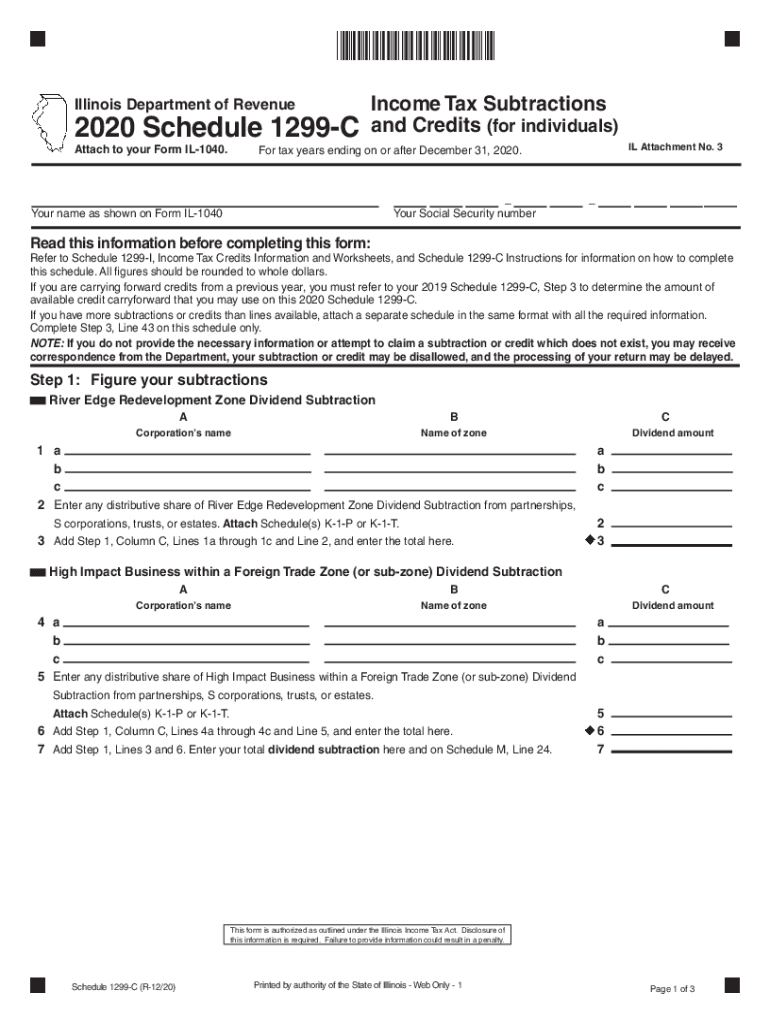

The 1299 tax form is essential for certain tax reporting requirements in the United States. It is crucial to understand the guidelines set forth by the Internal Revenue Service (IRS) regarding its use. This form is typically utilized by specific taxpayers, including those engaged in certain business activities. Familiarizing yourself with the IRS instructions can help ensure accurate completion and submission.

Filing Deadlines and Important Dates

Timely filing of the 1299 tax form is vital to avoid penalties. Generally, the deadline for submitting this form aligns with the annual tax return due date, which is typically April fifteenth for most taxpayers. However, specific circumstances may alter this date, such as weekends or holidays. It is advisable to check the IRS website for any updates or changes to the filing schedule.

Required Documents for Submission

When preparing to complete the 1299 tax form, gather all necessary documentation to support your claims. This may include income statements, expense receipts, and any other relevant financial records. Ensuring you have all required documents on hand will facilitate a smoother filing process and help prevent delays or errors.

Form Submission Methods

The 1299 tax form can be submitted through various methods, including online filing, mailing, or in-person submission at designated IRS offices. Online filing is often the most efficient option, allowing for quicker processing and confirmation of receipt. If choosing to mail the form, ensure it is sent to the correct address to avoid delays.

Penalties for Non-Compliance

Failure to file the 1299 tax form by the deadline can result in significant penalties. The IRS may impose fines based on the amount of tax owed and the length of delay in filing. Understanding these potential penalties emphasizes the importance of timely and accurate submission of the form.

Eligibility Criteria for Using the 1299 Tax Form

Not all taxpayers are required to file the 1299 tax form. Eligibility typically depends on specific business activities or income levels. It is essential to review the eligibility criteria outlined by the IRS to determine if this form applies to your situation. Consulting with a tax professional can provide clarity on your obligations.

Taxpayer Scenarios Involving the 1299 Tax Form

Different taxpayer scenarios may necessitate the use of the 1299 tax form. For instance, self-employed individuals, small business owners, or those with unique income sources may need to file this form. Understanding your specific scenario can help ensure compliance with tax regulations and accurate reporting of your financial activities.

Quick guide on how to complete how to control your mouse using a keyboard on windows 10 how to move your mouse cursor without a mouseuse mouse keys to move

Effortlessly Prepare How To Control Your Mouse Using A Keyboard On Windows 10 How To Move Your Mouse Cursor Without A MouseUse Mouse Keys To Move The on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly without any holdups. Manage How To Control Your Mouse Using A Keyboard On Windows 10 How To Move Your Mouse Cursor Without A MouseUse Mouse Keys To Move The on any platform using the airSlate SignNow Android or iOS applications and streamline your document-related processes today.

How to Edit and Electronically Sign How To Control Your Mouse Using A Keyboard On Windows 10 How To Move Your Mouse Cursor Without A MouseUse Mouse Keys To Move The with Ease

- Locate How To Control Your Mouse Using A Keyboard On Windows 10 How To Move Your Mouse Cursor Without A MouseUse Mouse Keys To Move The and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or black out sensitive details using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign How To Control Your Mouse Using A Keyboard On Windows 10 How To Move Your Mouse Cursor Without A MouseUse Mouse Keys To Move The to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to control your mouse using a keyboard on windows 10 how to move your mouse cursor without a mouseuse mouse keys to move

Create this form in 5 minutes!

How to create an eSignature for the how to control your mouse using a keyboard on windows 10 how to move your mouse cursor without a mouseuse mouse keys to move

The best way to create an eSignature for your PDF file in the online mode

The best way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

The best way to make an eSignature for a PDF file on Android

People also ask

-

What is the 1299 tax form and how is it used?

The 1299 tax form is used to report specific tax information, and it can be essential for businesses aiming to ensure compliance. By utilizing airSlate SignNow, you can easily send, eSign, and manage your 1299 tax form documentation efficiently. This streamlines the process and helps you stay organized during tax season.

-

How can airSlate SignNow help with the 1299 tax form?

airSlate SignNow offers a seamless way to manage the 1299 tax form with its eSignature solutions. You can quickly prepare, send, and track documents, ensuring that all necessary signatures are obtained on time. This efficient handling of your 1299 tax form saves you time and helps prevent errors.

-

Is there a cost associated with using airSlate SignNow for the 1299 tax form?

Yes, airSlate SignNow offers several pricing plans to fit your needs. The pricing is designed to be cost-effective, especially for small to medium-sized businesses that need to manage documents like the 1299 tax form. You can choose a plan that provides the best value for your document management needs.

-

What features does airSlate SignNow offer for managing the 1299 tax form?

With airSlate SignNow, you get features like document templates, customizable fields, and automated workflows specifically for managing the 1299 tax form. These tools enable you to create a standardized process for document handling, thereby enhancing productivity. Additionally, eSigning capabilities ensure quick turnaround times.

-

Can I integrate airSlate SignNow with other applications for the 1299 tax form?

Absolutely! airSlate SignNow integrates with a variety of applications, allowing you to streamline your workflow for the 1299 tax form. You can integrate it with popular platforms like Google Drive, Salesforce, and more to enhance your documentation processes. This makes managing your 1299 tax form even more efficient.

-

What are the benefits of using airSlate SignNow for the 1299 tax form?

The main benefits of using airSlate SignNow for the 1299 tax form include reduced paper clutter, faster processing times, and improved accuracy. The eSignature technology ensures that you can get documents signed on the go, cutting down delays typically associated with manual signatures. This ultimately helps your business operate more smoothly.

-

Is it easy to get started with airSlate SignNow for the 1299 tax form?

Yes, getting started with airSlate SignNow for the 1299 tax form is quick and user-friendly. You can sign up for an account, and the intuitive interface guides you through preparing your documents. Within minutes, you'll be ready to send and manage your 1299 tax form seamlessly.

Get more for How To Control Your Mouse Using A Keyboard On Windows 10 How To Move Your Mouse Cursor Without A MouseUse Mouse Keys To Move The

- If you cannot check every box do not complete this form

- Washington subcontractor agreement template form

- Due diligence sample letter form

- Claim for line of duty act loda benefits form

- San antonio homeless strategic planhomelessness form

- Virginia alcohol safety action program form

- Printable va forms notary public

- 306 cedar road form

Find out other How To Control Your Mouse Using A Keyboard On Windows 10 How To Move Your Mouse Cursor Without A MouseUse Mouse Keys To Move The

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors