Schedule 1299 C Income Tax Subtractions and Credits for Individuals Schedule 1299 C Income Tax Subtractions and Credits for Indi 2022

Understanding the Illinois Schedule 1299 C

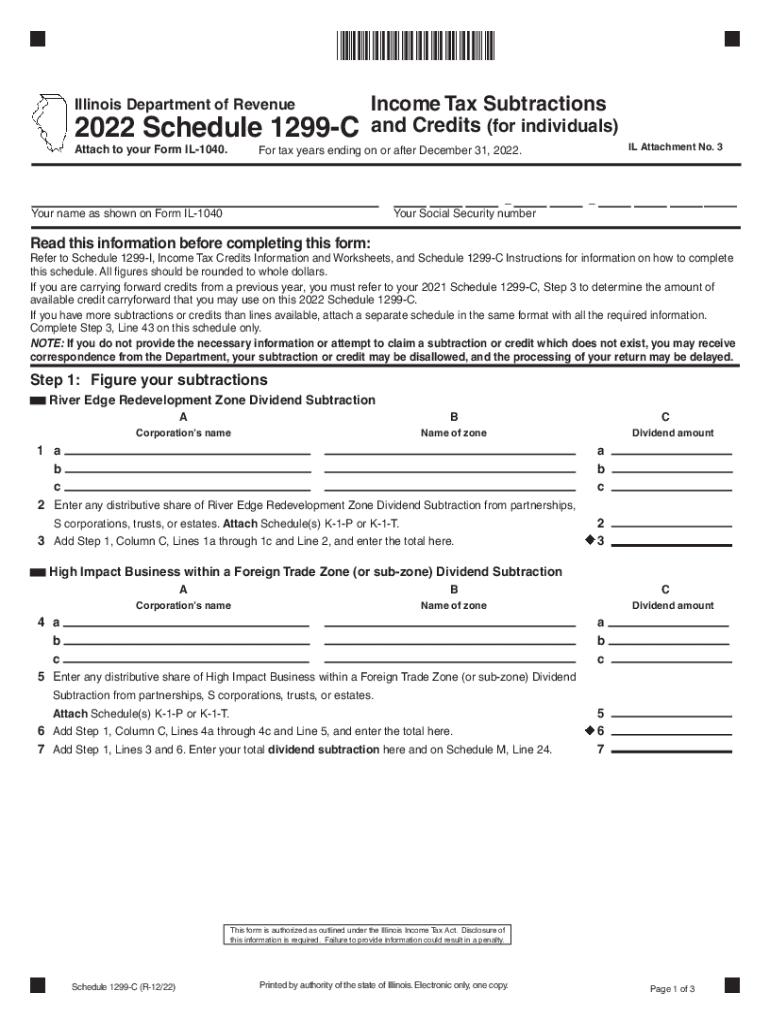

The Illinois Schedule 1299 C is a crucial form for individuals seeking to claim specific income tax subtractions and credits. This form allows taxpayers to report various deductions that can reduce their taxable income, ultimately leading to potential tax savings. It is essential for residents of Illinois to understand the purpose of this form and how it fits into their overall tax filing process.

Steps to Complete the Illinois Schedule 1299 C

Completing the Illinois Schedule 1299 C involves several key steps:

- Gather necessary documentation, including income statements and records of eligible expenses.

- Fill out personal information at the top of the form, including your name, address, and Social Security number.

- Identify the specific subtractions and credits you qualify for, referencing the guidelines provided by the Illinois Department of Revenue.

- Calculate the total amount of subtractions and credits, and enter this information in the appropriate sections of the form.

- Review your completed form for accuracy before submitting it with your Illinois income tax return.

Key Elements of the Illinois Schedule 1299 C

Several key elements are essential to understand when working with the Illinois Schedule 1299 C:

- Subtractions: These are specific amounts that can be deducted from your total income, reducing your taxable income.

- Credits: Tax credits directly reduce the amount of tax owed, providing a dollar-for-dollar reduction.

- Eligibility: Ensure you meet the eligibility criteria for each subtraction or credit claimed on the form.

Legal Use of the Illinois Schedule 1299 C

The Illinois Schedule 1299 C is legally binding when completed accurately and submitted according to state regulations. It is vital to ensure that all information provided is truthful and verifiable, as inaccuracies can lead to penalties or audits. Utilizing a reliable e-signature platform can enhance the legal standing of your submitted documents, ensuring compliance with electronic signature laws.

Obtaining the Illinois Schedule 1299 C

The Illinois Schedule 1299 C can be obtained through the Illinois Department of Revenue's website. It is available for download in PDF format, allowing taxpayers to print and fill it out manually. Additionally, many tax preparation software programs include the form, streamlining the process for users who prefer digital completion.

Filing Deadlines for the Illinois Schedule 1299 C

Filing deadlines for the Illinois Schedule 1299 C align with the general income tax return deadlines. Typically, individual taxpayers must submit their forms by April 15 of each year. However, it is essential to stay informed about any changes to deadlines, especially during tax season, to avoid penalties for late submission.

Quick guide on how to complete 2021 schedule 1299 c income tax subtractions and credits for individuals 2021 schedule 1299 c income tax subtractions and

Prepare Schedule 1299 C Income Tax Subtractions And Credits for Individuals Schedule 1299 C Income Tax Subtractions And Credits for Indi effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily find the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Schedule 1299 C Income Tax Subtractions And Credits for Individuals Schedule 1299 C Income Tax Subtractions And Credits for Indi on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to alter and eSign Schedule 1299 C Income Tax Subtractions And Credits for Individuals Schedule 1299 C Income Tax Subtractions And Credits for Indi with ease

- Find Schedule 1299 C Income Tax Subtractions And Credits for Individuals Schedule 1299 C Income Tax Subtractions And Credits for Indi and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Schedule 1299 C Income Tax Subtractions And Credits for Individuals Schedule 1299 C Income Tax Subtractions And Credits for Indi and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 schedule 1299 c income tax subtractions and credits for individuals 2021 schedule 1299 c income tax subtractions and

Create this form in 5 minutes!

How to create an eSignature for the 2021 schedule 1299 c income tax subtractions and credits for individuals 2021 schedule 1299 c income tax subtractions and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Schedule 1299 C?

The Illinois Schedule 1299 C is a supplemental form used for reporting specific tax credits and deductions for businesses in the state of Illinois. It allows organizations to claim various incentives while filing their tax returns, ultimately reducing their tax liability. By integrating the Illinois Schedule 1299 C into your business filings, you can maximize potential tax savings.

-

How can airSlate SignNow help me manage the Illinois Schedule 1299 C?

airSlate SignNow allows you to easily prepare, send, and eSign your Illinois Schedule 1299 C documents securely online. This streamlines your tax filing process and ensures that your documents are signed promptly, enhancing compliance and efficiency. Using airSlate SignNow helps ensure you meet deadlines related to filing the Illinois Schedule 1299 C.

-

Is there a cost associated with using airSlate SignNow for Illinois Schedule 1299 C?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs when managing documents like the Illinois Schedule 1299 C. The cost is competitive and often more affordable than traditional paper-based processes. You can choose a plan that best fits your budget while streamlining the eSigning of tax-related documents.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides several features that enhance document management for the Illinois Schedule 1299 C, including secure eSigning, templates for repetitive forms, customizable workflows, and real-time tracking of document status. These features make it easy to keep your Illinois Schedule 1299 C organized and accessible. Additionally, the platform is user-friendly, which simplifies the document preparation process.

-

Can airSlate SignNow integrate with other software I use for taxation?

Yes, airSlate SignNow can integrate with various accounting and tax software solutions, allowing you to streamline your workflow for managing the Illinois Schedule 1299 C. This integration helps eliminate data entry errors and ensures that your tax filings are accurate and timely. Check the airSlate SignNow integrations page to see a full list of compatible applications.

-

What benefits does electronic signing offer for tax documents like the Illinois Schedule 1299 C?

Electronic signing of tax documents, such as the Illinois Schedule 1299 C, offers numerous benefits, including faster turnaround times, improved compliance, and enhanced security. With airSlate SignNow, you can eSign documents from anywhere, reducing the time spent waiting for signatures. This efficiency is crucial during tax season when deadlines are tight.

-

How secure is my data when using airSlate SignNow for Illinois Schedule 1299 C?

airSlate SignNow prioritizes the security of your data when processing documents like the Illinois Schedule 1299 C. The platform employs advanced encryption protocols and follows strict data protection regulations to safeguard your information. You can confidently eSign and share sensitive tax documents knowing they are well-protected.

Get more for Schedule 1299 C Income Tax Subtractions And Credits for Individuals Schedule 1299 C Income Tax Subtractions And Credits for Indi

Find out other Schedule 1299 C Income Tax Subtractions And Credits for Individuals Schedule 1299 C Income Tax Subtractions And Credits for Indi

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter