Business Income Tax Forms & Instructions Colorado 2021

What is the Business Income Tax Forms & Instructions Colorado

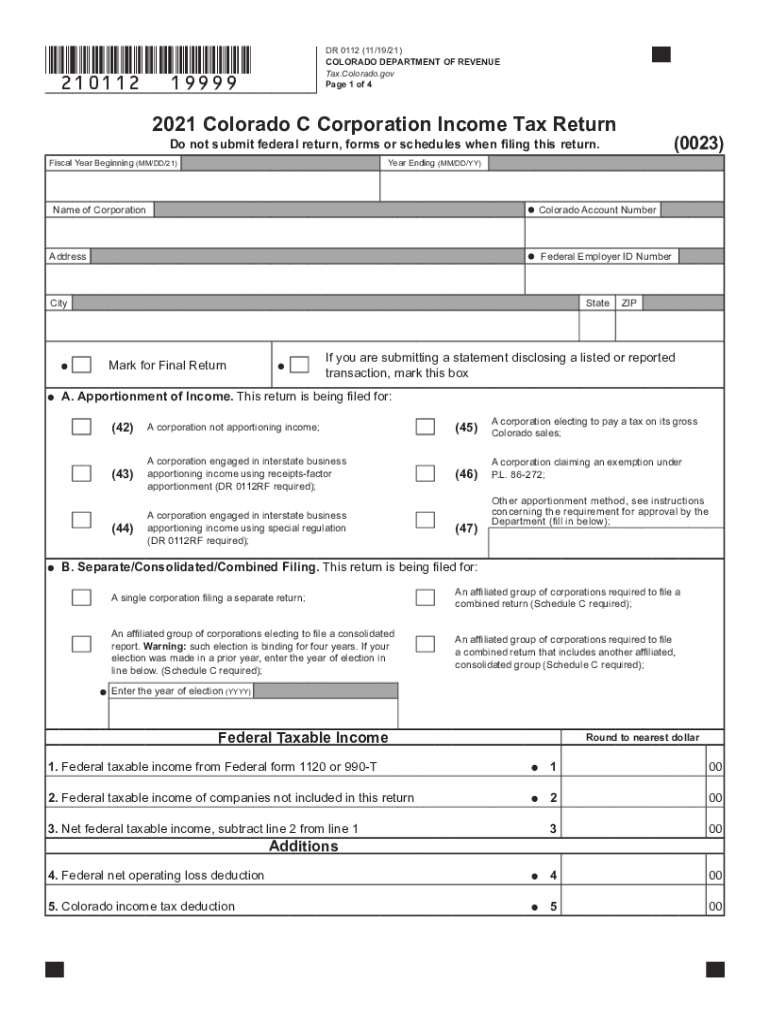

The Business Income Tax Forms & Instructions Colorado, specifically Form 112, is designed for businesses operating within the state. This form is crucial for reporting income and calculating tax liabilities for various business entities, including corporations and partnerships. It provides a structured way for businesses to comply with state tax regulations while ensuring transparency and accuracy in their financial reporting.

Steps to Complete the Business Income Tax Forms & Instructions Colorado

Completing the Business Income Tax Forms & Instructions Colorado involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Fill out the form accurately, ensuring all income and deductions are reported.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the designated filing deadline, either online or via mail.

Following these steps can help ensure that your submission is complete and compliant with state requirements.

Legal Use of the Business Income Tax Forms & Instructions Colorado

The Business Income Tax Forms & Instructions Colorado are legally binding documents that must be completed in accordance with state tax laws. Accurate reporting is essential to avoid penalties and ensure compliance with the Colorado Department of Revenue regulations. The form must be signed by an authorized representative of the business, affirming that the information provided is true and correct.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Business Income Tax Forms & Instructions Colorado is essential for compliance. Typically, the deadline for submitting Form 112 aligns with the federal tax filing dates, which are generally April fifteenth for most businesses. However, businesses may qualify for extensions, and it is important to check for any specific state-related deadlines that may apply.

Required Documents

To complete the Business Income Tax Forms & Instructions Colorado, businesses must prepare several required documents, including:

- Income statements detailing all sources of revenue.

- Expense reports outlining all business-related costs.

- Previous year’s tax returns for reference.

- Any supporting documentation for deductions claimed.

Having these documents on hand will facilitate a smoother filing process.

Who Issues the Form

The Business Income Tax Forms & Instructions Colorado, including Form 112, are issued by the Colorado Department of Revenue. This state agency oversees tax collection and enforcement, providing guidance and resources to ensure businesses comply with state tax laws. It is advisable for businesses to refer to the Department's official resources for the most current information and updates regarding tax forms.

Quick guide on how to complete business income tax forms amp instructions colorado

Complete Business Income Tax Forms & Instructions Colorado effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to design, amend, and electronically sign your documents promptly without interruptions. Manage Business Income Tax Forms & Instructions Colorado on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Business Income Tax Forms & Instructions Colorado with ease

- Locate Business Income Tax Forms & Instructions Colorado and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or redact sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes moments and holds the same legal standing as a conventional handwritten signature.

- Verify all the details and click on the Done button to store your adjustments.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form hunting, or errors that necessitate printing fresh document copies. airSlate SignNow manages your document management needs in just a few clicks from any chosen device. Modify and eSign Business Income Tax Forms & Instructions Colorado and ensure stellar communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct business income tax forms amp instructions colorado

Create this form in 5 minutes!

How to create an eSignature for the business income tax forms amp instructions colorado

The way to make an electronic signature for your PDF document online

The way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to make an e-signature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The best way to make an e-signature for a PDF file on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to the number 112?

airSlate SignNow is an innovative eSignature solution that enables businesses to efficiently send and sign documents. The number 112 is often associated with emergency services, highlighting the urgency and importance of quick document processing. With airSlate SignNow, you can manage your signatures swiftly and securely, ensuring that your business operates without delays.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow starts at just a few dollars per month, making it an affordable option for businesses of all sizes. The cost varies based on the features you need, but it's designed to offer an excellent value, especially when considering solutions related to the number 112 where time-sensitive document handling is crucial.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a variety of features such as customizable templates, real-time notifications, and in-app document editing. These features help streamline your workflow, especially for urgent document needs associated with the number 112. With its user-friendly interface, you can manage all aspects of signing documents efficiently.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers integrations with popular applications like Google Drive, Dropbox, and Salesforce. This means if you're managing documents related to urgent situations denoted by the number 112, you can seamlessly connect your favorite tools to enhance efficiency and accessibility.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow can signNowly reduce the time it takes to get documents signed, which is especially beneficial for urgent requirements represented by the number 112. Additionally, you'll save costs on paper and mailing, and improve your overall workflow, making document handling smoother and faster.

-

Is airSlate SignNow secure for sending sensitive documents?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and GDPR compliance, to protect sensitive documents. This is particularly important when dealing with urgent matters like those identified by the number 112, where confidentiality and security are paramount.

-

How do I get started with airSlate SignNow?

Getting started with airSlate SignNow is easy; you can sign up for a free trial on their website. This allows you to explore the features that cater to your urgent document needs without any upfront commitment, ensuring a great experience with solutions related to the number 112.

Get more for Business Income Tax Forms & Instructions Colorado

- Missouri corporation 497313020 form

- Quitclaim deed from corporation to two individuals missouri form

- Warranty deed from corporation to two individuals missouri form

- Warranty deed from individual to a trust missouri form

- Missouri wife 497313024 form

- Warranty deed from husband to himself and wife missouri form

- Quitclaim deed from husband to himself and wife missouri form

- Quitclaim deed from husband and wife to husband and wife missouri form

Find out other Business Income Tax Forms & Instructions Colorado

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure