PDF PAYMENT PAYMENT Colorado Department of Revenue 2020

Understanding the 2018 112 Form

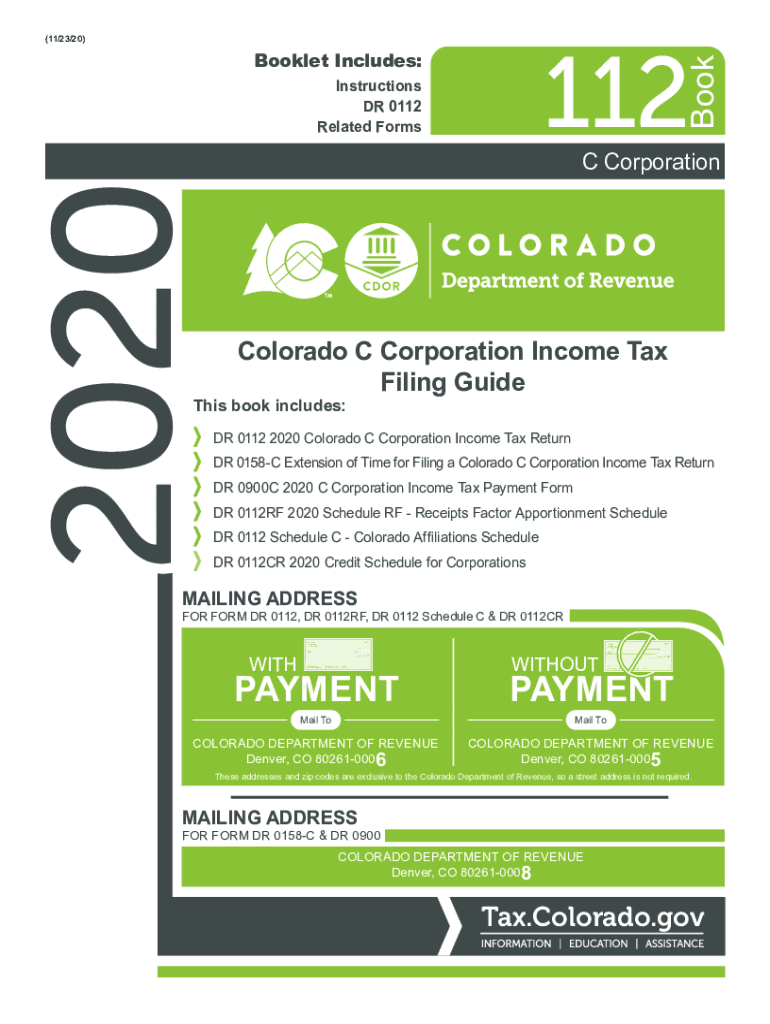

The 2018 112 form, also known as the Colorado C Corporation form 112, is a crucial document for corporations operating in Colorado. It is utilized to report income, gains, losses, deductions, and credits, ultimately determining the corporation's tax liability. This form is specifically designed for C corporations, which are taxed separately from their owners. Understanding the requirements and structure of this form is essential for compliance with Colorado tax laws.

Key Elements of the 2018 112 Form

The 2018 112 form consists of several key sections that need to be completed accurately. These include:

- Identification Information: This section requires basic details about the corporation, such as the name, address, and federal employer identification number (EIN).

- Income Reporting: Corporations must report all sources of income, including sales revenue and investment income.

- Deductions and Credits: This section allows corporations to claim various deductions and credits that can reduce their taxable income.

- Tax Calculation: Corporations must calculate their total tax liability based on the reported income and applicable tax rates.

Steps to Complete the 2018 112 Form

Filling out the 2018 112 form requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather necessary documents, including financial statements, previous tax returns, and any supporting documentation for deductions.

- Fill out the identification section with accurate corporate information.

- Report all income sources in the appropriate section, ensuring that all amounts are correctly calculated.

- Claim deductions and credits by providing the required details and supporting documentation.

- Calculate the total tax liability based on the reported income and deductions.

- Review the completed form for accuracy before submission.

Filing Deadlines and Important Dates

Corporations must adhere to specific deadlines when filing the 2018 112 form to avoid penalties. The filing deadline for the 2018 tax year is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For most corporations operating on a calendar year, this means the form is due by April 15 of the following year. It is advisable to check for any changes or extensions that may apply.

Form Submission Methods

The 2018 112 form can be submitted through various methods, including:

- Online Submission: Corporations can file electronically through the Colorado Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Colorado Department of Revenue.

- In-Person: Corporations may also choose to deliver the form in person at designated state offices.

Penalties for Non-Compliance

Failure to file the 2018 112 form on time or inaccuracies in reporting can result in penalties. These may include fines based on the amount of tax owed or additional interest on unpaid taxes. It is crucial for corporations to ensure timely and accurate filing to avoid these financial repercussions.

Quick guide on how to complete pdf payment payment colorado department of revenue

Complete PDF PAYMENT PAYMENT Colorado Department Of Revenue effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a seamless eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage PDF PAYMENT PAYMENT Colorado Department Of Revenue on any platform with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign PDF PAYMENT PAYMENT Colorado Department Of Revenue without hassle

- Locate PDF PAYMENT PAYMENT Colorado Department Of Revenue and click Get Form to begin.

- Use the resources we provide to fill out your form.

- Highlight important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or mismanaged files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign PDF PAYMENT PAYMENT Colorado Department Of Revenue and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf payment payment colorado department of revenue

Create this form in 5 minutes!

How to create an eSignature for the pdf payment payment colorado department of revenue

The way to make an electronic signature for your PDF document in the online mode

The way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

How to make an eSignature for a PDF file on Android devices

People also ask

-

What is the 2018 112 form and why is it important?

The 2018 112 form refers to the IRS form used for reporting income and loss for estates and trusts. It's important because it ensures compliance with IRS regulations and helps with accurate tax reporting for estates and trusts.

-

How can airSlate SignNow help with the 2018 112 form?

airSlate SignNow streamlines the process of preparing and signing the 2018 112 form by providing electronic signature capabilities. This means users can easily collect signatures from involved parties, reducing the time and effort needed for document management.

-

Is there a cost associated with using airSlate SignNow for the 2018 112 form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, starting with a free trial. Users can explore features essential for efficiently managing the 2018 112 form without a signNow upfront investment.

-

What features does airSlate SignNow offer for handling the 2018 112 form?

airSlate SignNow includes features such as document templates, drag-and-drop editing, and customized workflows specifically designed for handling the 2018 112 form. These features help simplify the preparation and signing process.

-

Can I integrate airSlate SignNow with other software for the 2018 112 form?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as CRM and accounting software. This integration enhances the workflow for managing the 2018 112 form by connecting all necessary tools in one platform.

-

What are the benefits of using airSlate SignNow for the 2018 112 form?

Using airSlate SignNow for the 2018 112 form provides signNow benefits, including faster processing times, legally binding eSignatures, and improved document tracking. These advantages help users stay organized and compliant.

-

Is airSlate SignNow secure for handling the 2018 112 form?

Yes, airSlate SignNow prioritizes security with advanced encryption and compliance with regulatory standards such as GDPR and HIPAA. Users can confidently manage sensitive information related to the 2018 112 form without compromising data security.

Get more for PDF PAYMENT PAYMENT Colorado Department Of Revenue

- Oxbridge academy courses 2022 online application form

- St 28apdffillercom form

- Wellness inventory pdf form

- Business license application city of sunnyvale form

- There their theyre form

- Nc doc visiting application online form

- Usaa payable on death form

- Notice of winding up for limited liability company form

Find out other PDF PAYMENT PAYMENT Colorado Department Of Revenue

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe