112 Form 2016

What is the 112 Form

The 112 Form is a tax document used by corporations to report their income, gains, losses, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for C corporations, as it provides a comprehensive overview of the corporation’s financial activities over the tax year. The information submitted on the 112 Form is used to calculate the corporation's tax liability, ensuring compliance with federal tax regulations.

How to use the 112 Form

To effectively use the 112 Form, corporations must gather all necessary financial information, including income statements, balance sheets, and details of deductions and credits. The form requires accurate reporting of various financial activities, and it must be completed in accordance with IRS guidelines. Once filled out, the form can be submitted electronically or by mail, depending on the corporation's preference and eligibility for e-filing.

Steps to complete the 112 Form

Completing the 112 Form involves several key steps:

- Gather financial documents, including income statements and balance sheets.

- Fill out the form accurately, ensuring all income, deductions, and credits are reported.

- Review the form for completeness and accuracy.

- Submit the form electronically or by mail to the IRS by the designated deadline.

Legal use of the 112 Form

The legal use of the 112 Form is critical for corporations to maintain compliance with federal tax laws. The form must be filed annually, and failure to do so can result in penalties and interest on unpaid taxes. It is important for corporations to ensure that all information reported is truthful and accurate, as discrepancies can lead to audits or legal consequences.

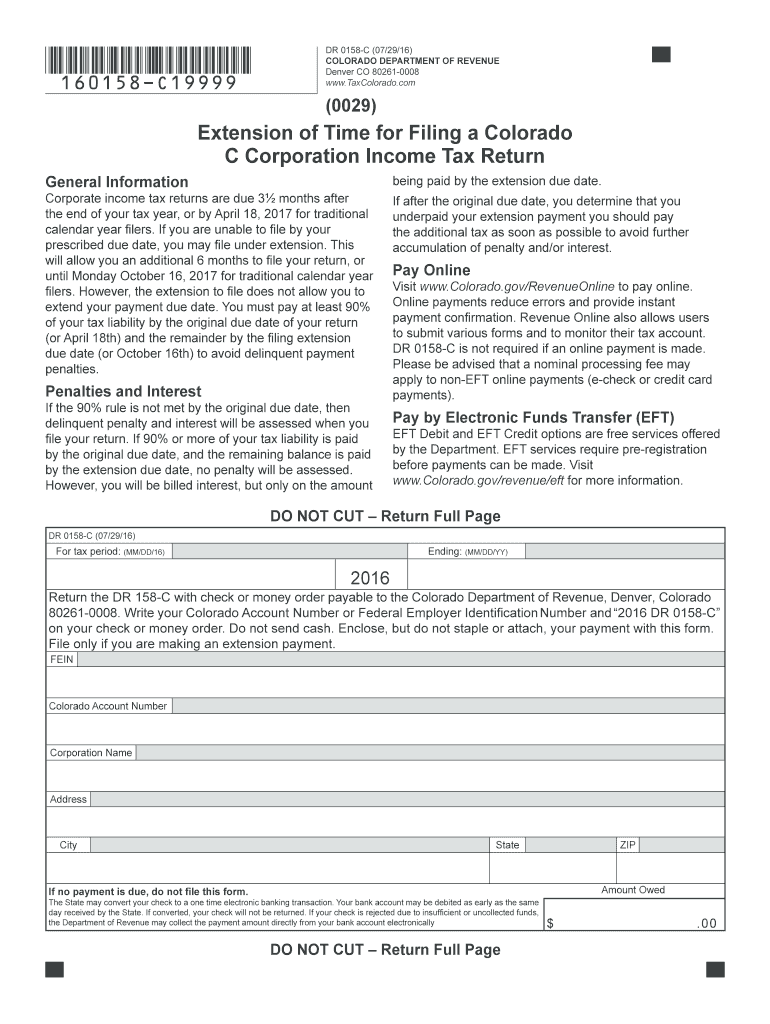

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines for the 112 Form to avoid penalties. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this typically falls on April 15. Extensions may be available, but they must be requested in advance.

Required Documents

To complete the 112 Form, corporations need to gather several required documents, including:

- Income statements detailing revenue and expenses.

- Balance sheets showing assets and liabilities.

- Records of any deductions and credits claimed.

- Previous year’s tax return for reference.

Form Submission Methods (Online / Mail / In-Person)

The 112 Form can be submitted through various methods. Corporations can file electronically using IRS-approved software, which is often the fastest and most efficient option. Alternatively, the form can be mailed to the appropriate IRS address based on the corporation's location. In-person submissions are generally not available for tax forms, emphasizing the importance of electronic or mail submissions.

Quick guide on how to complete 112 2016 form

Complete 112 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without interruptions. Handle 112 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

How to modify and electronically sign 112 Form with ease

- Find 112 Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign 112 Form to guarantee effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 112 2016 form

Create this form in 5 minutes!

How to create an eSignature for the 112 2016 form

How to make an eSignature for the 112 2016 Form in the online mode

How to make an electronic signature for your 112 2016 Form in Chrome

How to generate an eSignature for signing the 112 2016 Form in Gmail

How to make an eSignature for the 112 2016 Form straight from your smartphone

How to make an electronic signature for the 112 2016 Form on iOS devices

How to create an eSignature for the 112 2016 Form on Android devices

People also ask

-

What is a 112 Form and who needs it?

The 112 Form is a crucial tax document that businesses must file to report their annual income and financial activities. It is typically required for S corporations and certain partnerships. Understanding how to properly complete a 112 Form can ensure compliance with IRS regulations.

-

How can airSlate SignNow help with the 112 Form?

airSlate SignNow provides a seamless solution for electronically signing and managing your 112 Form documents. The platform simplifies the eSigning process, allowing you to gather necessary signatures quickly and securely, reducing the time spent on paperwork.

-

What are the pricing options for airSlate SignNow when using the 112 Form?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs, making it an economical choice for managing 112 Form submissions. You can opt for monthly or annual subscriptions, which include features that simplify document management and eSigning.

-

What features does airSlate SignNow offer for 112 Form management?

With airSlate SignNow, you gain access to robust features including customizable templates for the 112 Form, automatic reminders for signatures, and secure cloud storage. These features enhance the efficiency of your document handling and ensure that you stay organized.

-

Can airSlate SignNow integrate with other software for managing the 112 Form?

Yes, airSlate SignNow easily integrates with various accounting and financial software, which helps in managing your 112 Form alongside other financial documents. This integration streamlines your workflow and ensures that all your data is synchronized efficiently.

-

Is airSlate SignNow secure for handling sensitive 112 Form data?

Absolutely. airSlate SignNow prioritizes security by implementing advanced encryption protocols to protect your sensitive 112 Form data. Moreover, the platform complies with industry standards, ensuring that your information remains confidential and secure.

-

What are the benefits of using airSlate SignNow for the 112 Form?

Using airSlate SignNow for your 112 Form can signNowly reduce the time spent on document management while enhancing accuracy through its intuitive interface. The platform also allows for tracking the status of your forms in real-time, ensuring a smoother filing process.

Get more for 112 Form

Find out other 112 Form

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document