Colorado Dept of Revenue Fillable Form 112 2018

What is the Colorado Dept Of Revenue Fillable Form 112

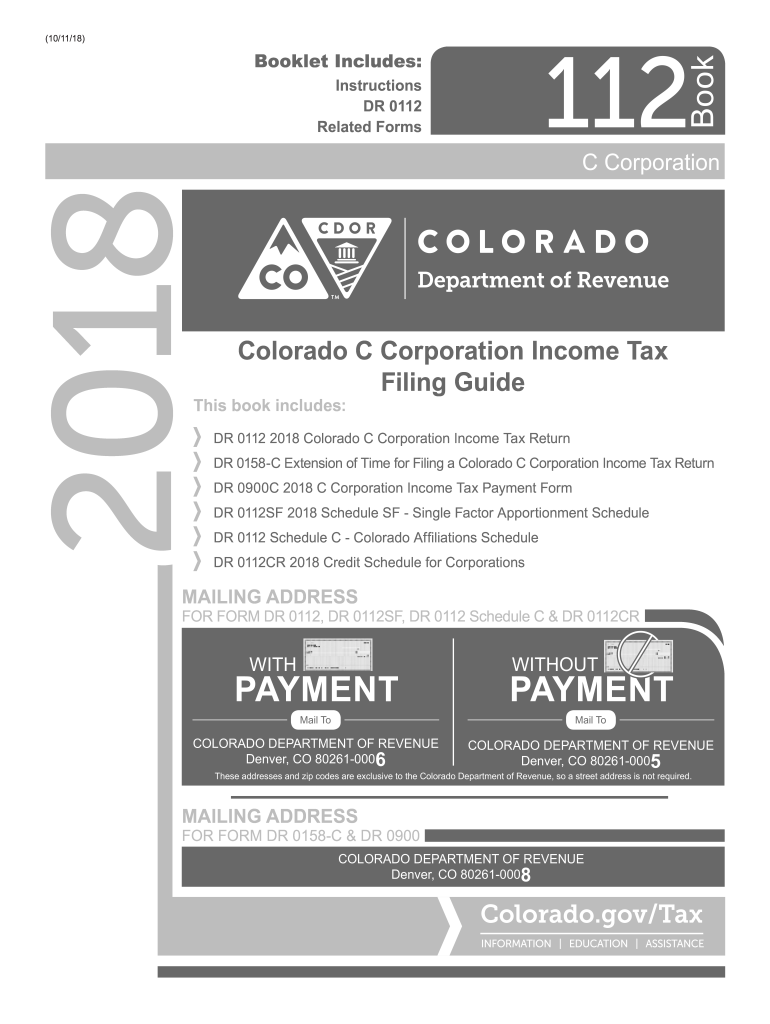

The Colorado Dept Of Revenue Fillable Form 112, also known as the 2018 112 form, is a tax document specifically designed for C corporations operating in Colorado. This form is used to report corporate income, calculate tax liability, and ensure compliance with state tax regulations. It is essential for corporations to accurately complete this form to avoid penalties and ensure proper tax reporting.

How to use the Colorado Dept Of Revenue Fillable Form 112

Using the Colorado Dept Of Revenue Fillable Form 112 involves several steps. First, gather all necessary financial information, including income statements and expense reports. Next, access the fillable form, which can be completed digitally. Input the required information in the designated fields, ensuring accuracy in all entries. After completing the form, review it for any errors before submission. This process helps maintain compliance with Colorado tax laws.

Steps to complete the Colorado Dept Of Revenue Fillable Form 112

Completing the Colorado Dept Of Revenue Fillable Form 112 requires careful attention to detail. Follow these steps:

- Download the fillable form from the Colorado Department of Revenue website.

- Enter your corporation's identification information, including name and address.

- Report total income and allowable deductions accurately in the specified sections.

- Calculate the total tax liability based on the instructions provided on the form.

- Sign and date the form to certify its accuracy.

Legal use of the Colorado Dept Of Revenue Fillable Form 112

The legal use of the Colorado Dept Of Revenue Fillable Form 112 is governed by state tax regulations. To be legally valid, the form must be completed accurately and submitted by the designated deadline. Additionally, electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). This ensures that the form holds legal weight in tax matters.

Filing Deadlines / Important Dates

It is crucial for corporations to be aware of the filing deadlines associated with the Colorado Dept Of Revenue Fillable Form 112. Typically, the form must be filed by the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April fifteenth. Missing this deadline can result in penalties and interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The Colorado Dept Of Revenue Fillable Form 112 can be submitted through various methods. Corporations have the option to file electronically using the Colorado Department of Revenue's online portal, which offers a streamlined process. Alternatively, the completed form can be mailed to the appropriate address listed on the form. In-person submissions may also be accepted at designated state offices. Each method has its own advantages, so corporations should choose the one that best fits their needs.

Quick guide on how to complete 112 2018 2019 form

Complete Colorado Dept Of Revenue Fillable Form 112 effortlessly on any device

Online document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage Colorado Dept Of Revenue Fillable Form 112 on any device with airSlate SignNow Android or iOS applications and enhance any document-centered process today.

The simplest way to alter and eSign Colorado Dept Of Revenue Fillable Form 112 with ease

- Locate Colorado Dept Of Revenue Fillable Form 112 and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes a few seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about misplaced or lost files, tedious document searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Colorado Dept Of Revenue Fillable Form 112 and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 112 2018 2019 form

Create this form in 5 minutes!

How to create an eSignature for the 112 2018 2019 form

How to create an electronic signature for your 112 2018 2019 Form in the online mode

How to make an electronic signature for your 112 2018 2019 Form in Google Chrome

How to generate an eSignature for signing the 112 2018 2019 Form in Gmail

How to make an eSignature for the 112 2018 2019 Form from your mobile device

How to generate an electronic signature for the 112 2018 2019 Form on iOS

How to make an electronic signature for the 112 2018 2019 Form on Android devices

People also ask

-

What is the Colorado Dept Of Revenue Fillable Form 112?

The Colorado Dept Of Revenue Fillable Form 112 is a tax return form specifically designed for corporations in Colorado to report their income. This form allows users to provide essential financial information to the state’s tax authorities. Utilizing the fillable version streamlines the filing process, ensuring accuracy and efficiency.

-

How can airSlate SignNow help with the Colorado Dept Of Revenue Fillable Form 112?

AirSlate SignNow simplifies the process of completing and submitting the Colorado Dept Of Revenue Fillable Form 112 by providing an easy-to-use eSignature solution. Users can fill out the form digitally, add signatures, and send it directly to the Department of Revenue, making the process faster and more efficient.

-

Is there a cost associated with using airSlate SignNow for the Colorado Dept Of Revenue Fillable Form 112?

Yes, there is a cost to using airSlate SignNow; however, it offers a cost-effective solution for managing your documents. Pricing plans are flexible to accommodate various business needs, allowing you to choose the best option for handling the Colorado Dept Of Revenue Fillable Form 112 and other documents.

-

What features does airSlate SignNow offer for the Colorado Dept Of Revenue Fillable Form 112?

AirSlate SignNow provides features such as customizable templates, secure eSignatures, and seamless document sharing for the Colorado Dept Of Revenue Fillable Form 112. Additionally, users benefit from real-time tracking and notifications to ensure timely submissions and compliance.

-

Can I integrate airSlate SignNow with other applications for the Colorado Dept Of Revenue Fillable Form 112?

Yes, airSlate SignNow offers integrations with various applications, enhancing your workflow for the Colorado Dept Of Revenue Fillable Form 112. You can connect with platforms like Google Drive, Dropbox, and CRM systems to streamline document management and filing processes.

-

How secure is the process of submitting the Colorado Dept Of Revenue Fillable Form 112 with airSlate SignNow?

AirSlate SignNow prioritizes security, employing advanced encryption and compliance protocols to protect your data when submitting the Colorado Dept Of Revenue Fillable Form 112. This ensures that your sensitive information remains confidential throughout the signing and submission process.

-

What benefits does airSlate SignNow provide for businesses using the Colorado Dept Of Revenue Fillable Form 112?

Using airSlate SignNow for the Colorado Dept Of Revenue Fillable Form 112 offers numerous benefits, including increased efficiency, reduced paperwork, and improved accuracy. Businesses can save time and resources by automating the document workflow and ensuring that forms are completed correctly without delays.

Get more for Colorado Dept Of Revenue Fillable Form 112

Find out other Colorado Dept Of Revenue Fillable Form 112

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now