Dr 0112 2024-2026

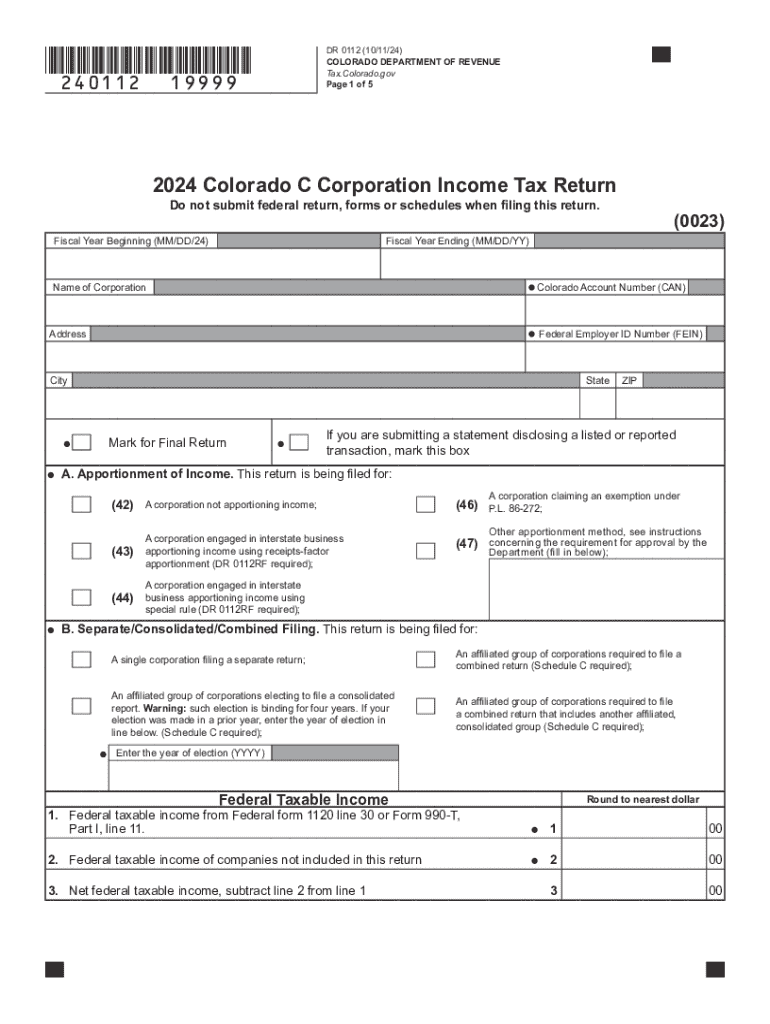

What is the Colorado Form 112?

The Colorado Form 112, also known as the DR 0112, is a tax form specifically designed for corporations operating within the state of Colorado. This form is used to report corporate income, calculate tax liability, and provide necessary financial information to the Colorado Department of Revenue. It is essential for businesses to accurately complete this form to ensure compliance with state tax regulations.

Steps to Complete the Colorado Form 112

Completing the Colorado Form 112 involves several key steps:

- Gather all financial documents, including income statements and balance sheets.

- Fill out the identification section with your business name, address, and federal employer identification number (EIN).

- Report total income, deductions, and any applicable credits in the designated sections.

- Calculate the total tax due based on the provided tax rates.

- Review the form for accuracy and completeness before submission.

How to Obtain the Colorado Form 112

The Colorado Form 112 can be obtained directly from the Colorado Department of Revenue's website. It is available for download in PDF format, allowing businesses to print and fill it out manually. Additionally, many tax preparation software programs include the Colorado Form 112, making it easier for businesses to complete their filings electronically.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines associated with the Colorado Form 112. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. Extensions may be available, but they must be requested in advance.

Required Documents

When completing the Colorado Form 112, businesses should have several documents ready, including:

- Income statements detailing revenue and expenses.

- Balance sheets summarizing assets, liabilities, and equity.

- Any relevant tax credits or deductions documentation.

Form Submission Methods

The Colorado Form 112 can be submitted through various methods. Businesses have the option to file the form electronically through approved tax software, which often streamlines the process and reduces errors. Alternatively, the form can be mailed to the Colorado Department of Revenue or submitted in person at designated offices. It is important to choose a submission method that aligns with your business's needs and capabilities.

Create this form in 5 minutes or less

Find and fill out the correct dr 0112

Create this form in 5 minutes!

How to create an eSignature for the dr 0112

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Colorado Form 112?

The Colorado Form 112 is a tax return form used by corporations to report their income and calculate their tax liability in Colorado. It is essential for businesses operating in the state to ensure compliance with local tax regulations. Using airSlate SignNow can streamline the process of completing and submitting the Colorado Form 112.

-

How can airSlate SignNow help with the Colorado Form 112?

airSlate SignNow provides an easy-to-use platform for businesses to electronically sign and send the Colorado Form 112. This not only saves time but also enhances accuracy by reducing the chances of errors in the documentation process. With airSlate SignNow, you can manage your tax forms efficiently and securely.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs, including options for small businesses and larger enterprises. Each plan provides access to features that simplify the completion of forms like the Colorado Form 112. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow when dealing with documents like the Colorado Form 112. These integrations allow you to connect with popular tools such as Google Drive, Dropbox, and CRM systems, making document management more efficient.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features including eSignature capabilities, document templates, and real-time tracking. These features are particularly beneficial when preparing the Colorado Form 112, as they ensure that all necessary signatures are collected promptly and that the document is submitted on time.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents like the Colorado Form 112. The platform employs advanced encryption and security protocols to protect your data, ensuring that your information remains confidential and secure.

-

Can I access airSlate SignNow on mobile devices?

Yes, airSlate SignNow is accessible on mobile devices, allowing you to manage and sign documents like the Colorado Form 112 on the go. This flexibility ensures that you can complete your tax forms anytime and anywhere, making it easier to stay on top of your business obligations.

Get more for Dr 0112

Find out other Dr 0112

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe