Income Tax FormsC CorporationsDepartment of Revenue Taxation 2022

Understanding Colorado Form 112

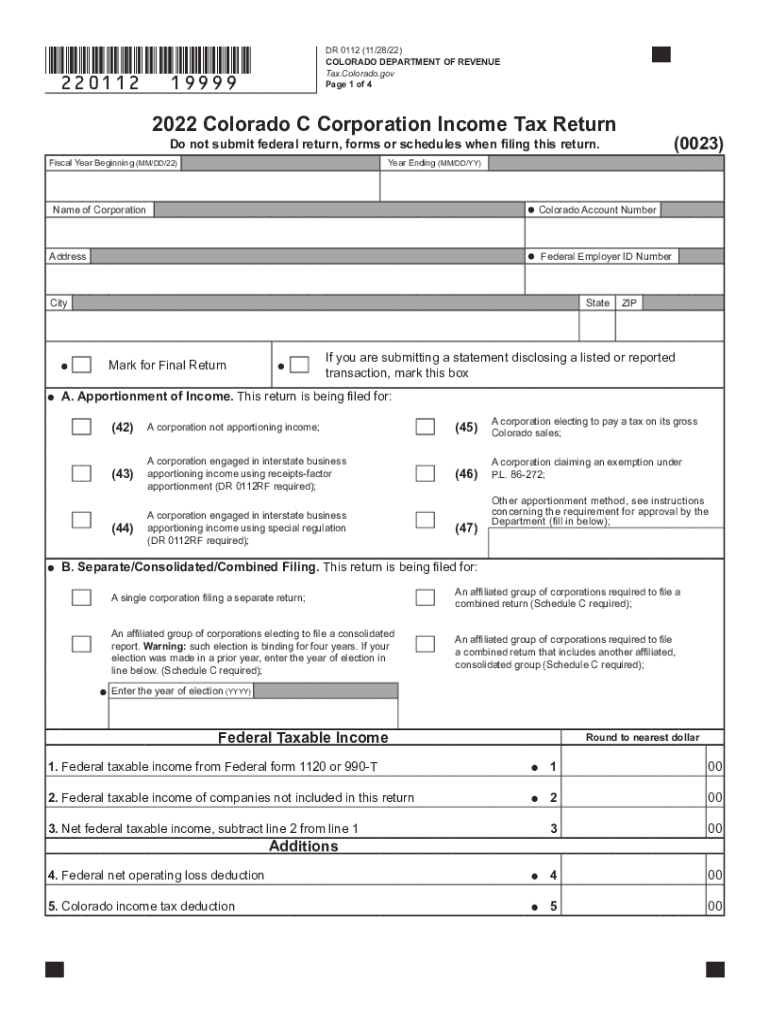

The Colorado Form 112 is a state income tax return specifically designed for C corporations. It is essential for corporations operating in Colorado to accurately report their income, deductions, and tax liabilities. The form includes various sections that require detailed financial information, ensuring compliance with state tax regulations. Understanding the nuances of this form is crucial for accurate filing and avoiding potential penalties.

Steps to Complete Colorado Form 112

Completing the Colorado Form 112 involves several key steps:

- Gather all necessary financial documents, including income statements, balance sheets, and expense reports.

- Fill out the identification section, providing the corporation's name, address, and federal employer identification number (EIN).

- Report total income and allowable deductions in the appropriate sections of the form.

- Calculate the corporation's taxable income and the corresponding tax liability based on Colorado's tax rates.

- Review the completed form for accuracy and ensure all required signatures are included.

Filing Deadlines for Colorado Form 112

Corporations must be aware of the filing deadlines for Colorado Form 112 to avoid late penalties. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year basis, this means the form is typically due by April 15. Extensions may be available, but it is essential to file any requests for extensions before the original due date.

Required Documents for Filing

To successfully file Colorado Form 112, corporations must prepare and submit several key documents:

- Federal Form 1120, which serves as the basis for the Colorado return.

- Financial statements, including income statements and balance sheets.

- Documentation supporting any deductions claimed, such as receipts and invoices.

- Any other relevant tax forms or schedules that pertain to specific deductions or credits.

Legal Use of Colorado Form 112

Colorado Form 112 is legally binding when completed accurately and submitted on time. The form must be signed by an authorized officer of the corporation, affirming the truthfulness of the information provided. Compliance with the Colorado Department of Revenue regulations ensures that the form is accepted and processed without issues. Failure to comply with filing requirements may result in penalties or legal repercussions.

Form Submission Methods

Corporations can submit Colorado Form 112 through various methods, ensuring flexibility in how they file:

- Online: Many corporations opt to file electronically through the Colorado Department of Revenue's online portal.

- By Mail: Corporations can print the completed form and send it via postal mail to the appropriate address provided by the state.

- In-Person: Some corporations may choose to file in person at a local Department of Revenue office, allowing for immediate confirmation of submission.

Quick guide on how to complete 2022 income tax formsc corporationsdepartment of revenue taxation

Effortlessly Prepare Income Tax FormsC CorporationsDepartment Of Revenue Taxation on Any Device

Digital document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed forms, as you can easily locate the necessary document and securely save it online. airSlate SignNow equips you with all the resources required to generate, edit, and eSign your files quickly without any hold-ups. Handle Income Tax FormsC CorporationsDepartment Of Revenue Taxation from any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

The Easiest Method to Edit and eSign Income Tax FormsC CorporationsDepartment Of Revenue Taxation Effortlessly

- Locate Income Tax FormsC CorporationsDepartment Of Revenue Taxation and then click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from your preferred device. Edit and eSign Income Tax FormsC CorporationsDepartment Of Revenue Taxation and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 income tax formsc corporationsdepartment of revenue taxation

Create this form in 5 minutes!

How to create an eSignature for the 2022 income tax formsc corporationsdepartment of revenue taxation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Colorado Form 112 instructions for 2019?

The Colorado Form 112 instructions for 2019 provide detailed guidelines on completing the state's corporate income tax return. These instructions cover everything from eligibility criteria to specific line items you need to fill out. Following these instructions ensures compliance with state tax laws and helps minimize errors.

-

How can airSlate SignNow assist with filing Colorado Form 112 for 2019?

airSlate SignNow simplifies the process of organizing and signing the necessary documents for filing Colorado Form 112 for 2019. Our platform allows users to upload forms, gather electronic signatures, and streamline collaboration, ensuring a quick and effective filing process. This can signNowly reduce the time spent on paperwork.

-

What are the pricing options for airSlate SignNow services related to Colorado Form 112?

airSlate SignNow offers flexible pricing options that cater to businesses of all sizes needing assistance with Colorado Form 112 for 2019. Our plans are designed to be cost-effective while providing full access to our electronic signature features and document management tools. Visit our pricing page to find a plan that suits your needs.

-

Is airSlate SignNow compliant with Colorado tax regulations?

Yes, airSlate SignNow is compliant with Colorado tax regulations and ensures that all electronic signatures and document management practices meet legal requirements. This compliance is crucial when handling sensitive documents, such as the Colorado Form 112 instructions for 2019. You can trust us to keep your documents secure and legally binding.

-

What unique features does airSlate SignNow offer for document signing?

airSlate SignNow provides a range of unique features that enhance the document signing experience, including customizable workflows and templates specifically for Colorado Form 112 instructions for 2019. Additionally, our platform supports real-time tracking and notifications, enabling users to stay informed at every step of the process. These features make managing corporate filings easier and more efficient.

-

Can airSlate SignNow integrate with accounting software for Colorado Form 112?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting software, making it easier to handle the financial data required for Colorado Form 112 instructions for 2019. This integration streamlines workflows, reducing the need for manual data entry and ensuring that all information is accurately captured. You can connect your existing tools effortlessly.

-

What benefits does using airSlate SignNow provide when completing Colorado Form 112?

Using airSlate SignNow for completing Colorado Form 112 offers numerous benefits, including increased efficiency, enhanced security, and ease of use. Our platform helps ensure that documents are signed quickly and are easily accessible. This means you can focus more on your business while maintaining compliance with Colorado tax laws.

Get more for Income Tax FormsC CorporationsDepartment Of Revenue Taxation

Find out other Income Tax FormsC CorporationsDepartment Of Revenue Taxation

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple