Form 104PN Part Year ResidentNonresident Tax Calculation Schedule 2021

What is the Form 104PN Part Year Resident/Nonresident Tax Calculation Schedule

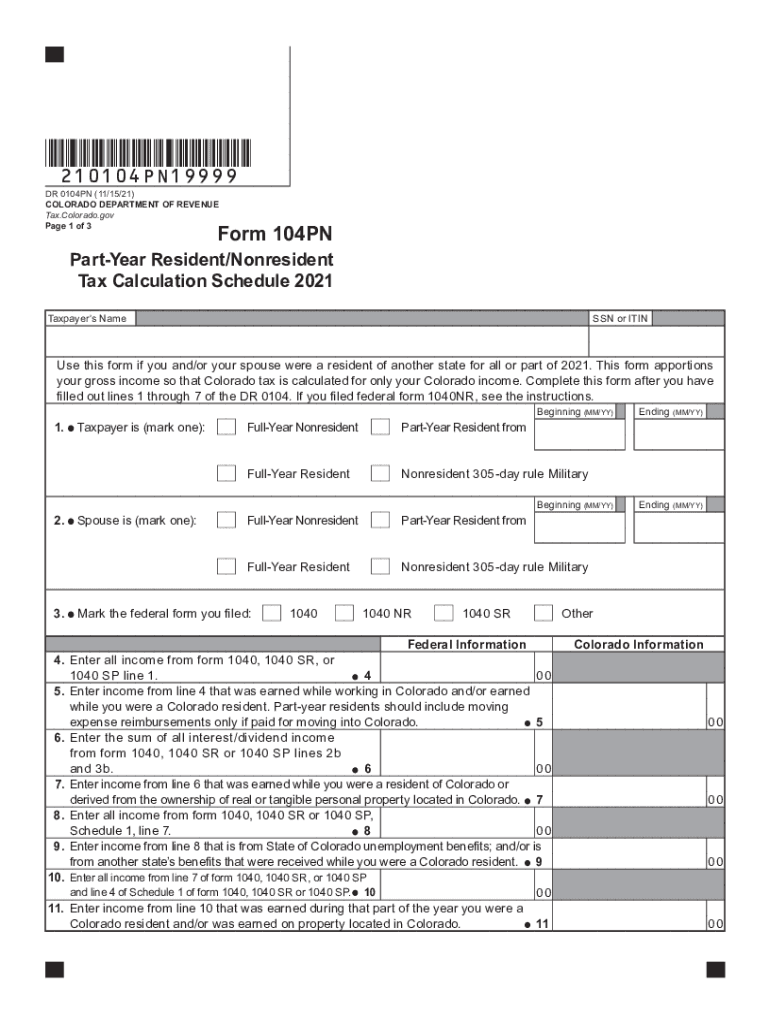

The Form 104PN is specifically designed for individuals who have lived in Colorado for only part of the year or for those who are nonresidents. This tax calculation schedule helps determine the appropriate tax obligations for individuals based on the time spent in the state and the income earned during that period. By accurately completing this form, taxpayers can ensure they are paying the correct amount of state taxes, avoiding potential penalties or overpayment.

Steps to complete the Form 104PN Part Year Resident/Nonresident Tax Calculation Schedule

Completing the Form 104PN involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, determine your residency status for the year and identify the income earned while residing in Colorado. Fill out the form by entering your total income, deductions, and credits applicable to your situation. Be sure to follow the specific instructions provided for each section of the form to ensure accuracy. Finally, review your completed form for any errors before submitting it to the appropriate state tax authority.

Legal use of the Form 104PN Part Year Resident/Nonresident Tax Calculation Schedule

The Form 104PN is legally recognized for tax purposes in Colorado, provided it is filled out correctly and submitted on time. To ensure its legal standing, taxpayers must adhere to the guidelines set forth by the Colorado Department of Revenue. This includes maintaining accurate records of residency and income, as well as complying with all filing deadlines. Utilizing a trusted eSignature platform can further enhance the legal validity of the submitted form, as it ensures secure signing and compliance with electronic signature laws.

Filing Deadlines / Important Dates

Timely filing of the Form 104PN is crucial to avoid penalties. Generally, the deadline for submitting the form coincides with the federal tax deadline, which is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that might apply to their specific situation, especially if they are awaiting documentation or clarification regarding their residency status.

Required Documents

To complete the Form 104PN accurately, several documents are essential. These include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any other income sources

- Documentation proving residency status in Colorado

- Any relevant deductions or credits that apply

Having these documents readily available will streamline the process and help ensure compliance with state tax regulations.

Examples of using the Form 104PN Part Year Resident/Nonresident Tax Calculation Schedule

Consider a scenario where an individual moves to Colorado in June and works part-time during their residency. They would need to report only the income earned from June to December on the Form 104PN. Conversely, a nonresident who earns income from a Colorado-based company while living in another state must also use this form to report that income accurately. Each example illustrates how the form is tailored to accommodate various residency situations, ensuring fair taxation based on actual income earned in the state.

Quick guide on how to complete form 104pn part year residentnonresident tax calculation schedule 2021

Prepare Form 104PN Part Year ResidentNonresident Tax Calculation Schedule seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious substitute for conventional printed and signed papers, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Form 104PN Part Year ResidentNonresident Tax Calculation Schedule on any device with airSlate SignNow Android or iOS applications and enhance any document-driven procedure today.

The easiest way to modify and eSign Form 104PN Part Year ResidentNonresident Tax Calculation Schedule effortlessly

- Locate Form 104PN Part Year ResidentNonresident Tax Calculation Schedule and click Obtain Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Complete button to save your amendments.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or mislaid files, tiresome form searches, or errors requiring new document copies to be printed. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 104PN Part Year ResidentNonresident Tax Calculation Schedule and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 104pn part year residentnonresident tax calculation schedule 2021

Create this form in 5 minutes!

How to create an eSignature for the form 104pn part year residentnonresident tax calculation schedule 2021

The way to make an electronic signature for your PDF document in the online mode

The way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an e-signature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

The best way to make an e-signature for a PDF file on Android devices

People also ask

-

What is DR 0104PN and how does it relate to airSlate SignNow?

DR 0104PN is a reference code for a specific service within airSlate SignNow that streamlines document signing and management. This feature allows businesses to efficiently handle their eSigning needs, ensuring a seamless experience for their clients.

-

What are the pricing options for using airSlate SignNow with DR 0104PN?

airSlate SignNow offers competitive pricing plans that include the DR 0104PN feature. These plans are designed to cater to the needs of businesses of all sizes, providing cost-effective solutions for efficient document management.

-

What features can I expect from the DR 0104PN functionality?

The DR 0104PN functionality in airSlate SignNow includes essential features like automated workflows, templates for repetitive documents, and advanced security protocols. These features enhance the eSigning process, making it user-friendly and efficient for businesses.

-

How can DR 0104PN benefit my business?

Implementing the DR 0104PN feature through airSlate SignNow can signNowly decrease the time spent on document management. By simplifying the eSigning process, businesses can increase productivity and improve customer satisfaction.

-

Does airSlate SignNow with DR 0104PN integrate with other tools?

Yes, airSlate SignNow with DR 0104PN seamlessly integrates with a variety of popular business tools, allowing for a unified workflow. This integration capability ensures that your team can work efficiently across platforms without disruptions.

-

Is there a free trial available for DR 0104PN?

airSlate SignNow typically offers a free trial period that includes access to features like DR 0104PN. This allows you to evaluate the platform and see how it can meet your eSigning needs before making a commitment.

-

How secure is the DR 0104PN feature in airSlate SignNow?

The DR 0104PN feature is built with robust security measures to protect your documents and sensitive information. airSlate SignNow employs encryption and compliance protocols to ensure the safety of all eSigned documents.

Get more for Form 104PN Part Year ResidentNonresident Tax Calculation Schedule

- Warranty deed from husband and wife to husband and wife missouri form

- Missouri postnuptial agreement form

- Missouri postnuptial form

- Amendment to postnuptial property agreement missouri missouri form

- Missouri declaratory judgment 497313032 form

- Mo certificate title form

- Quitclaim deed from husband and wife to an individual missouri form

- Warranty deed husband wife form

Find out other Form 104PN Part Year ResidentNonresident Tax Calculation Schedule

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself