DR 0104PN, Part Year ResidentNonresident Tax Calculation Schedule 2024-2026

Understanding the DR 0104PN Tax Calculation Schedule

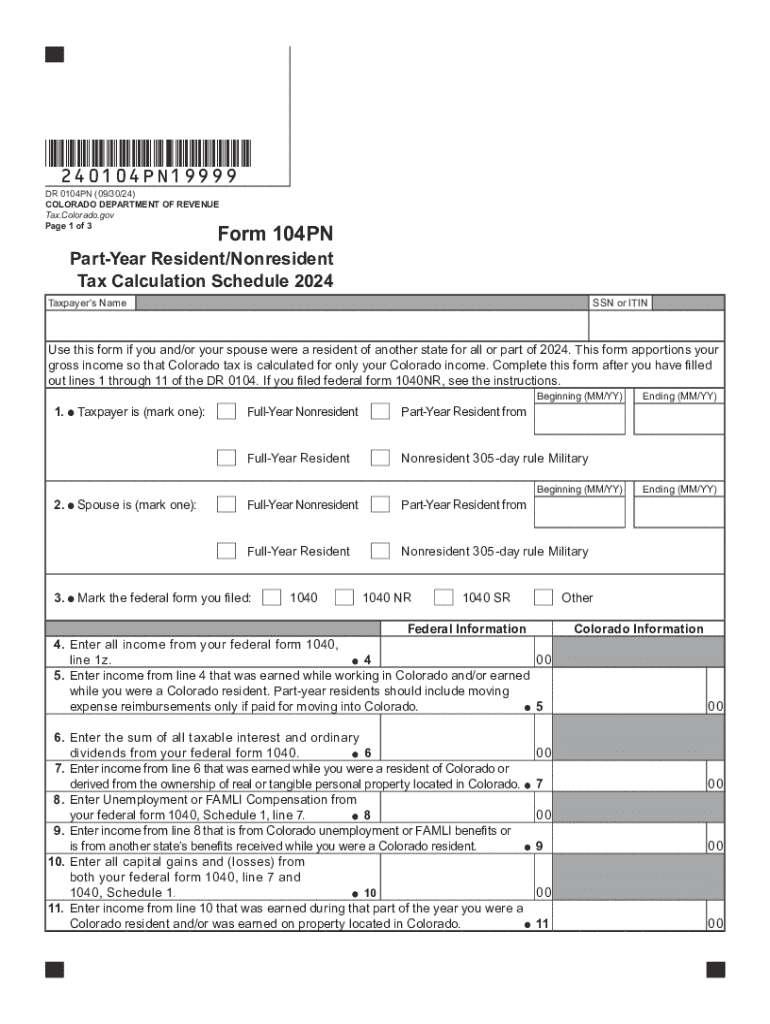

The DR 0104PN is a crucial component for Colorado taxpayers who are part-year residents or nonresidents. This schedule is specifically designed to assist in calculating the state income tax owed based on the income earned during the time spent in Colorado. It allows taxpayers to accurately report their income and determine their tax liability, ensuring compliance with state tax laws.

Steps to Complete the DR 0104PN Schedule

Completing the DR 0104PN involves several steps to ensure accurate reporting. First, gather all relevant income documents, including W-2s and 1099s. Next, identify the income earned while residing in Colorado and the total income for the year. The schedule will require you to fill in specific sections detailing your Colorado income, deductions, and credits. Finally, calculate the tax owed based on the provided instructions and ensure all figures are accurate before submission.

Key Elements of the DR 0104PN Schedule

The DR 0104PN includes several key elements that taxpayers must pay attention to. These include the calculation of total income, adjustments for deductions, and credits applicable to part-year residents and nonresidents. Additionally, the schedule outlines specific instructions for reporting income from various sources, ensuring that taxpayers can accurately reflect their financial situations on their Colorado state tax returns.

Eligibility Criteria for Using the DR 0104PN

To utilize the DR 0104PN, taxpayers must meet certain eligibility criteria. This schedule is specifically for those who have lived in Colorado for only part of the year or who have earned income from Colorado sources while residing in another state. It is essential to determine residency status accurately, as this will affect tax obligations and the appropriate forms to use.

Filing Deadlines for the DR 0104PN

Taxpayers must adhere to specific filing deadlines when submitting the DR 0104PN. Typically, Colorado state income tax returns are due on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be adjusted. It is crucial to stay informed about these dates to avoid penalties and ensure timely compliance with state tax regulations.

Form Submission Methods for the DR 0104PN

The DR 0104PN can be submitted through various methods, providing flexibility for taxpayers. Options include filing online through the Colorado Department of Revenue's e-filing system, mailing a paper form to the designated address, or submitting in person at local tax offices. Each method has its own processing times and requirements, so it is advisable to choose the one that best suits your needs.

Create this form in 5 minutes or less

Find and fill out the correct dr 0104pn part year residentnonresident tax calculation schedule 772030587

Create this form in 5 minutes!

How to create an eSignature for the dr 0104pn part year residentnonresident tax calculation schedule 772030587

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the colorado state income tax form 104?

The colorado state income tax form 104 is the official document used by residents of Colorado to report their income and calculate their state tax liability. It is essential for individuals and businesses to accurately complete this form to ensure compliance with state tax laws.

-

How can airSlate SignNow help with the colorado state income tax form 104?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the colorado state income tax form 104. This streamlines the process, making it faster and more efficient for users to manage their tax documents securely.

-

Is there a cost associated with using airSlate SignNow for the colorado state income tax form 104?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including options for individuals and businesses. The cost is competitive and provides a cost-effective solution for managing the colorado state income tax form 104 and other documents.

-

What features does airSlate SignNow offer for the colorado state income tax form 104?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage, all of which enhance the experience of managing the colorado state income tax form 104. These features ensure that users can complete their tax forms efficiently and securely.

-

Can I integrate airSlate SignNow with other software for the colorado state income tax form 104?

Yes, airSlate SignNow offers integrations with various software applications, allowing users to seamlessly manage their workflows related to the colorado state income tax form 104. This integration capability enhances productivity and ensures that all necessary documents are easily accessible.

-

What are the benefits of using airSlate SignNow for the colorado state income tax form 104?

Using airSlate SignNow for the colorado state income tax form 104 provides numerous benefits, including time savings, increased accuracy, and enhanced security. The platform simplifies the signing process and helps users avoid common pitfalls associated with paper forms.

-

Is airSlate SignNow compliant with Colorado state regulations for the colorado state income tax form 104?

Yes, airSlate SignNow is designed to comply with all relevant regulations, ensuring that users can confidently use the platform for the colorado state income tax form 104. This compliance helps protect users and their sensitive information during the tax filing process.

Get more for DR 0104PN, Part Year ResidentNonresident Tax Calculation Schedule

Find out other DR 0104PN, Part Year ResidentNonresident Tax Calculation Schedule

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free