DR 0104PN 2020

What is the DR 0104PN

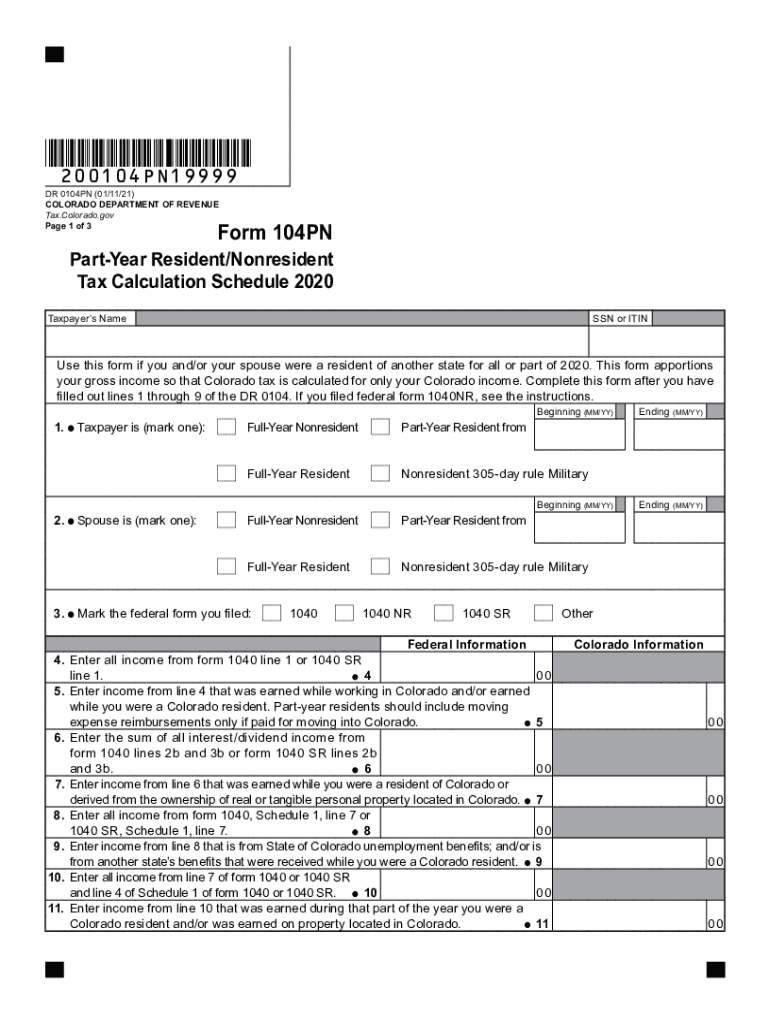

The DR 0104PN is a Colorado tax form specifically designed for non-residents and part-year residents who need to report their income earned in Colorado. This form allows individuals to calculate their state income tax liability based on the income they earned while residing or working in Colorado during the tax year. The DR 0104PN is essential for ensuring compliance with state tax laws and accurately reporting income to the Colorado Department of Revenue.

How to use the DR 0104PN

Using the DR 0104PN involves several steps to ensure accurate completion. First, gather all necessary documentation, including W-2 forms, 1099s, and any other income statements. Next, follow the instructions provided on the form to report your income, deductions, and credits. It is crucial to calculate your taxable income correctly to determine your tax liability. After completing the form, review it for accuracy before submission to avoid delays or penalties.

Steps to complete the DR 0104PN

Completing the DR 0104PN involves a systematic approach:

- Gather all relevant income documents, such as W-2s and 1099s.

- Fill out your personal information, including your name, address, and Social Security number.

- Report your total income earned in Colorado, ensuring to include all applicable sources.

- Calculate any deductions or credits you may qualify for, which can reduce your taxable income.

- Determine your total tax liability based on the income reported.

- Sign and date the form, certifying that the information provided is accurate.

Legal use of the DR 0104PN

The DR 0104PN is legally binding when completed and submitted according to Colorado state tax laws. To ensure its legal validity, it must be signed by the taxpayer, and all information provided must be truthful and accurate. The form is subject to review by the Colorado Department of Revenue, which may audit submissions to verify compliance. Filing the form electronically or via mail is acceptable, provided it meets all state requirements.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the DR 0104PN to avoid penalties. Typically, the deadline for submitting the form aligns with the federal tax deadline, which is usually April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply and ensure timely submission to the Colorado Department of Revenue.

Required Documents

To accurately complete the DR 0104PN, certain documents are required:

- W-2 forms from employers for income earned in Colorado.

- 1099 forms for any freelance or contract work performed in the state.

- Documentation of any deductions or credits claimed, such as receipts or statements.

- Personal identification information, including Social Security number and address.

Form Submission Methods (Online / Mail / In-Person)

The DR 0104PN can be submitted through various methods to accommodate taxpayers' preferences. Options include:

- Online submission through the Colorado Department of Revenue's e-filing system.

- Mailing a printed copy of the completed form to the appropriate address provided by the Department of Revenue.

- In-person submission at designated tax offices, if preferred.

Quick guide on how to complete dr 0104pn 549414189

Complete DR 0104PN with ease on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, adjust, and eSign your documents promptly without delays. Manage DR 0104PN on any device using airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and eSign DR 0104PN effortlessly

- Locate DR 0104PN and click Get Form to initiate.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and eSign DR 0104PN while ensuring effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dr 0104pn 549414189

Create this form in 5 minutes!

How to create an eSignature for the dr 0104pn 549414189

How to generate an eSignature for your PDF document in the online mode

How to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF on Android devices

People also ask

-

What is the 2015 Colorado 104PN and why is it important?

The 2015 Colorado 104PN is a state income tax form used by certain residents to report their tax liabilities. It's essential for ensuring compliance and optimizing potential tax credits or deductions. Completing this form accurately can lead to potential tax savings for eligible individuals.

-

How can airSlate SignNow simplify the eSigning of the 2015 Colorado 104PN?

With airSlate SignNow, you can easily upload and eSign the 2015 Colorado 104PN documents online. The platform allows for seamless collaboration with tax professionals or clients, ensuring that all signatures are securely captured. This simplifies the overall process, saving you time and reducing paperwork.

-

Are there any costs associated with using airSlate SignNow for the 2015 Colorado 104PN?

airSlate SignNow offers various pricing plans that cater to different business needs. Whether you're an individual or a business, you can choose a plan that fits your budget while ensuring you have access to the features necessary for managing your 2015 Colorado 104PN. Check our website for the latest pricing details.

-

What features does airSlate SignNow provide for managing the 2015 Colorado 104PN?

airSlate SignNow includes features like document templates, real-time tracking, and secure cloud storage that are beneficial for the 2015 Colorado 104PN. These features help ensure that your tax documents are organized and accessible whenever you need them. You can also set reminders for deadlines to ensure timely submissions.

-

Can airSlate SignNow help me share the 2015 Colorado 104PN with my tax advisor?

Yes, airSlate SignNow facilitates easy sharing of the 2015 Colorado 104PN with your tax advisor or any relevant stakeholders. You can invite them to view or eSign the document securely, ensuring that everyone has access to the necessary files for accurate tax preparation. This collaboration feature enhances efficiency.

-

Is airSlate SignNow compliant with tax laws for the 2015 Colorado 104PN?

Yes, airSlate SignNow complies with legal standards and regulations necessary for handling the 2015 Colorado 104PN. Our platform uses secure encryption to protect your sensitive information and ensure that your eSigned documents are legally binding. This compliance adds peace of mind for users managing tax-related documents.

-

What integrations does airSlate SignNow offer to support the 2015 Colorado 104PN process?

airSlate SignNow integrates with various tools that can enhance the process of completing the 2015 Colorado 104PN. Integrations with cloud storage and accounting software streamline document management and ensure that your data is well-organized. This seamless integration process allows you to focus on what matters most—your taxes.

Get more for DR 0104PN

Find out other DR 0104PN

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online