Tax Colorado Govpart Year and NonresidentPart Year and NonresidentDepartment of Revenue Colorado 2022

Understanding the Colorado DR 0104PN Form

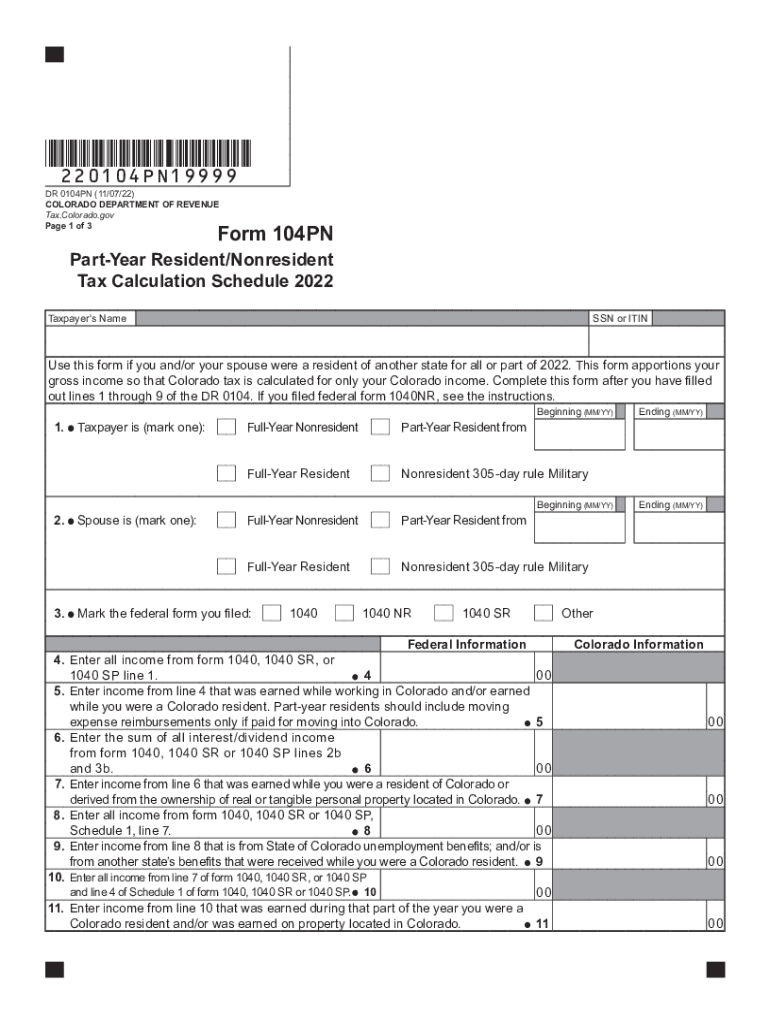

The Colorado DR 0104PN form is specifically designed for part-year and nonresident taxpayers in Colorado. This form allows individuals who have earned income in Colorado but do not reside in the state for the entire tax year to report their income accurately. It is crucial for ensuring compliance with Colorado tax laws and for determining the correct amount of state income tax owed.

Steps to Complete the Colorado DR 0104PN Form

Completing the DR 0104PN form involves several key steps:

- Gather all necessary documentation, including W-2 forms, 1099s, and any other income statements.

- Determine your residency status and the portion of the year you lived in Colorado.

- Calculate your total income earned during your time in Colorado.

- Fill out the form, ensuring to include all required information such as income, deductions, and credits.

- Review the completed form for accuracy before submission.

Legal Use of the Colorado DR 0104PN Form

The DR 0104PN form is legally binding when filled out correctly and submitted to the Colorado Department of Revenue. It is essential to ensure that all information is truthful and complete, as inaccuracies can lead to penalties or legal repercussions. The form must be signed and dated by the taxpayer, affirming that the information provided is accurate to the best of their knowledge.

Filing Deadlines for the Colorado DR 0104PN Form

Taxpayers must be aware of the filing deadlines associated with the DR 0104PN form. Typically, the form is due on the same date as the federal income tax return, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to deadlines each tax year.

Required Documents for the Colorado DR 0104PN Form

To complete the DR 0104PN form accurately, taxpayers should gather the following documents:

- W-2 forms from all employers during the tax year.

- 1099 forms for any additional income received.

- Records of any deductions or credits that may apply.

- Proof of residency status, if applicable.

Examples of Using the Colorado DR 0104PN Form

Consider a scenario where an individual worked in Colorado for six months but lived in another state for the remainder of the year. This individual would use the DR 0104PN form to report the income earned while in Colorado. Another example includes a nonresident who may have earned rental income from a property located in Colorado. In both cases, the DR 0104PN form is essential for accurately reporting income and fulfilling tax obligations.

Quick guide on how to complete taxcoloradogovpart year and nonresidentpart year and nonresidentdepartment of revenue colorado

Accomplish Tax colorado govpart year and nonresidentPart Year And NonresidentDepartment Of Revenue Colorado effortlessly on any gadget

Online document organization has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, as you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools you need to produce, modify, and eSign your documents swiftly without any hold-ups. Manage Tax colorado govpart year and nonresidentPart Year And NonresidentDepartment Of Revenue Colorado on any gadget with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Tax colorado govpart year and nonresidentPart Year And NonresidentDepartment Of Revenue Colorado without hassle

- Locate Tax colorado govpart year and nonresidentPart Year And NonresidentDepartment Of Revenue Colorado and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to finalize your changes.

- Choose your preferred method to send your form, be it email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or inaccuracies that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Tax colorado govpart year and nonresidentPart Year And NonresidentDepartment Of Revenue Colorado and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct taxcoloradogovpart year and nonresidentpart year and nonresidentdepartment of revenue colorado

Create this form in 5 minutes!

How to create an eSignature for the taxcoloradogovpart year and nonresidentpart year and nonresidentdepartment of revenue colorado

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dr 0104pn used for in airSlate SignNow?

The dr 0104pn is a specific form used within airSlate SignNow to streamline the electronic signature process for various documents. This template simplifies document management and is tailored to meet regulatory compliance, ensuring your eSignatures are legally binding. By utilizing dr 0104pn, businesses can enhance operational efficiency and reduce turnaround times.

-

How much does using dr 0104pn cost?

The cost to implement the dr 0104pn template in airSlate SignNow varies based on your subscription plan. Typically, users can expect affordable pricing that scales with their organizational needs. For detailed pricing information, it's best to consult our pricing page to find the plan that includes access to dr 0104pn.

-

What features does dr 0104pn include?

The dr 0104pn template in airSlate SignNow comes with several key features, including customizable fields, automated reminders, and straightforward eSigning capabilities. Additionally, it supports multiple document formats and ensures secure storage of your signed documents. These features streamline your workflow and enhance document management efficiency.

-

How can dr 0104pn improve my business operations?

Using dr 0104pn can signNowly improve business operations by reducing the time spent on paperwork. With features like automated workflow and eSigning, tasks that once took days can often be completed in minutes. This increase in efficiency allows employees to focus on more strategic tasks, ultimately boosting productivity.

-

Can dr 0104pn integrate with other software systems?

Yes, airSlate SignNow's dr 0104pn is designed to integrate seamlessly with various business software systems. This includes CRMs, document management systems, and more, allowing users to manage their paperwork in one centralized platform. Enhanced integration capabilities ensure that your business processes remain smooth and interconnected.

-

Is dr 0104pn legally compliant for eSignatures?

Absolutely! The dr 0104pn template adheres to all legal standards required for electronic signatures, ensuring compliance with regulations such as the ESIGN Act and UETA. By using dr 0104pn, businesses can be confident that their electronically signed documents are legally valid and enforceable.

-

What support does airSlate SignNow provide for dr 0104pn?

airSlate SignNow offers robust customer support for users of the dr 0104pn template. Whether you need assistance during setup or have questions about features, our expert team is available via chat, email, and phone. We also provide extensive resources, including tutorials and FAQs, to help you get the most out of dr 0104pn.

Get more for Tax colorado govpart year and nonresidentPart Year And NonresidentDepartment Of Revenue Colorado

- Letter landlord demand template form

- Texas letter demand form

- Tx criminal records form

- Texas criminal 497327490 form

- Letter landlord demand sample 497327491 form

- Deed trust security form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles texas form

- Letter from tenant to landlord about landlords failure to make repairs texas form

Find out other Tax colorado govpart year and nonresidentPart Year And NonresidentDepartment Of Revenue Colorado

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form