Withholding Tax Louisiana Department of Louisiana Gov 2020

Understanding the Louisiana Withholding Tax

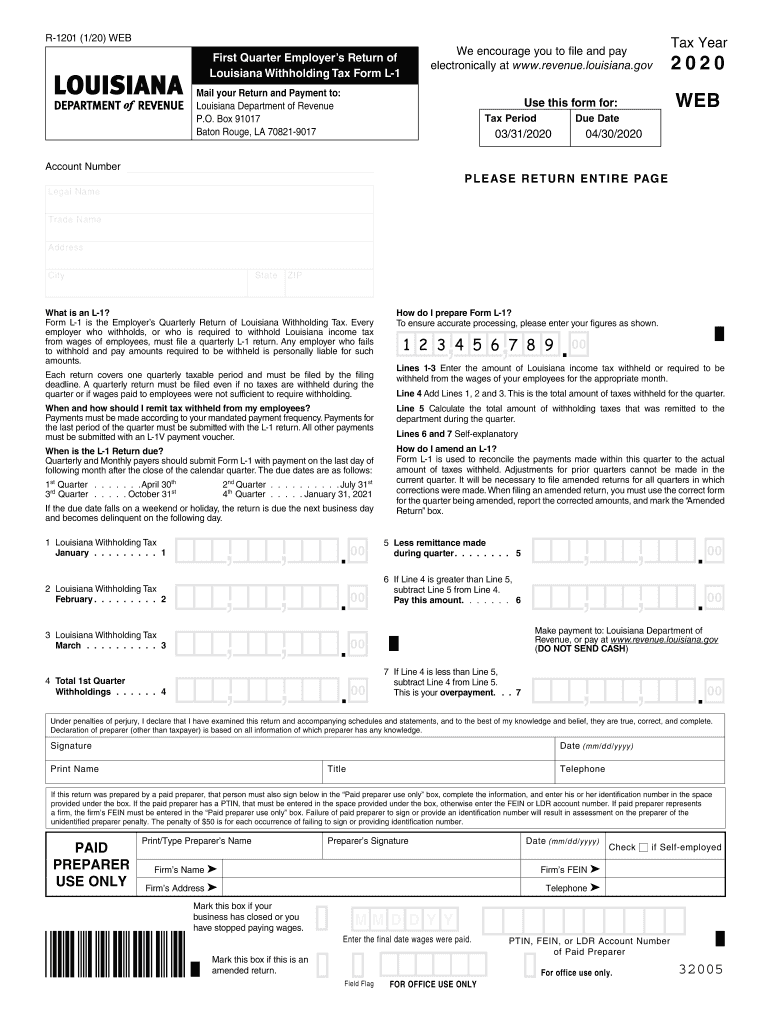

The Louisiana withholding tax is a tax that employers are required to deduct from employees' wages. This tax is remitted to the Louisiana Department of Revenue and is essential for funding state services. The Louisiana L-1 form is used to report this tax, specifically for the fourth quarter of 2018. Understanding the purpose and function of this tax is crucial for both employers and employees in maintaining compliance with state regulations.

Steps to Complete the Louisiana L-1 Form

Completing the Louisiana L-1 form for the fourth quarter involves several key steps:

- Gather all necessary payroll records for the quarter.

- Calculate the total wages paid to employees during this period.

- Determine the amount of withholding tax based on the applicable rates.

- Fill out the Louisiana L-1 form with accurate information, including employer details and total tax withheld.

- Review the form for accuracy before submission.

Filing Deadlines for the Louisiana L-1 Form

Timely filing of the Louisiana L-1 form is critical to avoid penalties. For the fourth quarter, the form must be submitted by January 31 of the following year. Employers should ensure they are aware of this deadline to maintain compliance and avoid unnecessary fines.

Required Documents for Filing

When filing the Louisiana L-1 form, employers should have the following documents ready:

- Payroll records for the fourth quarter.

- Employee tax withholding information.

- Any previous correspondence with the Louisiana Department of Revenue regarding withholding tax.

Penalties for Non-Compliance

Failure to file the Louisiana L-1 form on time or inaccuracies in reporting can result in penalties. The Louisiana Department of Revenue may impose fines, which can increase based on the duration of non-compliance. Employers should be diligent in their filing to avoid these consequences.

Digital vs. Paper Version of the Louisiana L-1 Form

Employers have the option to file the Louisiana L-1 form either digitally or via paper submission. Digital filing is often more efficient, providing immediate confirmation of submission and reducing the risk of lost documents. However, some employers may prefer traditional paper methods for record-keeping purposes. Understanding the benefits of each method can help employers choose the best option for their needs.

Quick guide on how to complete withholding tax louisiana department of louisianagov

Complete Withholding Tax Louisiana Department Of Louisiana gov seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to generate, modify, and electronically sign your documents rapidly without interruptions. Handle Withholding Tax Louisiana Department Of Louisiana gov on any device with the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign Withholding Tax Louisiana Department Of Louisiana gov effortlessly

- Find Withholding Tax Louisiana Department Of Louisiana gov and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or errors that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Withholding Tax Louisiana Department Of Louisiana gov and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct withholding tax louisiana department of louisianagov

Create this form in 5 minutes!

How to create an eSignature for the withholding tax louisiana department of louisianagov

The best way to make an electronic signature for a PDF in the online mode

The best way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

The best way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is louisiana l 1 2018 4th quarter, and how does it benefit my business?

Louisiana l 1 2018 4th quarter refers to specific data reporting requirements for businesses in Louisiana. By utilizing airSlate SignNow, you can easily eSign and send essential documents needed for these reports, enhancing compliance and operational efficiency.

-

How does airSlate SignNow help in preparing for the louisiana l 1 2018 4th quarter filing?

AirSlate SignNow streamlines the document preparation process for louisiana l 1 2018 4th quarter filings. You can create, sign, and manage your documents digitally, ensuring that all submissions are accurate and timely.

-

What features does airSlate SignNow offer to simplify the louisiana l 1 2018 4th quarter submission process?

Our platform includes features like eSigning, document templates, and real-time tracking, which all facilitate a smoother louisiana l 1 2018 4th quarter submission process. These tools save time and minimize errors, allowing you to focus on other critical business functions.

-

Is there a specific pricing plan for businesses focusing on louisiana l 1 2018 4th quarter reports?

AirSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you are managing the louisiana l 1 2018 4th quarter or other documentation processes, our cost-effective solution can be tailored to meet your needs.

-

Can airSlate SignNow integrate with my current accounting software for louisiana l 1 2018 4th quarter reporting?

Yes, airSlate SignNow integrates seamlessly with various accounting software. This feature is particularly beneficial for managing documents related to the louisiana l 1 2018 4th quarter, ensuring all your documentation remains synchronized for efficient reporting.

-

How does using airSlate SignNow improve collaboration during the louisiana l 1 2018 4th quarter preparation?

With airSlate SignNow's collaborative tools, team members can work together in real-time on documents needed for the louisiana l 1 2018 4th quarter. This enhances communication and speeds up the review and approval process, ultimately leading to timely submissions.

-

What resources are available for understanding the louisiana l 1 2018 4th quarter requirements?

AirSlate SignNow provides various resources, including guides and FAQs, to help you understand the louisiana l 1 2018 4th quarter requirements. Our support team is also available to assist with any questions you may have during the filing process.

Get more for Withholding Tax Louisiana Department Of Louisiana gov

- Waiver release liability 497427130 form

- Waiver and release from liability for minor child for bowling alley form

- Waiver and release from liability for adult for parasailing form

- Waiver and release from liability for minor child for parasailing form

- Liability adult 497427134 form

- Liability minor 497427135 form

- Waiver and release from liability for adult for curling facility form

- Waiver and release from liability for minor child for curling facility form

Find out other Withholding Tax Louisiana Department Of Louisiana gov

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple