WEB 2024-2026

What is the Louisiana Withholding Tax Form L-1?

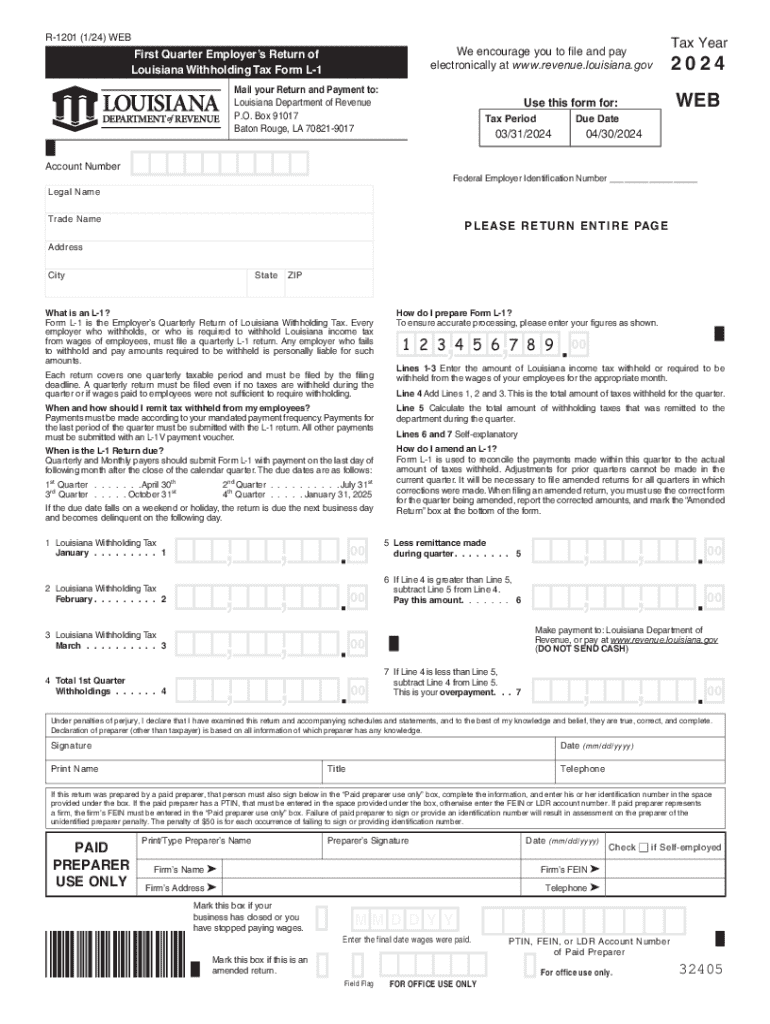

The Louisiana withholding tax form L-1 is a crucial document used by employers to report and remit state income tax withheld from employees' wages. This form is essential for compliance with Louisiana state tax regulations, ensuring that the correct amount of taxes is collected and submitted to the Louisiana Department of Revenue. The L-1 form is typically required for businesses operating in Louisiana and is part of the broader framework of state tax forms, including the Louisiana state tax form for 2024.

Steps to Complete the Louisiana Withholding Tax Form L-1

Completing the Louisiana withholding tax form L-1 involves several straightforward steps:

- Gather necessary information, including employer details and employee wage data.

- Fill in the total amount of wages paid to employees during the reporting period.

- Calculate the total withholding amount based on the applicable tax rates.

- Review the form for accuracy to avoid potential penalties.

- Submit the completed form by the designated filing deadline.

Filing Deadlines for the Louisiana Withholding Tax Form L-1

Employers must adhere to specific filing deadlines for the Louisiana withholding tax form L-1. Generally, the form is due on a monthly or quarterly basis, depending on the amount of tax withheld. It is crucial to check the Louisiana Department of Revenue's guidelines for the exact due dates to ensure timely submission and avoid penalties.

Required Documents for Filing the L-1 Form

When preparing to file the Louisiana withholding tax form L-1, employers should have the following documents ready:

- Payroll records detailing employee wages and withholdings.

- Previous L-1 forms for reference, if applicable.

- Any relevant tax rate tables provided by the Louisiana Department of Revenue.

Who Issues the Louisiana Withholding Tax Form L-1?

The Louisiana withholding tax form L-1 is issued by the Louisiana Department of Revenue. This state agency is responsible for overseeing tax collection and compliance, providing guidance and resources for employers to ensure accurate reporting of withheld taxes.

Penalties for Non-Compliance with the L-1 Form

Failure to file the Louisiana withholding tax form L-1 on time or inaccuracies in reporting can result in penalties. Employers may face fines, interest on unpaid taxes, and potential legal consequences. It is essential for businesses to understand these risks and prioritize compliance to avoid financial repercussions.

Create this form in 5 minutes or less

Find and fill out the correct web

Create this form in 5 minutes!

How to create an eSignature for the web

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the louisiana withholding tax form l 1?

The louisiana withholding tax form l 1 is a document used by employers in Louisiana to report and remit state income tax withheld from employee wages. This form is essential for compliance with state tax regulations and ensures that employees' taxes are accurately reported.

-

How can airSlate SignNow help with the louisiana withholding tax form l 1?

airSlate SignNow provides an efficient platform for businesses to electronically sign and send the louisiana withholding tax form l 1. This streamlines the process, reduces paperwork, and ensures that your forms are submitted on time, enhancing overall productivity.

-

Is there a cost associated with using airSlate SignNow for the louisiana withholding tax form l 1?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans provide access to features that simplify the completion and submission of the louisiana withholding tax form l 1, making it a cost-effective solution for businesses.

-

What features does airSlate SignNow offer for managing the louisiana withholding tax form l 1?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are beneficial for managing the louisiana withholding tax form l 1. These tools help ensure that your forms are completed accurately and efficiently.

-

Can I integrate airSlate SignNow with other software for the louisiana withholding tax form l 1?

Absolutely! airSlate SignNow offers integrations with various accounting and payroll software, making it easier to manage the louisiana withholding tax form l 1 alongside your other financial documents. This integration helps streamline your workflow and maintain accurate records.

-

What are the benefits of using airSlate SignNow for the louisiana withholding tax form l 1?

Using airSlate SignNow for the louisiana withholding tax form l 1 provides numerous benefits, including time savings, reduced errors, and enhanced security. The platform's user-friendly interface makes it easy for businesses to manage their tax forms efficiently.

-

How secure is airSlate SignNow when handling the louisiana withholding tax form l 1?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive information, including the louisiana withholding tax form l 1. You can trust that your documents are safe and secure throughout the signing process.

Get more for WEB

- Waves gizmo answer key form

- Confidential informant list for my city

- Direct deposit change request form

- Sol plaatje municipality application form

- Bi 1738 form 15812052

- Saha section 8 housing list form

- The reiv commercial lease code 143 pages form

- Bahamas tourist visa application bahamas visa visahq form

Find out other WEB

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast