Instructions for Form 1120 RIC Internal Revenue Service 2013

What is the Instructions For Form 1120 RIC Internal Revenue Service

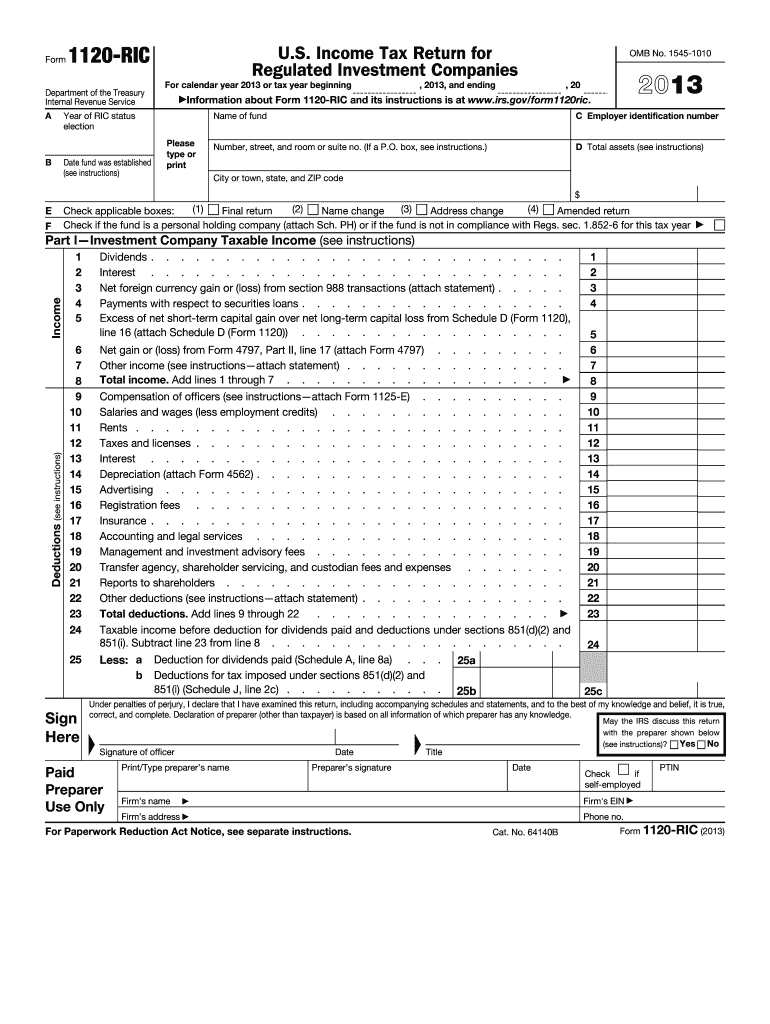

The Instructions For Form 1120 RIC are essential guidelines provided by the Internal Revenue Service (IRS) for regulated investment companies (RICs) to report their income, deductions, and tax liabilities. This form is specifically designed for entities that qualify as RICs under the Internal Revenue Code. Understanding these instructions is crucial for compliance with federal tax regulations, ensuring accurate reporting, and avoiding potential penalties.

Steps to complete the Instructions For Form 1120 RIC Internal Revenue Service

Completing the Instructions For Form 1120 RIC involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Review the eligibility criteria to confirm that your entity qualifies as a regulated investment company.

- Follow the detailed instructions provided for each section of the form, ensuring all required information is included.

- Attach any necessary schedules or supplementary forms as indicated in the instructions.

- Double-check all entries for accuracy before submission.

Legal use of the Instructions For Form 1120 RIC Internal Revenue Service

The legal use of the Instructions For Form 1120 RIC is vital for ensuring compliance with federal tax laws. RICs must adhere to specific regulations regarding income distribution and taxation. Using the most current version of the instructions ensures that all reporting is accurate and meets IRS standards. Failure to comply with these guidelines can result in legal penalties, including fines and loss of RIC status.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions For Form 1120 RIC are crucial for compliance. Generally, the form must be filed by the fifteenth day of the third month following the end of the tax year. For example, if the tax year ends on December 31, the form is due by March 15 of the following year. It is important to stay informed about any changes to these deadlines, as they can vary based on specific circumstances or IRS updates.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Instructions For Form 1120 RIC can be done through various methods:

- Online: If eligible, RICs can file electronically using IRS-approved software.

- Mail: Completed forms can be sent to the designated IRS address for paper submissions.

- In-Person: Some taxpayers may choose to deliver their forms directly to an IRS office, though this is less common.

Required Documents

To accurately complete the Instructions For Form 1120 RIC, several documents are typically required:

- Financial statements, including profit and loss statements.

- Tax documents from previous years, if applicable.

- Any schedules or forms that support deductions and credits claimed.

- Documentation proving compliance with RIC requirements, such as income distribution records.

Quick guide on how to complete instructions for form 1120 ric 2018internal revenue service

Explore the most efficient method to complete and endorse your Instructions For Form 1120 RIC Internal Revenue Service

Are you still spending time preparing your official documents on paper instead of processing them online? airSlate SignNow provides a superior approach to complete and endorse your Instructions For Form 1120 RIC Internal Revenue Service and associated forms for public services. Our advanced eSignature platform equips you with everything necessary to handle paperwork swiftly and in compliance with official standards - powerful PDF editing, management, safeguarding, signing, and sharing tools, all readily available within a user-friendly interface.

Only a few steps are necessary to successfully complete and endorse your Instructions For Form 1120 RIC Internal Revenue Service:

- Load the editable template into the editor using the Get Form option.

- Review what details you must enter in your Instructions For Form 1120 RIC Internal Revenue Service.

- Move between the fields using the Next feature to avoid missing anything.

- Utilize Text, Check, and Cross tools to complete the fields with your details.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is most important or Redact areas that are no longer relevant.

- Click on Sign to create a legally enforceable eSignature using your preferred method.

- Add the Date next to your signature and finalize your task with the Done button.

Store your completed Instructions For Form 1120 RIC Internal Revenue Service in the Documents directory of your profile, download it, or transfer it to your preferred cloud storage. Our solution also offers versatile file-sharing options. There's no need to print your forms when you can submit them to the appropriate public office - use email, fax, or request a USPS "snail mail" delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 1120 ric 2018internal revenue service

FAQs

-

Which Internal Revenue Service forms do I need to fill (salaried employee) for tax filing when my visa status changed from F1 OPT to H1B during 2015?

You can use the IRS page for residency test: Substantial Presence TestIf you live in a state that does not have income tax, you can use IRS tool: Free File: Do Your Federal Taxes for Free or any other free online software. TaxAct is one such.If not and if you are filing for the first time, it might be worth spending few dollars on a tax consultant. You can claim the fee in your return.

-

How should I fill out the preference form for the IBPS PO 2018 to get a posting in an urban city?

When you get selected as bank officer of psb you will have to serve across the country. Banks exist not just in urban areas but also in semi urban and rural areas also. Imagine every employee in a bank got posting in urban areas as their wish as a result bank have to shut down all rural and semi urban branches as there is no people to serve. People in other areas deprived of banking service. This makes no sense. Being an officer you will be posted across the country and transferred every three years. You have little say of your wish. Every three year urban posting followed by three years rural and vice versa. If you want your career to grow choose Canara bank followed by union bank . These banks have better growth potentials and better promotion scope

-

When and how are the assignments for IGNOU CHR to be submitted for the December 2018 TEE? How and when to fill out the examination form? Where do I look for the datasheet?

First download the assignments from IGNOU - The People's University website and write them with A4 size paper then submitted it in your study center.check the above website you will find a link that TEE from fill up for dec 2018 after got the link you will fill your tee from online.Remember while filling your TEE you should put tick mark on the box like this;Are you submitted assignments: yes[ ] No[ ]

-

How do I mail a regular letter to Venezuela? Do I need to fill out a customs form for a regular letter or do I just need to add an international mail stamp and send it?

You do not need to fill out a customs form for a regular letter sent from the US to any other country. Postage for an international letter under 1 ounce is currently $1.15. You may apply any stamp - or combination of stamps - which equals that amount.

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 1120 ric 2018internal revenue service

How to make an electronic signature for your Instructions For Form 1120 Ric 2018internal Revenue Service in the online mode

How to generate an eSignature for your Instructions For Form 1120 Ric 2018internal Revenue Service in Google Chrome

How to generate an eSignature for signing the Instructions For Form 1120 Ric 2018internal Revenue Service in Gmail

How to generate an eSignature for the Instructions For Form 1120 Ric 2018internal Revenue Service from your smart phone

How to generate an electronic signature for the Instructions For Form 1120 Ric 2018internal Revenue Service on iOS

How to generate an eSignature for the Instructions For Form 1120 Ric 2018internal Revenue Service on Android

People also ask

-

What are the Instructions For Form 1120 RIC Internal Revenue Service?

The Instructions For Form 1120 RIC Internal Revenue Service provide detailed guidelines on how to correctly fill out and submit the form for regulated investment companies. This includes eligibility criteria, required information, and filing deadlines to ensure compliance. Following these instructions helps in efficiently managing tax obligations.

-

Why should I use airSlate SignNow for my Form 1120 RIC filings?

Using airSlate SignNow for your Form 1120 RIC filings streamlines the eSigning and document management process. Our solution offers a user-friendly interface and cost-effective features, ensuring that you can electronically sign and send documents securely and efficiently. This makes following the Instructions For Form 1120 RIC Internal Revenue Service simpler.

-

Is airSlate SignNow affordable for small businesses needing to file Form 1120 RIC?

Yes, airSlate SignNow is designed to be cost-effective, making it accessible for small businesses managing their filings. Our pricing plans cater to various budgets, ensuring that even businesses with limited resources can effectively handle their tax documents, including the Instructions For Form 1120 RIC Internal Revenue Service.

-

Can airSlate SignNow integrate with other business applications for tax filing?

Absolutely! airSlate SignNow offers seamless integrations with various business applications, allowing you to streamline your document processes. This integration capability helps ensure that all required information is accurately captured when following the Instructions For Form 1120 RIC Internal Revenue Service.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow provides several features including eSignature capabilities, secure document storage, and real-time tracking of document statuses. These features enhance the management of your tax documents, ensuring you can comply with the Instructions For Form 1120 RIC Internal Revenue Service efficiently and without hassle.

-

How secure is the information I send using airSlate SignNow regarding Form 1120 RIC?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and robust security measures to ensure that all information transmitted, including documents related to the Instructions For Form 1120 RIC Internal Revenue Service, is protected from unauthorized access and data bsignNowes.

-

What kind of support does airSlate SignNow offer for users filling out Form 1120 RIC?

airSlate SignNow offers comprehensive customer support to assist users with any questions about filling out Form 1120 RIC. Our support team is available to provide guidance on both the technical aspects of using our platform and understanding the Instructions For Form 1120 RIC Internal Revenue Service.

Get more for Instructions For Form 1120 RIC Internal Revenue Service

- Employment verification form texas

- Roof condition certification form citizensflacom

- Form 101 hi home improvement contract lord tile

- W 2 fillable form

- 4th step guide fourth step inventory big book study worksheets form

- Cayuga addiction recovery services carsnypushlarcom form

- Realty transfer certificate sanders county form

- Request for informal classification and appraisal review

Find out other Instructions For Form 1120 RIC Internal Revenue Service

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast