IA W 4 44109 Tax Iowa Gov 2022-2026

Understanding the IA W-4 44109 Tax Form

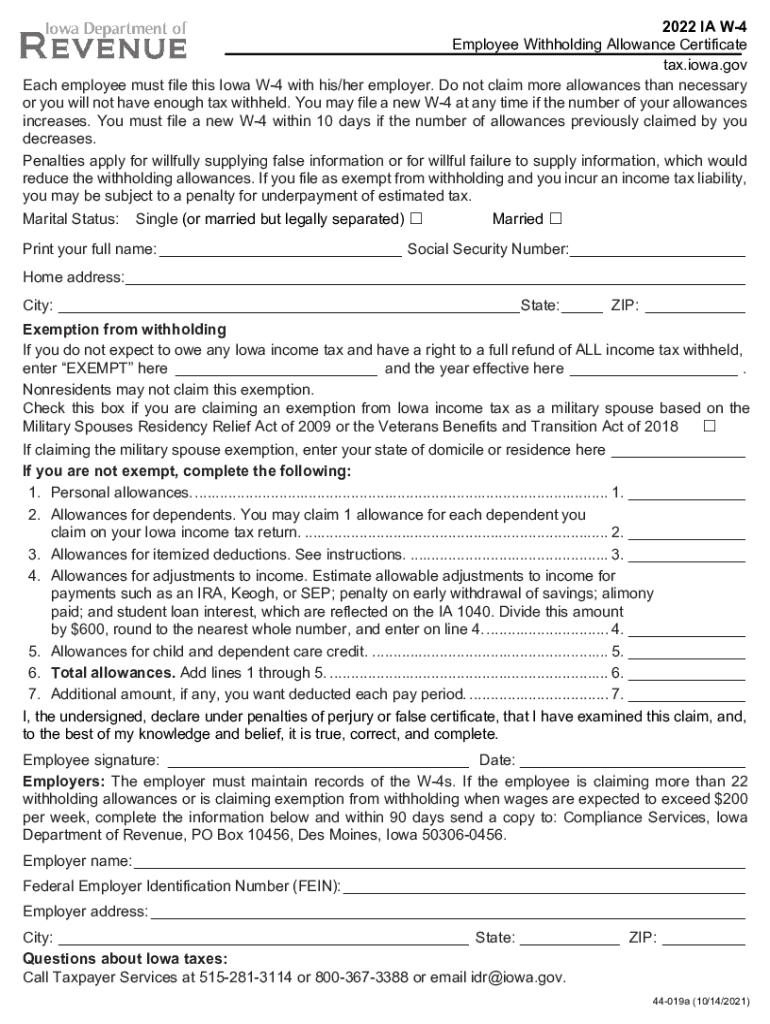

The IA W-4 44109 is a crucial document for Iowa residents, used to determine the amount of state tax withholding from an employee's paycheck. This form is essential for ensuring that the correct amount of state tax is withheld, which helps prevent underpayment or overpayment of taxes throughout the year. It is important to understand the specific requirements and components of this form to ensure compliance with Iowa state tax laws.

Steps to Complete the IA W-4 44109 Tax Form

Completing the IA W-4 44109 involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status, such as single or married, which affects your withholding rate.

- Provide information about your allowances. The number of allowances you claim will influence the amount of tax withheld from your paycheck.

- Sign and date the form to certify that the information provided is accurate.

Once completed, submit the form to your employer, who will use it to adjust your state tax withholding accordingly.

Legal Use of the IA W-4 44109 Tax Form

The IA W-4 44109 is legally recognized by the state of Iowa as a valid means for employees to communicate their tax withholding preferences to their employers. To ensure its legal standing, it is vital to fill out the form accurately and submit it to the correct employer. Misrepresentation or inaccuracies can lead to penalties, including fines or additional tax liabilities.

Key Elements of the IA W-4 44109 Tax Form

Understanding the key elements of the IA W-4 44109 can help you fill it out correctly:

- Personal Information: This section captures your identity and contact details.

- Filing Status: Your filing status affects your tax rate and withholding.

- Allowances: The number of allowances claimed can reduce the amount withheld.

- Signature: Your signature certifies the accuracy of the information provided.

Who Issues the IA W-4 44109 Tax Form

The IA W-4 44109 is issued by the Iowa Department of Revenue. This state agency is responsible for tax collection and compliance, ensuring that residents meet their tax obligations. Employers are required to provide this form to their employees and may also offer assistance in completing it correctly.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines associated with the IA W-4 44109. Typically, employees should submit their completed forms to their employers at the start of their employment or whenever there is a change in their tax situation, such as a change in marital status or a significant change in income. Keeping track of these dates helps ensure proper tax withholding throughout the year.

Examples of Using the IA W-4 44109 Tax Form

Consider a few scenarios where the IA W-4 44109 is utilized:

- A new employee starts a job and needs to complete the IA W-4 44109 to establish their state tax withholding.

- An employee gets married and updates their IA W-4 44109 to reflect their new filing status, which may change their tax withholding.

- A worker with multiple jobs may need to adjust their IA W-4 44109 to ensure they are not over-withheld.

Quick guide on how to complete ia w 4 44109 taxiowagov

Complete IA W 4 44109 Tax iowa gov effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, adjust, and eSign your documents swiftly without delays. Manage IA W 4 44109 Tax iowa gov on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign IA W 4 44109 Tax iowa gov without breaking a sweat

- Obtain IA W 4 44109 Tax iowa gov and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign IA W 4 44109 Tax iowa gov and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ia w 4 44109 taxiowagov

Create this form in 5 minutes!

How to create an eSignature for the ia w 4 44109 taxiowagov

The way to generate an e-signature for a PDF file in the online mode

The way to generate an e-signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to generate an e-signature from your smartphone

The way to create an e-signature for a PDF file on iOS devices

The way to generate an e-signature for a PDF file on Android

People also ask

-

How to IA with airSlate SignNow?

To integrate airSlate SignNow into your workflow, simply sign up for an account and explore the platform's features. Learn how to IA by accessing templates, creating workflows, and utilizing automation tools to streamline document management. The intuitive interface ensures anyone can start eSigning documents quickly and efficiently.

-

What pricing options are available for learning how to IA with airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. Whether you're just starting or require advanced features, there's a plan for everyone that guides you in learning how to IA effectively. Check their website for the latest pricing details and special offers.

-

What features help in learning how to IA with airSlate SignNow?

airSlate SignNow is packed with features that simplify document management and eSigning. The platform provides templates, collaboration tools, and mobile access, all designed to enhance your understanding of how to IA. You'll discover the benefits of automation, reminders, and tracking to maintain efficiency.

-

How does airSlate SignNow benefit businesses looking to learn how to IA?

By using airSlate SignNow, businesses can reduce paper usage and improve turnaround times signNowly. This cost-effective solution helps teams learn how to IA by enabling seamless document workflows and quick access to eSignatures. The enhanced efficiency leads to better productivity and customer satisfaction.

-

Can I integrate airSlate SignNow with other tools while learning how to IA?

Absolutely! airSlate SignNow supports integration with various apps such as Google Drive, Salesforce, and more. This capability facilitates your journey to understanding how to IA by allowing you to combine tools and automate processes. Explore the integration options to maximize your workflow efficiency.

-

Is there a mobile app available for learning how to IA with airSlate SignNow?

Yes, airSlate SignNow has a mobile app that makes it convenient to manage documents on the go. This app allows you to learn how to IA by eSigning and sending documents directly from your smartphone or tablet. Stay productive and access your files anywhere, anytime.

-

What support does airSlate SignNow offer for learning how to IA?

airSlate SignNow provides comprehensive support resources, including tutorials, FAQs, and a dedicated help center. When you learn how to IA, you can also contact customer support for any specific queries or assistance needed. They are committed to ensuring you have a smooth experience.

Get more for IA W 4 44109 Tax iowa gov

Find out other IA W 4 44109 Tax iowa gov

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT