Iowa W4 2020

What is the Iowa W-4?

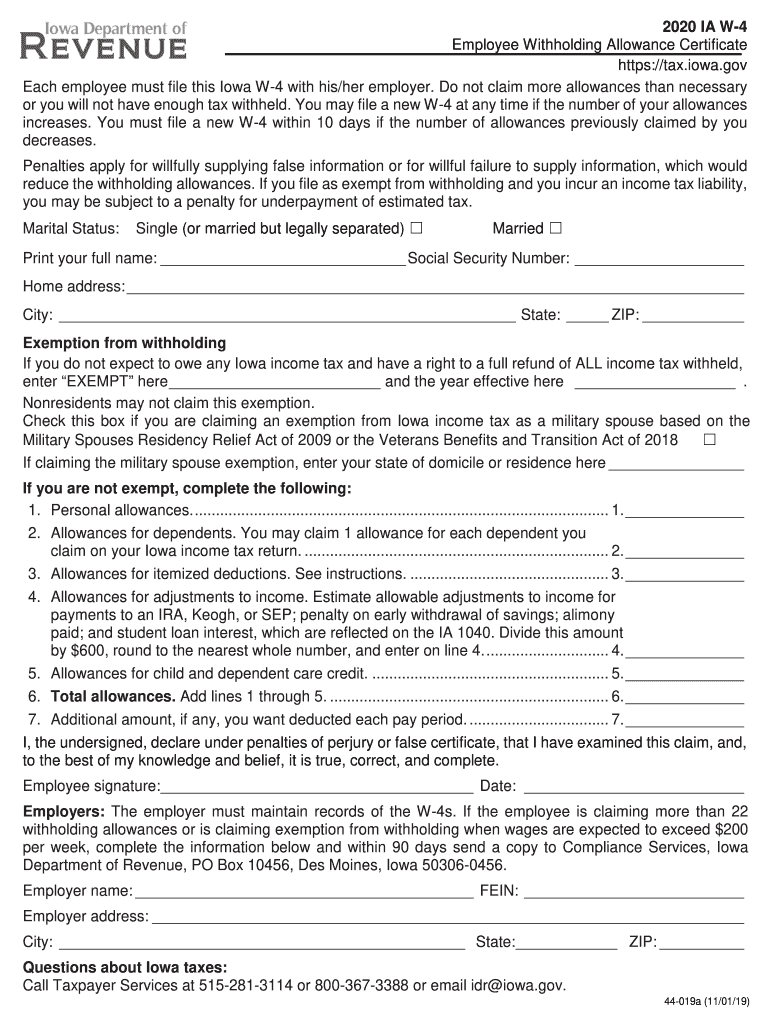

The Iowa W-4, also known as the Iowa Employee Withholding Form, is a crucial document used by employers to determine the amount of state income tax to withhold from employees' paychecks. This form is essential for ensuring that employees meet their tax obligations in the state of Iowa. It allows employees to indicate their filing status, number of allowances, and any additional withholding amounts they wish to specify. Understanding this form is vital for both employees and employers to maintain compliance with Iowa tax laws.

How to use the Iowa W-4

Using the Iowa W-4 involves several steps to ensure accurate completion. Employees must first obtain the form from their employer or download it from the Iowa Department of Revenue website. After filling out the necessary information, including personal details and withholding preferences, the employee submits the form to their employer. It is important to review the form periodically, especially after significant life changes, such as marriage or the birth of a child, as these can affect withholding amounts.

Steps to complete the Iowa W-4

Completing the Iowa W-4 requires careful attention to detail. Here are the steps to follow:

- Obtain the Iowa W-4 form from your employer or the Iowa Department of Revenue website.

- Fill in your personal information, including your name, address, and Social Security number.

- Choose your filing status, which can be single, married, or head of household.

- Indicate the number of allowances you are claiming, based on your tax situation.

- Specify any additional amount you want withheld from your paycheck, if applicable.

- Sign and date the form before submitting it to your employer.

Legal use of the Iowa W-4

The Iowa W-4 is legally binding once it is completed and submitted to an employer. It must be filled out accurately to ensure compliance with state tax regulations. Employers are required to keep the W-4 forms on file and use them to calculate the correct withholding amounts. Failure to comply with these regulations can lead to penalties for both employees and employers, making it essential to understand the legal implications of this form.

Key elements of the Iowa W-4

Several key elements are essential to the Iowa W-4. These include:

- Personal Information: Name, address, and Social Security number.

- Filing Status: Options include single, married, or head of household.

- Allowances: The number of allowances claimed affects withholding amounts.

- Additional Withholding: An option to specify any extra amount to be withheld.

Form Submission Methods

The Iowa W-4 can be submitted through various methods, depending on the employer's preferences. Typically, employees will provide the completed form directly to their employer in person. Some employers may also allow electronic submissions via email or a secure online portal. It is important to confirm the preferred submission method with your employer to ensure timely processing.

Quick guide on how to complete 2020 ia w 4 employee withholding allowance certificate httpstax

Effortlessly Prepare Iowa W4 on Any Device

Online document management has become increasingly popular for businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly without delays. Handle Iowa W4 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Edit and eSign Iowa W4 with Ease

- Obtain Iowa W4 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of missing or lost documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any preferred device. Modify and eSign Iowa W4 and guarantee excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 ia w 4 employee withholding allowance certificate httpstax

Create this form in 5 minutes!

How to create an eSignature for the 2020 ia w 4 employee withholding allowance certificate httpstax

How to generate an eSignature for the 2020 Ia W 4 Employee Withholding Allowance Certificate Httpstax in the online mode

How to create an electronic signature for your 2020 Ia W 4 Employee Withholding Allowance Certificate Httpstax in Google Chrome

How to generate an eSignature for signing the 2020 Ia W 4 Employee Withholding Allowance Certificate Httpstax in Gmail

How to generate an eSignature for the 2020 Ia W 4 Employee Withholding Allowance Certificate Httpstax right from your mobile device

How to make an eSignature for the 2020 Ia W 4 Employee Withholding Allowance Certificate Httpstax on iOS devices

How to create an eSignature for the 2020 Ia W 4 Employee Withholding Allowance Certificate Httpstax on Android devices

People also ask

-

What is the printable Iowa withholding form 2019 used for?

The printable Iowa withholding form 2019 is used by employers in Iowa to report and calculate the state income tax withheld from employees' paychecks. This document is essential for compliance with Iowa payroll regulations and helps ensure accurate tax withholdings.

-

Where can I find a printable Iowa withholding form 2019?

You can easily obtain a printable Iowa withholding form 2019 by visiting the official Iowa Department of Revenue website or using our platform to access pre-filled forms. airSlate SignNow provides convenient options to download and print the form directly.

-

Is there a cost associated with obtaining the printable Iowa withholding form 2019?

No, the printable Iowa withholding form 2019 is free to download from official sources. However, if you choose to use airSlate SignNow for eSigning and managing the form, there may be associated costs based on our subscription plans.

-

Can I fill out the printable Iowa withholding form 2019 electronically?

Yes, with airSlate SignNow, you can fill out the printable Iowa withholding form 2019 electronically. Our platform allows you to input your information digitally, making it easier to eSign and share the document with employers or employees.

-

What features does airSlate SignNow offer for managing the printable Iowa withholding form 2019?

airSlate SignNow offers a variety of features for managing the printable Iowa withholding form 2019, including eSignature capabilities, secure cloud storage, and easy document sharing. These features streamline the signing process, enhancing efficiency and compliance.

-

How can airSlate SignNow help businesses that need the printable Iowa withholding form 2019?

airSlate SignNow helps businesses by providing a user-friendly platform for accessing, filling out, and eSigning the printable Iowa withholding form 2019. Our service reduces the time spent on paperwork and ensures that forms are completed accurately and securely.

-

Are there any mobile options for accessing the printable Iowa withholding form 2019?

Yes, airSlate SignNow is mobile-friendly, allowing you to access the printable Iowa withholding form 2019 from your smartphone or tablet. Whether you're in the office or on the go, you can easily fill out and eSign your forms anytime, anywhere.

Get more for Iowa W4

- Perrysburg income tax form 2015

- Rcw 5918365 form

- Gexpro credit application form

- Petition for correction of entry in birth certificate sample form

- Civil no contact orderpdf clinton county illinois clintonco illinois form

- Anz telegraphic transfer form

- Limited power of attorney copart form

- 2013 annual conference report form society of st vincent de paul

Find out other Iowa W4

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order