Iowa W4 2019

What is the Iowa W-4?

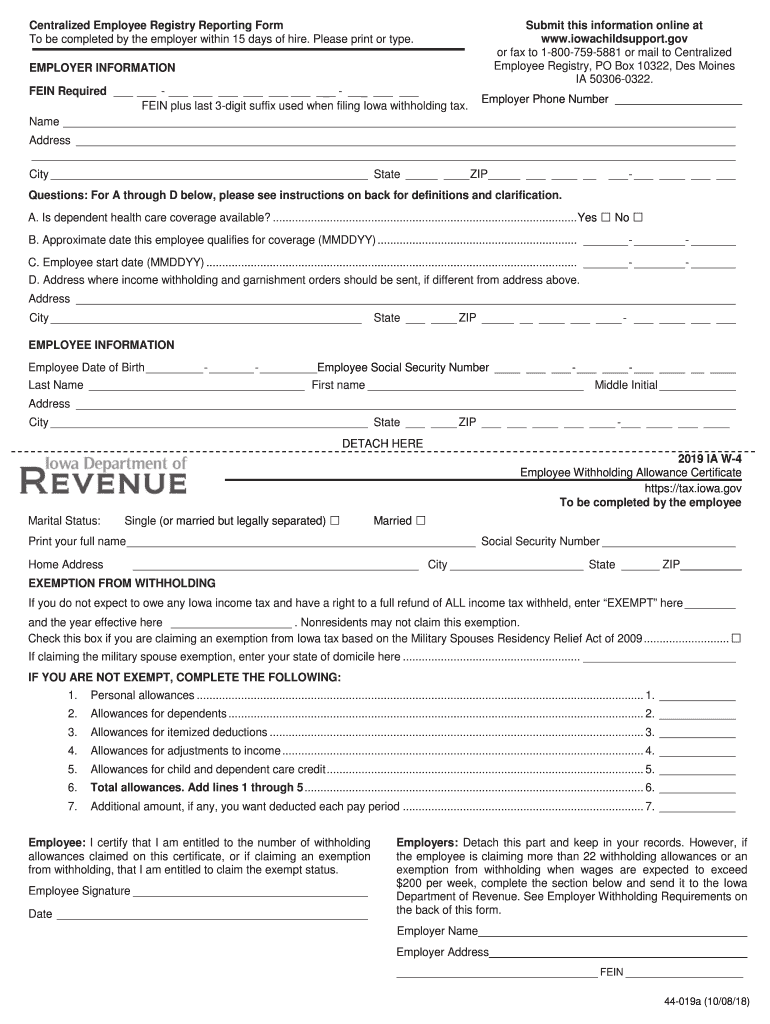

The Iowa W-4, officially known as the Iowa Employee Withholding Allowance Certificate, is a crucial document for employees working in Iowa. It is used to determine the amount of state income tax to withhold from an employee's paycheck. The form allows employees to claim allowances based on their personal circumstances, such as marital status and number of dependents. Proper completion of the Iowa W-4 ensures that the correct amount of state tax is withheld, helping to avoid underpayment or overpayment when filing state taxes.

How to Obtain the Iowa W-4

To obtain the Iowa W-4 form, individuals can visit the Iowa Department of Revenue's official website, where the form is available for download as a printable document. Additionally, employers may provide copies of the form to new hires as part of their onboarding process. It is important to ensure that you are using the correct version of the form for the relevant tax year, as updates may occur annually.

Steps to Complete the Iowa W-4

Completing the Iowa W-4 involves several straightforward steps:

- Personal Information: Fill in your name, address, and Social Security number at the top of the form.

- Filing Status: Indicate your filing status by selecting from the options provided, such as single or married.

- Allowances: Calculate and enter the number of allowances you are claiming based on your personal situation.

- Additional Withholding: If desired, specify any additional amount you wish to have withheld from your paycheck.

- Signature: Sign and date the form to validate your submission.

Key Elements of the Iowa W-4

The Iowa W-4 contains several key elements that are essential for accurate tax withholding:

- Employee Information: This section captures the employee's personal data, which is necessary for identification.

- Filing Status: The choice between single, married, or head of household affects the withholding calculations.

- Allowances: The number of allowances claimed directly influences the amount withheld from each paycheck.

- Additional Withholding: This optional field allows employees to request extra withholding if they anticipate owing more tax.

Legal Use of the Iowa W-4

The Iowa W-4 is legally recognized as a binding document for tax withholding purposes. It must be completed accurately to ensure compliance with state tax laws. Employers are required to keep a copy of the completed form on file and must use the information provided to calculate the appropriate amount of state tax to withhold from employee wages. Failure to comply with the regulations surrounding the Iowa W-4 can result in penalties for both employees and employers.

Form Submission Methods

Employees can submit the completed Iowa W-4 form to their employer through various methods:

- In-Person: Handing the form directly to the employer or the human resources department is the most straightforward method.

- Mail: Employees may also choose to mail the form to their employer's designated address.

- Email: Some employers may allow submission via email, provided the form is scanned and sent as an attachment.

Quick guide on how to complete ia dor w 4 2019

Complete Iowa W4 effortlessly on any device

Online document management has gained increased popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your documents without delays. Manage Iowa W4 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The most effective way to modify and eSign Iowa W4 with ease

- Find Iowa W4 and click Get Form to begin.

- Use the tools we provide to complete your form.

- Select relevant portions of the documents or obscure sensitive data using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature through the Sign feature, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Iowa W4 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ia dor w 4 2019

Create this form in 5 minutes!

How to create an eSignature for the ia dor w 4 2019

How to create an eSignature for your Ia Dor W 4 2019 in the online mode

How to generate an eSignature for your Ia Dor W 4 2019 in Google Chrome

How to create an electronic signature for putting it on the Ia Dor W 4 2019 in Gmail

How to make an eSignature for the Ia Dor W 4 2019 straight from your mobile device

How to generate an electronic signature for the Ia Dor W 4 2019 on iOS

How to create an eSignature for the Ia Dor W 4 2019 on Android OS

People also ask

-

What is the printable Iowa withholding form 2019?

The printable Iowa withholding form 2019 is an official document used by employers to report state income tax withheld from employees’ wages. This form is essential for compliance with Iowa tax regulations and can be easily accessed and printed online. By using airSlate SignNow, businesses can streamline the completion and submission of this form.

-

How can I obtain the printable Iowa withholding form 2019?

You can obtain the printable Iowa withholding form 2019 directly from the Iowa Department of Revenue's website or use airSlate SignNow for a quick and convenient access. Our platform allows you to fill out and eSign the form, ensuring it meets all requirements. Simply search for the form within our platform for a seamless experience.

-

Are there any costs associated with using airSlate SignNow for the printable Iowa withholding form 2019?

Using airSlate SignNow to manage the printable Iowa withholding form 2019 comes with a range of pricing plans tailored to fit various business needs. You can start with a free trial to explore our features and choose the plan that suits you best. Our cost-effective solutions offer great value, especially for businesses managing multiple documents.

-

What features does airSlate SignNow offer for the printable Iowa withholding form 2019?

airSlate SignNow offers several features to enhance your experience with the printable Iowa withholding form 2019. You can easily edit, eSign, and store your documents securely in the cloud. Additionally, our platform provides automated workflows to help you manage and track documents efficiently.

-

Can I integrate airSlate SignNow with other software for managing the printable Iowa withholding form 2019?

Yes, airSlate SignNow offers integration capabilities with various popular applications to enhance your workflow for the printable Iowa withholding form 2019. This means you can connect our platform with your existing HR or accounting software for smoother document handling. Check out our integration options to find compatible tools.

-

How does airSlate SignNow enhance the process of completing the printable Iowa withholding form 2019?

airSlate SignNow streamlines the process of completing the printable Iowa withholding form 2019 by offering an intuitive interface for editing and eSigning documents. You can collaborate with team members in real-time, ensuring everyone has the latest version and can contribute easily. This signNowly reduces the time spent on paperwork.

-

Is the printable Iowa withholding form 2019 available for eSignature?

Yes, the printable Iowa withholding form 2019 is available for eSignature through airSlate SignNow. This feature allows you to sign the form electronically, saving time and resources compared to traditional methods. Our legally compliant eSignature solution ensures your documents are securely signed and stored.

Get more for Iowa W4

Find out other Iowa W4

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document