0515, Page 1 MICHIGAN Nonresident and PartYear Resident Schedule Issued under Authority of Public Act 281 of 1967, as Amended Form

What is the 0515, Page 1 MICHIGAN Nonresident And PartYear Resident Schedule Issued Under Authority Of Public Act 281 Of 1967, As Amended

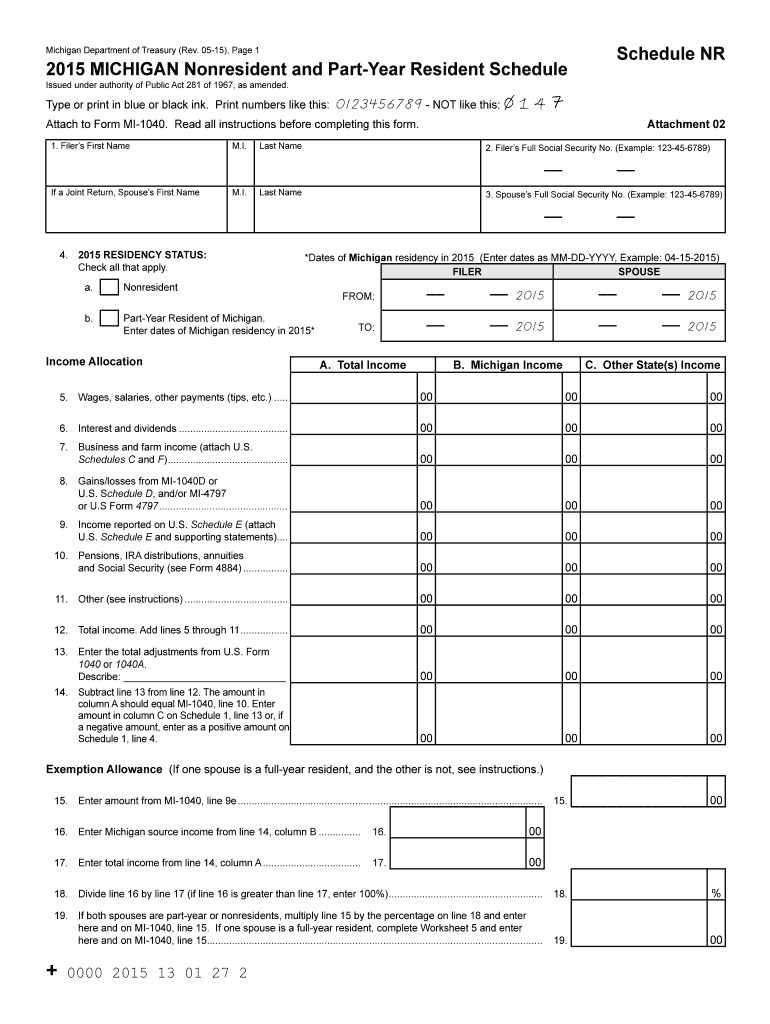

The 0515, Page 1 MICHIGAN Nonresident And PartYear Resident Schedule is a tax form specifically designed for individuals who do not reside in Michigan for the entire tax year or who have part-year residency. This schedule is issued under the authority of Public Act 281 of 1967, as amended. It is essential for reporting income earned within Michigan and determining the appropriate tax liability for nonresidents and part-year residents. Understanding this form is crucial for compliance with state tax regulations.

Steps to complete the 0515, Page 1 MICHIGAN Nonresident And PartYear Resident Schedule Issued Under Authority Of Public Act 281 Of 1967, As Amended

Completing the 0515 schedule involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements related to your time in Michigan.

- Determine your residency status for the tax year, identifying the periods you lived in Michigan versus other states.

- Fill out the form accurately, ensuring that all income earned in Michigan is reported.

- Calculate your tax liability based on the income reported and any applicable deductions or credits.

- Review the completed form for accuracy before submission.

Legal use of the 0515, Page 1 MICHIGAN Nonresident And PartYear Resident Schedule Issued Under Authority Of Public Act 281 Of 1967, As Amended

The 0515 schedule is legally binding when completed and submitted according to Michigan state tax laws. It must be filled out with accurate information regarding your income and residency status. Failure to provide truthful information can result in penalties or audits by the Michigan Department of Treasury. Using electronic signatures through a reliable platform ensures that the form is legally recognized and compliant with eSignature laws.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the 0515 schedule. Typically, the due date aligns with the federal tax filing deadline, which is usually April 15. However, if you are unable to meet this deadline, you may apply for an extension. Be sure to check for any updates or changes to these dates each tax year to avoid late fees or penalties.

Form Submission Methods (Online / Mail / In-Person)

The 0515 schedule can be submitted through various methods. Taxpayers have the option to file online using approved tax software, which often streamlines the process and ensures accuracy. Alternatively, the form can be mailed directly to the Michigan Department of Treasury or submitted in person at designated offices. Each method has its own advantages, so choose the one that best fits your needs.

Key elements of the 0515, Page 1 MICHIGAN Nonresident And PartYear Resident Schedule Issued Under Authority Of Public Act 281 Of 1967, As Amended

Key elements of the 0515 schedule include:

- Personal information such as name, address, and Social Security number.

- Details regarding residency status and the duration of time lived in Michigan.

- Income earned while residing in Michigan, including wages, interest, and dividends.

- Deductions and credits applicable to nonresidents and part-year residents.

Quick guide on how to complete 0515 page 1 2015 michigan nonresident and partyear resident schedule issued under authority of public act 281 of 1967 as amended

Complete [SKS] effortlessly on any gadget

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the resources you require to create, modify, and eSign your documents promptly without interruptions. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your paperwork.

- Emphasize essential sections of your documents or redact personal information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes just moments and holds the same legal validity as a conventional wet ink signature.

- Review all details and then click on the Done button to save your changes.

- Select how you wish to share your form, whether via email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 0515 page 1 2015 michigan nonresident and partyear resident schedule issued under authority of public act 281 of 1967 as amended

How to make an electronic signature for your PDF online

How to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to create an e-signature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The way to create an e-signature for a PDF on Android

People also ask

-

What is the 0515, Page 1 MICHIGAN Nonresident And PartYear Resident Schedule Issued Under Authority Of Public Act 281 Of 1967, As Amended?

The 0515, Page 1 MICHIGAN Nonresident And PartYear Resident Schedule is a tax document used by non-resident and part-year resident taxpayers in Michigan to report income earned in the state. It is issued under the authority of Public Act 281 of 1967, as amended, and must be filed with your Michigan tax return.

-

How can airSlate SignNow help me with the 0515, Page 1 MICHIGAN Nonresident And PartYear Resident Schedule?

airSlate SignNow simplifies the process of sending and eSigning the 0515, Page 1 MICHIGAN Nonresident And PartYear Resident Schedule. Our platform allows users to manage documents easily, ensuring you can focus on completing your tax filings rather than the paperwork itself.

-

What pricing options does airSlate SignNow offer for eSigning the 0515, Page 1 MICHIGAN Nonresident And PartYear Resident Schedule?

airSlate SignNow offers flexible pricing plans to accommodate different business needs, including monthly and annual subscriptions. This cost-effective solution makes it easy to manage documents such as the 0515, Page 1 MICHIGAN Nonresident And PartYear Resident Schedule without breaking the bank.

-

What features does airSlate SignNow provide for handling the 0515, Page 1 MICHIGAN Nonresident And PartYear Resident Schedule?

Our platform includes features such as customizable templates, secure eSigning, and tracking capabilities to streamline the process of managing the 0515, Page 1 MICHIGAN Nonresident And PartYear Resident Schedule. This ensures that you never miss a deadline and your documents remain compliant.

-

Can airSlate SignNow integrate with other tools to assist with the 0515, Page 1 MICHIGAN Nonresident And PartYear Resident Schedule?

Yes, airSlate SignNow offers integrations with numerous applications like accounting software and CRMs. This allows you to seamlessly manage the 0515, Page 1 MICHIGAN Nonresident And PartYear Resident Schedule alongside your other business tasks.

-

What are the benefits of using airSlate SignNow for my tax documents, including the 0515, Page 1 MICHIGAN Nonresident And PartYear Resident Schedule?

By using airSlate SignNow, you can reduce the time spent on paperwork and improve document accuracy. Our solution enhances collaboration and allows for faster processing of the 0515, Page 1 MICHIGAN Nonresident And PartYear Resident Schedule, enabling you to focus on important tax matters.

-

Is airSlate SignNow secure for managing the 0515, Page 1 MICHIGAN Nonresident And PartYear Resident Schedule?

Absolutely, airSlate SignNow employs advanced security measures to ensure that your documents, including the 0515, Page 1 MICHIGAN Nonresident And PartYear Resident Schedule, are protected. We comply with industry standards, providing peace of mind for all your sensitive data.

Get more for 0515, Page 1 MICHIGAN Nonresident And PartYear Resident Schedule Issued Under Authority Of Public Act 281 Of 1967, As Amended

Find out other 0515, Page 1 MICHIGAN Nonresident And PartYear Resident Schedule Issued Under Authority Of Public Act 281 Of 1967, As Amended

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself

- Electronic signature Maryland Landlord lease agreement Secure

- How To Electronic signature Utah Landlord lease agreement

- Electronic signature Wyoming Landlord lease agreement Safe

- Electronic signature Illinois Landlord tenant lease agreement Mobile

- Electronic signature Hawaii lease agreement Mobile

- How To Electronic signature Kansas lease agreement

- Electronic signature Michigan Landlord tenant lease agreement Now

- How Can I Electronic signature North Carolina Landlord tenant lease agreement